Pharma

The pharma vertical of PEL is uniquely positioned with a strong presence both within and outside India. It is divided into three businesses – Global Pharma Services, Global Pharma Products, and India Consumer Products.

Global Pharma Services Business

- Well-integrated, end-to-end development and manufacturing services, ranging from drug discovery and clinical development to commercial manufacturing of Active Pharmaceutical Ingredients (APIs) and Formulations for global pharmaceuticals companies

- Capabilities include handling niche injectables, HPAPIs and ADCs

- Partner of Choice’ for large pharmaceuticals and virtual biotech companies across the drug life cycle

- Supported over 34 commercial launches for its customers and has an attractive pipeline of over 150 molecules at various stages of development

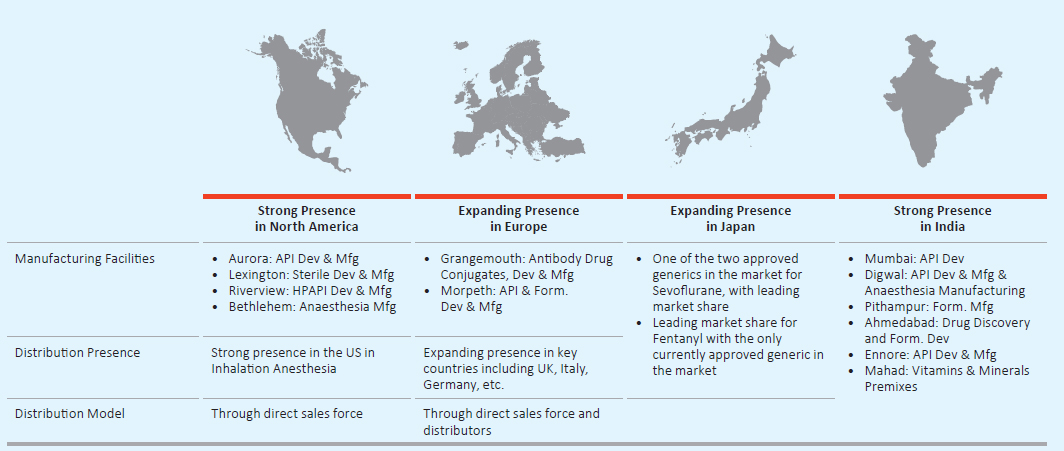

- Development and manufacturing facilities located across the globe, inspected by global pharma regulatory agencies, including the US Food and Drug Administration, the UK Medicines and Healthcare products Regulatory Agency, Japan Pharmaceuticals and Medical Devices Agency, Agência Nacional de Vigilância Sanitária and Health Canada

Global Pharma Products Business

- Differentiated branded hospital generics portfolio comprising inhalation and injectable anaesthesia, pain management drugs and intrathecal spasticity management drugs

- One of the few global suppliers of inhaled anaesthetics with an internal capability to manufacture all four generations of inhalation anaesthetic products

- State-of-the-art manufacturing facilities inspected by the US FDA, the UK MHRA and other pharma regulators

- Distribution to >100 countries leveraging direct sales force as well as distributor channel

India Consumer Products Business

- Over-the-counter (OTC) market portfolio comprising marquee brands and various products across key categories including skincare, gastro-intestinal care, women's intimate range, kid's well-being and baby care, pain management, and oral and respiratory healthcare

- Well-established brands include Saridon, Lacto Calamine, i-pill, Supradyn, Polycrol and Tetmosol

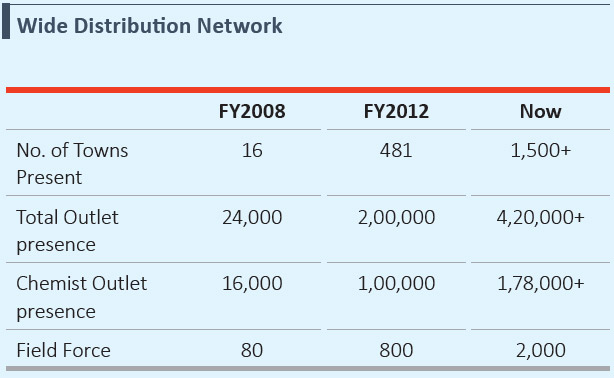

- Large India-wide distribution network with chemist coverage comparable with the top OTC players across over 1,500 towns

