Delivering to Our Investors

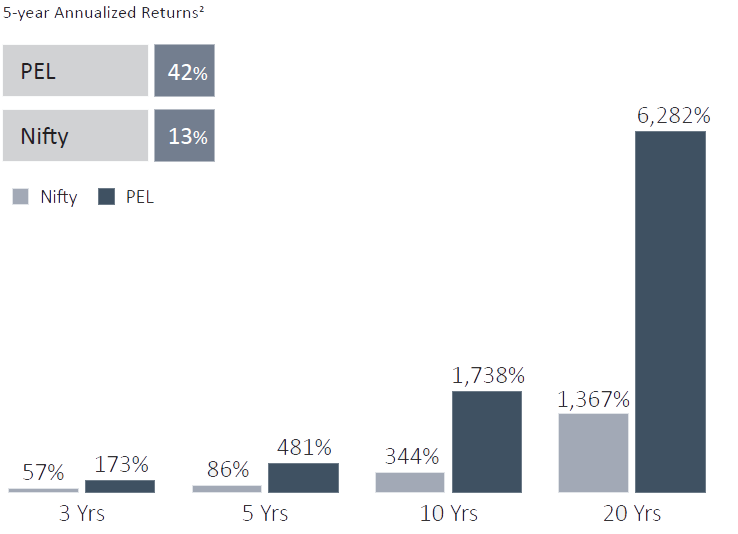

The Company has a strong track record of generating superior shareholder returns over the preceding three decades. Post the Abbott deal, during the phase of developing new businesses and growing the remaining healthcare businesses, the Company has delivered outstanding shareholder returns in the last five years, significantly higher than benchmark indices.

Consistently delivered strong shareholder returns – significantly higher than benchmark indices¹

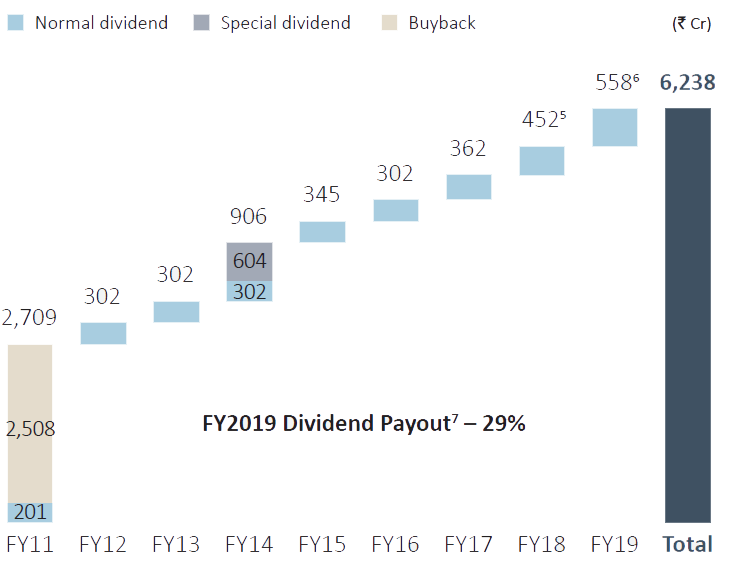

`6,238 Cr3,4,5,6 returned to shareholders since sale of Domestic Formulations business in 2010

28%

Annualised returns to

shareholders over the last

31 years

42%

Annualised returns delivered

over the last five years vs. 13%

by Nifty 50

29%

Dividend payout7 for FY2019

Note:

- Total shareholder returns are as on March 31, 2019. Assumes re-investment of dividend in the stock (Source: Bloomberg)

- Annualised returns are as on March 31, 2019

- Of the buyback of 41.8 mn shares shown in FY2011, buyback of 0.7 mn shares happened in FY2012

- Capital returned to shareholders through dividends, doesn’t include amount paid as Dividend Distribution Tax

- FY2018 Excludes any dividend pay-out upon conversions of CCDs & related Rights till book closure date

- FY2019 includes any dividend pay-out upon conversion of CCDs & Rights till book closure date for FY2019

- Recommended by the Board