Strong balance sheet and efficient capital allocation

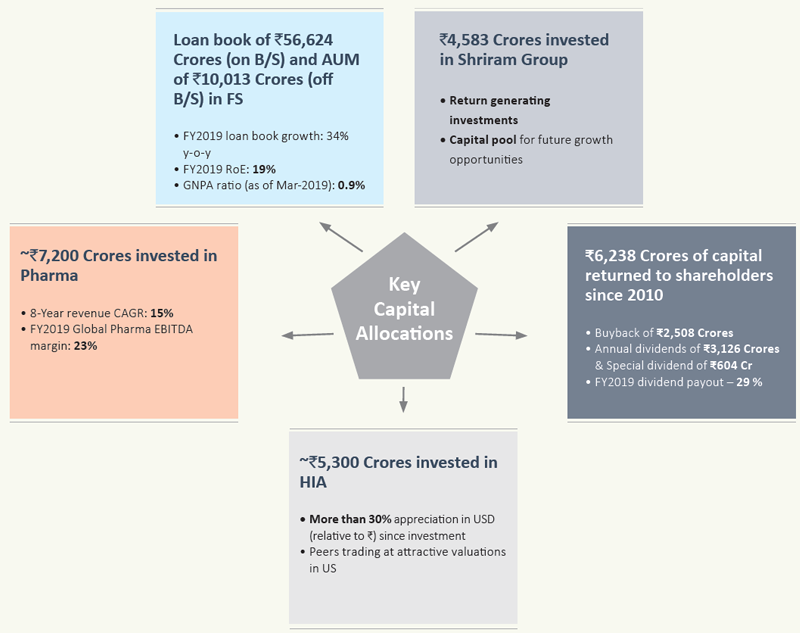

The Company has total equity of more than `27,000 Crores on its balance sheet. Of this, nearly `22,000 Crores of equity is allocated to the Financial Services business versus a loan book of nearly `56,600 Crores.

As on March 31, 2019 the Financial Services business had a debt-to-equity multiple of 3.9x (excluding investments in Shriram) and 2.2x (including investments in Shriram) – making it one of the least levered financial institutions in India.

The Company has successfully transformed itself multiple times on its strength of efficient allocation of capital across the business portfolio. Ever since the Company commenced its journey, it has always remained committed towards efficient capital allocation, while undertaking controlled risks, to consistently generate higher profitability and deliver superior shareholder returns.

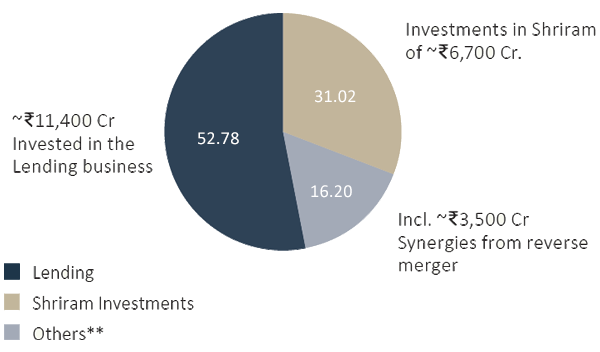

Equity (Book Value) - % split1

**“Others” includes DTA benefit from reverse merger and equity allocated to the Alternative AUM business Note: 1. Based on estimated allocation

Demonstrated track record for delivering value through focus on operating excellence, timely investments as well as disciplined exits