KEY HIGHLIGHTS – PHARMA

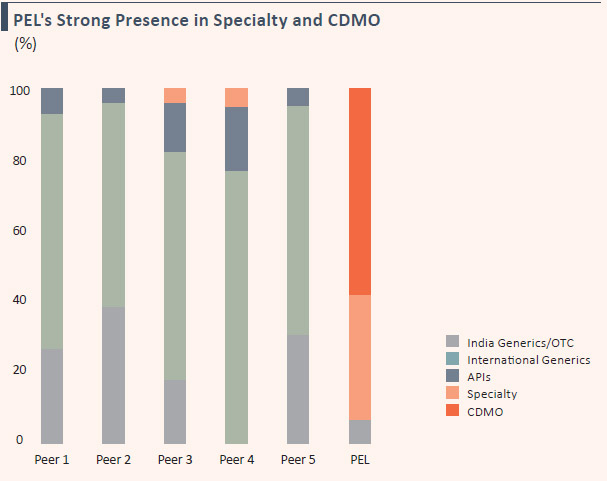

Differentiated Business Model

- Over 90% of revenues derived from niche businesses of complex generics and Contract Development and Manufacturing Operations (CDMOs)

- Positioned as partner of choice for large global pharma and virtual biotech companies

- Robust performance despite the sector facing pricing pressures and stringent regulatory regime

Note: Pharma peer set includes (not necessarily in the same order) Aurobindo Pharma, Cipla, Dr. Reddy’s Lab, Lupin and Sun Pharma

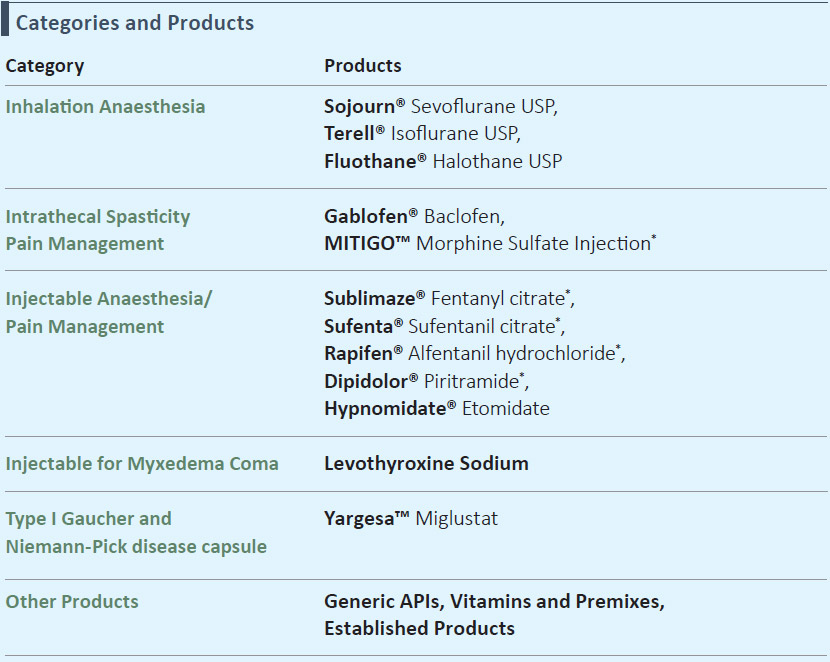

Strong Portfolio of Complex Products in the Global Pharma Products Business

- Niche capabilities in injectable anesthesia, inhalation anesthesia, intrathecal spasticity and pain management

