Proactive measures to mitigate potential risks

Conservative proactive measures have always complemented PEL’s bold strategic decisions, which enabled the Company navigate through challenging business environments.

Some of these proactive measures generally taken by the Company include:

Always maintained low leverage in the Financial Services business and allocated significant capital of ~`5,000 Crores to the business post the ~`7,000 Crore fund-raise in FY2018

Created independent risk and legal teams reporting directly to the Board

Unique asset monitoring process, that gives early warning signals

Maintained conservative provisioning despite healthy asset quality – 1.9% of overall loan book vs. GNPA ratio of 0.9%; 224% PCR1 - higher than top players in the industry

Proactively improved borrowing mix, by reducing share of CPs over the last 6 months from `18,000 Crores as on Sep-2018 to `8,900 Crores as on Mar- 2019

Nurtured a strong quality-driven culture in the Pharma business and hence, successfully completed 33 USFDA inspections

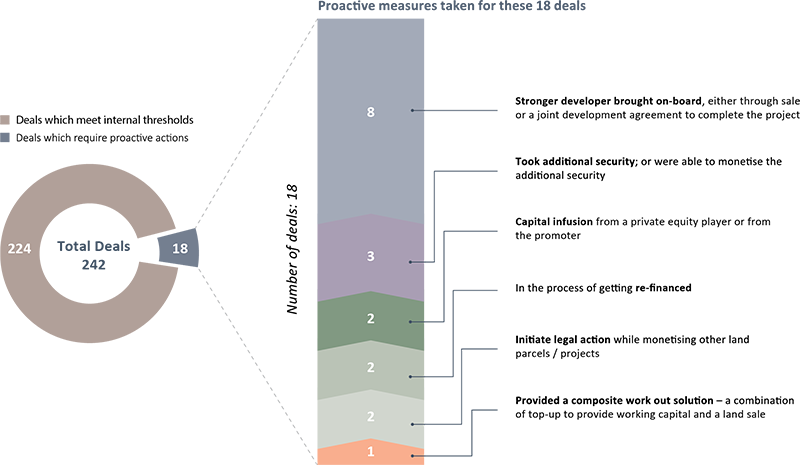

Periodic portfolio stress test – identified 18 deals and addressed potential asset quality stress under hypothetical, worst-case scenarios

Note: 1. PCR - Provision Coverage Ratio

Sensitivity Analysis: Residential Real Estate Portfolio

Even in the hypothetical worst case scenario, only 18 of 242 deals required ‘proactive measures’

Factors considered for sensitivity analysis:

- Cash cover

- Pricing

- Construction status

- Financial closure