- Integration of key acquired products from Janssen and Mallinckrodt on track

- Strategically chosen portfolio comprising of products with high entry barriers

*Controlled substances

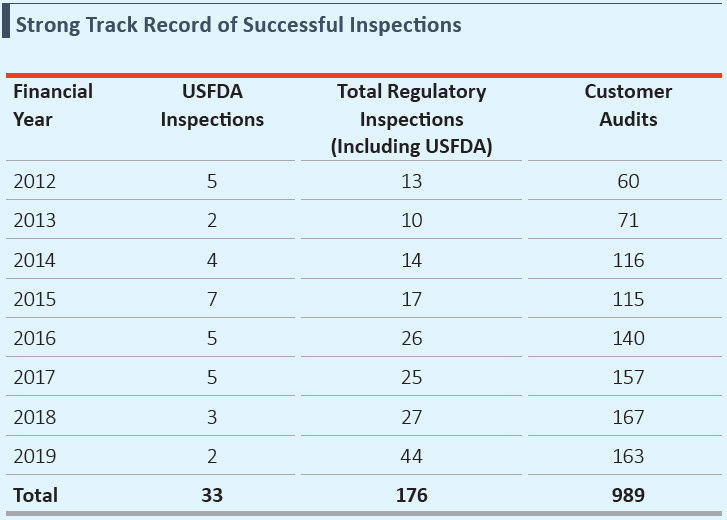

Strong Focus on Quality and Compliance

- A strong quality governance model, treating quality as an autonomous and independent function in itself, governed by a Board member

- Completed 33 USFDA inspections, 143 other regulatory inspections and over 989 customer audits, since inception

- Successfully cleared 2 USFDA inspections, 42 other regulatory inspections and 163 customer audits during FY2019

- Robust review process using various tools, including data integrity calculations and drive towards an audit readiness scorecard

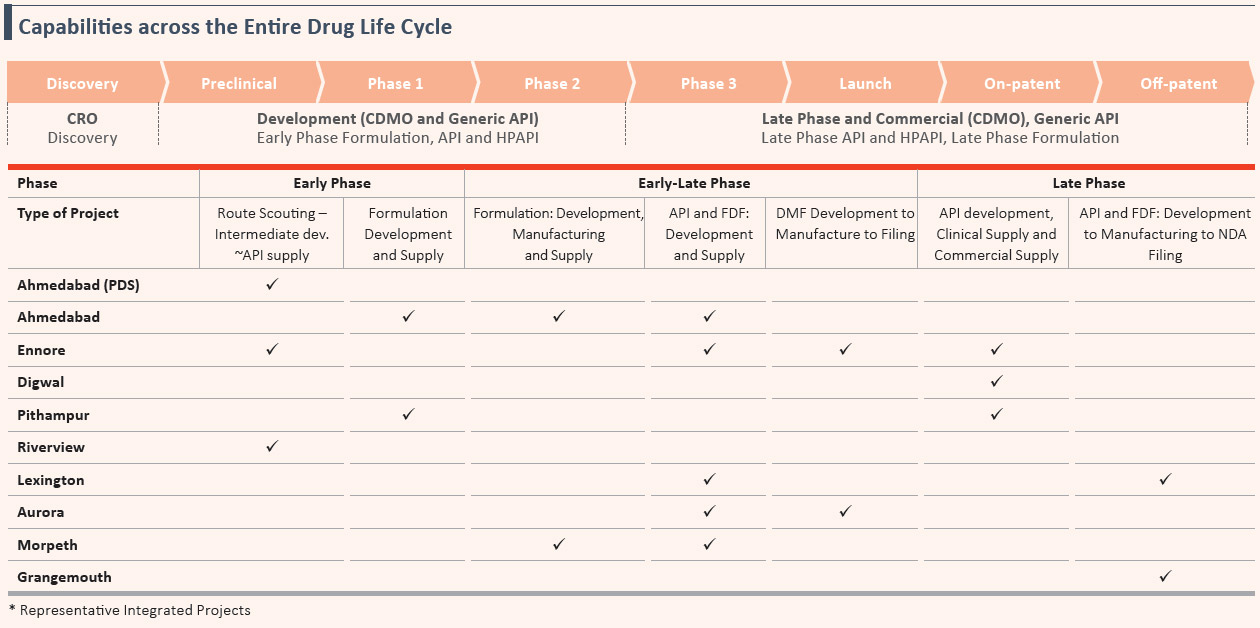

Integrated Model in the Global Pharma Services Business

- Integrated model of services spanning across the entire drug life cycle

- Built strong capabilities in HPAPIs and ADCs

- Considered as a preferred integrated partner in the area of cancer

- ʻXcelerate Integrated Solutions’ platform to facilitate strategic collaboration with customers

India-wide Distribution Network in the India Consumer Products Business

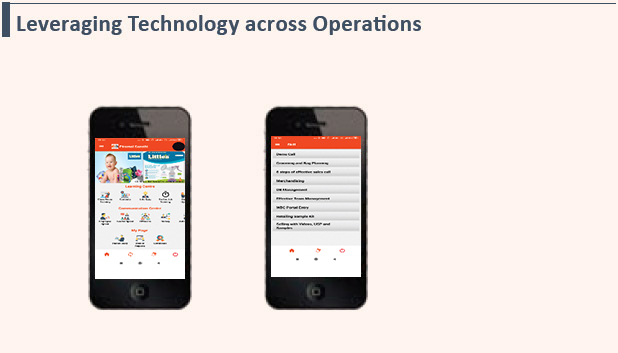

Using E-commerce and Technology to Grow the India Consumer Products Business

- Established the e-commerce channel in FY2019

- Tapping e-commerce, exports and institutional sales to widen the distribution network

- Focusing on further growth by increasing the number of SKUs listed in this channel

- Using technology in unique ways across operations

- Using Analytics for making business decisions such as trade schemes and distributor credit limits

- Training the field force that is spread pan-India

- Real-time tracking and reporting of sales data

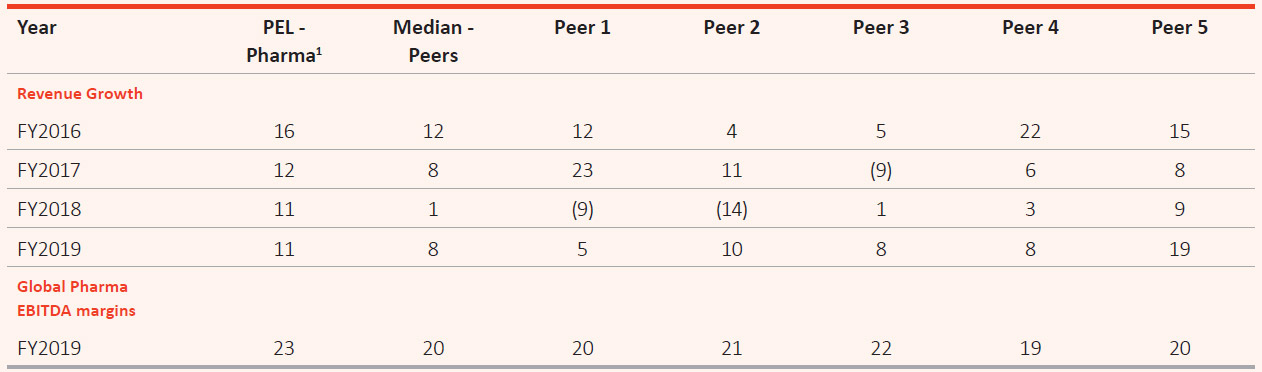

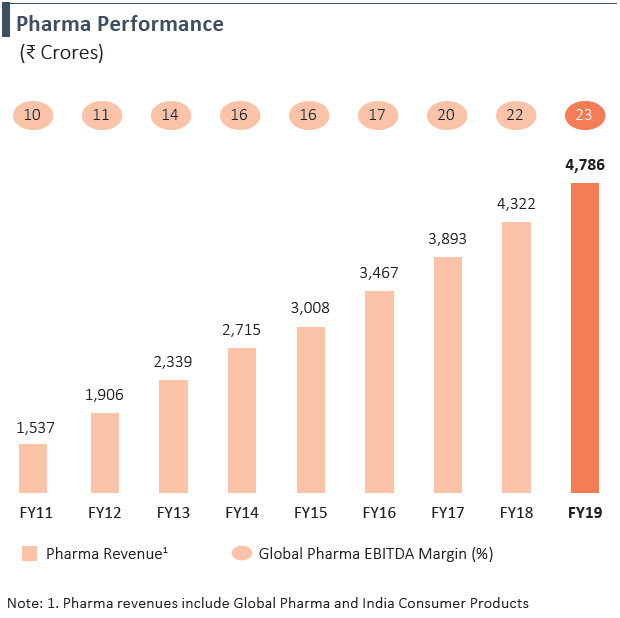

Strong Growth Track Record and Significant Improvement in Global Pharma EBITDA Margins

- 8 Year revenue CAGR of 15% for the Global Pharma business

- Margins have improved from 10% in FY2011 to 23% in FY2019 for Global Pharma business

Consistency in PEL’s Revenue Growth Stands out When Compared with Peers

(%)

Note:

- Pharma includes Global Pharma and India Consumer products.

- Pharma peer set includes (not necessarily in the same order) Aurobindo, Cipla, Dr. Reddy’s, Lupin and Sun Pharma.

Strong Presence in Regulated markets

Note:

|

MARKET SCENARIO

Globally, healthcare spending is expected to increase to more than $10 Trillion by 2022, accordingly to Deloitte. Pharma spending is expected to hit $1.2 Trillion by 2022, growing at a CAGR of above 6%. This acceleration is likely to be driven by growth in specialty medicines such as oncology and autoimmune biologics, rising share of pharmerging markets, novel therapies that address key unmet needs, and increased access to medicines as a result of new pricing policies around the world.

Global Pharma Services Business

Contract Development and Manufacturing Organisations (CDMOs) offer services ranging from preclinical and clinical development through commercialisation. With the increasing trend of outsourcing in the pharmaceutical industry, the contract manufacturing market will continue to grow. The extended footprint has also allowed CDMOs to become integrated full-service providers or ‘one-stop shops’ offering end-to-end solutions. This trend is expected to continue as both large and small pharmaceuticals and biotech companies prefer to work with strategically integrated partners.

CDMOs are increasingly benefitting from the strong funding environment in Biotech in the developed world. New drug approvals are on the rise, signaling a robust clinical development pipeline. The number of approved oncology therapies continue to rise. CDMOs serving API clients are likely to benefit due to sector consolidation and erratic API supplies from China. Consolidation among players has resulted in making the buyers’ position strong in the pharma industry. PEL, through its recent acquisitions of Sterile injectables and HPAPI facilities in the US, has proactively set itself to create a one-stop shop for its customers. This has resulted in making our value proposition much stronger and attractive for the big pharma companies to not only continue outsourcing, but to also consider PEL as a strategic partner for new/existing initiatives. The Company, with its integrated approach, is offering custom end-to-end services to accelerate the route of drugs to the market and reduce the cost and complexity of development.

Global Pharma Products Business

PEL was initially present in the $1.1 Billion market of inhalation anesthesia. The Company’s addressable market size has expanded to $55 billion in the hospital generics market. PEL’s careful portfolio selection ensures that the Company experiences lesser competitive pressures than most peers. PEL serves the institutional market, with a diverse set of buyers. The Company is predominantly in injectable and inhalation anesthesia dosage forms, which are difficult to manufacture and in the case of inhalation anaesthesia, the manufacturing as well as delivering requirements are unique.

In other products too, PEL benefits from unique factors. For a number of its inhalation anesthesia products, the Company provides its institutional customers in developed markets with vaporisers, which are necessary to administer drugs. Branded intrathecal products are injected by a physician into a pump, which is implanted into the patient on a long-term basis and for which regular refilling is required. The Company sells controlled substances in several markets outside the US, where original innovator brands have maintained legacy value.

India Consumer Products Business

The OTC products comprise several therapeutic applications, including vitamin and dietary supplements, weight management and analgesics. The India Brand Equity Foundation (IBEF) expects the Indian OTC market to grow at around 9% annually to reach `44,000 Crores by 2026. The growth of the OTC market is likely to be driven by the following factors:

- Growth in GDP and purchasing power

- Propensity for self-medication

- Rise in geriatric population

- Likely new regulations leading to liberalisation of OTC drug sales

- Increased use of media, particularly digital, to reach and educate consumers (in certain categories)

Over the past couple of years, the Indian OTC industry has been impacted due to the GST rollout and demonetisation. Channel partners (distributors and to some extent retailers) started down-stocking as the GST deadline approached, leading to shrinking of the wholesale channel. The companies that are able to optimise their supply chain and rationalise CFAs and distributors stand to benefit from the reduced compliance burden.

PEL undertook key initiatives both at strategic and operational levels in preparation for and after GST implementation. The Company supported its channel partners with additional credit, held extensive interaction to educate and understand their concerns and invested in capability building and people development to create sustained advantages. The GST rollout has provided the Company an opportunity to simplify operations and achieve better efficiencies. PEL should benefit due to supply chain optimisation and reduced compliance burden in the GST era.

OPERATIONAL PERFORMANCE

Global Pharma Services Business

During the year, PEL stayed on course to execute and deliver on its 3C strategy – Customers, Capability and Capacity – as evidenced by the highlights below:

- Substantial growth in the order book in FY2019 -

>50 new customers during the year and

>75% order book from existing customers - >70 integrated projects till date; 28 integrated projects in FY2019

- Completed a High Potency API plant annexed to the Riverview facility

- Completed a major API investment in support of a key innovator customer at Morpeth site

Global Pharma Products Business

During the year, the business has witnessed strong growth, driven by PEL’s focus on forging deeper relationships with its extensive customer base:

- The year saw the launch of Sevoflurane Integrated Closure variant in select European markets

- The Company also launched marquee products such as MITIGO™, which is an opioid agonist indicated for the management of intractable chronic pain

- Integration of key acquired products from Janssen and Mallinckrodt remains on track. The acquired products have high entry barriers as they are complex in terms of manufacturing, selling or distribution, resulting in limited competition

VIVEK SHARMA

CEO, Piramal Pharma Solutions

“The integrated business model we have built, complemented by our focus on quality, reliability, and customer centricity, has helped us successfully establish ourselves as the ‘partner of choice’ for both large pharma and biotech firms. During the year, we continued to see growth in our Order Book and an upward trend in our biotech relationships. Our extensive global capabilities in the segments of Antibody Drug Conjugates, High Potency APIs, Oral Solid Dosages and Sterile Injectables enable us to work with customers across a number of therapy areas including oncology, HIV, diabetes, malaria and metabolic diseases, among others. We remain committed to partnering with our customers to serve the patient community and reduce the burden of disease while continuing to deliver a strong performance.”

PETER DEYOUNG

CEO, Piramal Critical Care

“Last year, we were able to demonstrate the value of our portfolio of differentiated products that are difficult to manufacture and distribute as well as our strong customer connections directly and through partners into the hospital and institutional channel through the continuation of our profitable growth trajectory. In addition, during the year, we launched products such as MITIGO™ and continued to make progress on the transition and integration of the products acquired from Janssen. We realise that our customers depend on us for reliable high-quality supply of products, for use in life-saving or life‑improving medical procedures across the world. Hence, maintaining an absolute commitment to quality will always be a core pillar of our strategy. We are confident that this unique platform and capabilities will enable us to continue to defend and grow our existing products as well as provide us the opportunity to distribute additional products over the course of next year.”

India Consumer Products

During the year, the business continued to focus on its strategic endeavours:

- Added key brands in the Vitamins, Minerals and Nutrients categories

- Successfully initiated national distribution and sale of Digeplex. Products sold under Digeplex brand names are digestive enzymes used as remedies for digestive disorders

- E-commerce channel was established in FY2019. The Company is tapping e-commerce, rural, exports and alternate opportunities in order to widen the distribution network

- Increasingly using technology and analytics for making decisions in sales and operations

FINANCIAL PERFORMANCE

Revenue from the Pharma business grew by 11% y-o-y in FY2019 to `4,786 Crores on account of growth in base business, integration of acquired products into the sales force, strong order book and robust demand. Revenue has grown at a CAGR of 15% over the last 8 years, now contributing 36% to the overall PEL revenue mix. Our Global Pharma business, which accounts for 93% of Pharma revenues, has delivered a strong growth in EBITDA margins, from 10% in FY2011 to 23% in FY2019.

NANDINI PIRAMAL

Executive Director, PEL

“We remain committed to our strategy of growing India Consumer Products through launches, acquisitions, e-commerce and technology. The year saw us acquire marketing rights of leading products, while establishing our e-commerce channel and deploying technology across operations. The Supreme Court ruling of exempting Saridon from the list of banned fixed dose combinations is an affirmation to our commitment to provide effective and safe healthcare solutions that address the unique needs of Indian consumers. Going forward, the industry is expected to exhibit a remarkable recovery post recent headwinds and PEL is excited to ride the imminent growth wave and expand our business. We will continue to expand our portfolio with an aim to be among the top OTC product companies in India.”

WAY FORWARD

Over the past few years, PEL has made significant investments in activating various growth levers, which are expected to drive the next round of growth for its Pharma business. In the coming years, the Company will continue to develop new products, while evaluating inorganic growth opportunities. Following strategic initiatives and focus areas will shape its Pharma business for the years to come:

Strategic Priorities

Focus Areas

- Over 90% of revenues derived from niche businesses of complex generics and CDMO, as compared with less than 5% for most large Indian pharma companies

- A strong quality governance model, with the Quality function reporting to a Board member

- Stellar record in quality and compliance, having successfully cleared all regulatory inspections since 2011

- Integrated model of services spanning across the entire drug life cycle with strong capabilities in High Potency APIs and Antibody Drug Conjugates

- Continue the pursuit to build strong brands while tapping e-commerce, exports and institutional sales

- Using analytics for making business decisions such as designing trade schemes and setting credit limits for distributors

- Focus on steadfastly moving up the value chain in chosen business lines while seeking opportunities that complement the existing portfolio

- Profitably defending stronghold markets and increasing share in lower share markets, aided by growth through capacity expansions

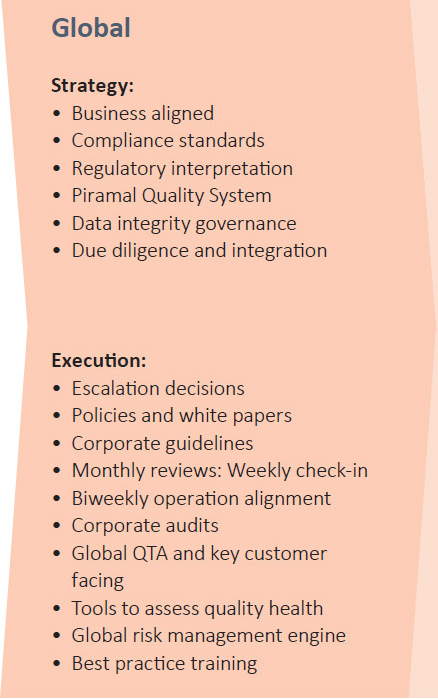

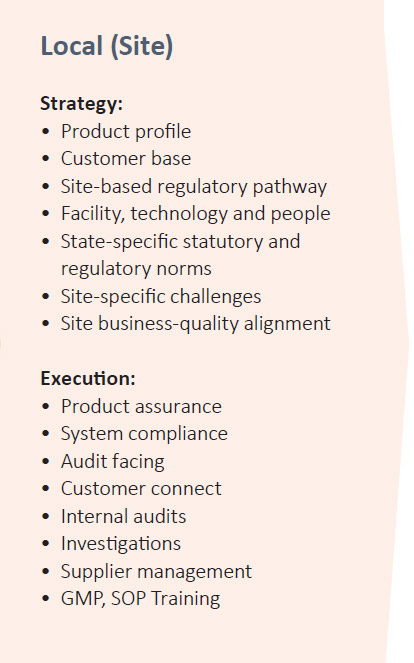

QUALITY AND BUSINESS EXCELLENCE

PEL is committed to consistently meet or exceed the requirements and expectations of its patients, customers, regulators and partners. In its pursuit to harness quality as a culture and for quality to continue to be a key differentiator, the Company ensures timely scale up of its standards to align with the industry benchmarks. The Company has a strong belief that quality is driven by a concern for patient safety. A deep commitment to building a quality‑driven organisational culture has helped PEL achieve regulatory compliances with zero defaults.

Robust Governance Strategies

Quality Governance

A strong governance and escalation mechanism is the foundation of PEL’s quality management framework. The Company’s quality management system is independent of its businesses and reports directly to the Board. IDEATE is an initiative that serves as a guide to building a sustainable governance model at PEL.

IDEATE stands for:

- Independent Quality Reporting

- Data Integrity Compliance

- Effective Governance

- Aligned Systems

- Transparent Work Culture

- Empowered Teams

Data Governance and Risk Mitigation Strategies

Data within pharmaceutical business is the most critical element and adequate data governance forms the foundation of an effective Quality Management System. PEL is committed to ensure that the data it generates is reliable to enable correct decision-making by the Company, its customers and the regulators.

PEL’S QUALITY MODEL

Quality Tool Kit

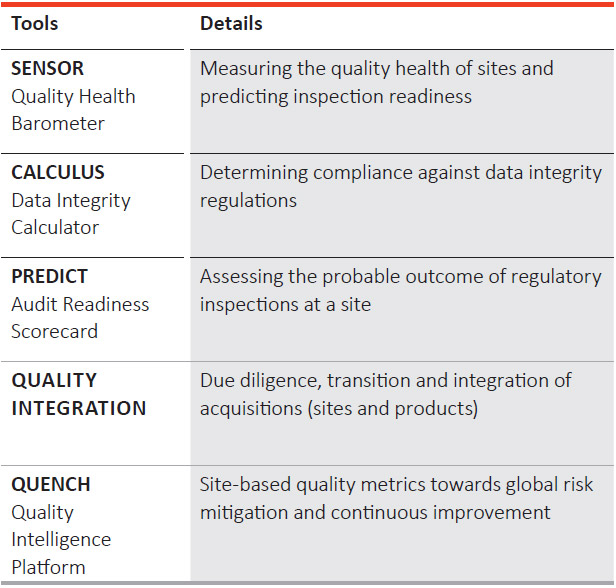

PEL’s quality team also uses several tools used for quality focus and risk avoidance at the site level. Proprietary tools for quality health evaluation and risk minimisation include:

In addition, the Company has multiple layers of vigilance, which include surprise corporate inspections of manufacturing sites by the QA team. These inspections lead to proactive identification of risks and their mitigation in a timely manner.

Over the past several years, PEL has invested significant capital into its India Consumer Product infrastructure, which has contributed to the Company’s strong product portfolio and far-reaching distribution network. Its emphasis on quality and its compliance track record has allowed it to move up the value chain in its business.

The India Consumer Products business utilises flexible manufacturing at external sites by third-party vendors. The in-house business development team follows stringent protocols for selection of such vendors. This team conducts detailed checks at all critical points in the chain from sourcing to finished products.

Summary

PEL is on a quality advancement journey from 'Quality for Compliance' to 'Quality as a Culture', with a focus on systems, processes, technology and people. The Company believes that quality is a collective responsibility and this belief is woven into the very fabric of the organisation. The belief is vindicated by the fact that all key facilities are approved and successfully inspected by the USFDA, a testament to the high compliance standards.