Finanacial Services

PEL’s Financial Services segment offers a comprehensive suite of financial products to meet the diverse and evolving needs of its customers. The Company has created its unique positioning in the financial services space through its strong presence in the following sub-segments:

| Business Description | Loan Book / AUM | Offerings | |

|---|---|---|---|

|

Real Estate (RE) Wholesale Lending End–to–end real estate financing model Read More |

`40,160 Crores |

Mezzanine Lending Construction Finance—Residential Construction Finance—Commercial Lease Rental Discounting |

|

Corporate Finance Group (CFG) Sector agnostic corporate lending book (non – Real Estate) Read More |

`9,889 Crores |

Senior Lending Promoter Funding Loan Against Shares Mezzanine & Structured Lending Project Finance Acquisition Funding Capex Funding Working Capital Term loan |

|

Emerging Corporate Lending (ECL) Lending to emerging and mid-market companies Read More |

`1,387 Crores |

Senior Debt Loan Against Property Lease Rental Discounting Structured Debt Loan Against Shares Project Finance Loan against receivables Acquisition financing |

|

Housing Finance Company (HFC) Retail lending Read More |

`5,188 Crores |

Retail Housing Loans Loan Against Property Small Construction Finance Affordable housing |

|

Investments in Shriram Leading player in used Commercial Vehicle and MSME Financing Read More |

`7,253 Crores Book value of investments |

10% in Shriram Transport Finance Company 20% in Shriram Capital Limited 10% in Shriram City Union Finance |

|

IndiaRF Debt and/or equity in assets across sectors (other than real estate) to drive restructuring with active participation in turnaround Read More |

`744 Crores AUM |

JV with Bain Capital Credit Initial contribution of $100 Mn each by PEL and Bain Capital Credit |

|

Alternative AUM The platform manages alternate AUM under several categories Read More |

`9,269 Crores AUM |

Alternate Funds Third party mandate Managed account Strategic partnerships: APG, CPPIB, CDPQ |

KEY DEVELOPMENTS IN FY2019

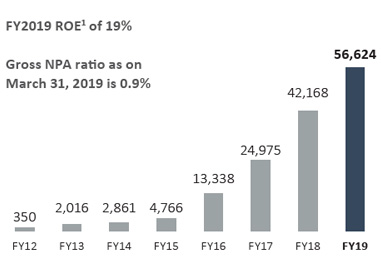

- Loan Book Growth of 34% y-o-y

- Healthy Asset Quality with GNPA Ratio of <1%

- Delivered robust ROE1 of 19% for FY2019

- Relationship with 147 developers across 400+ projects pan-India

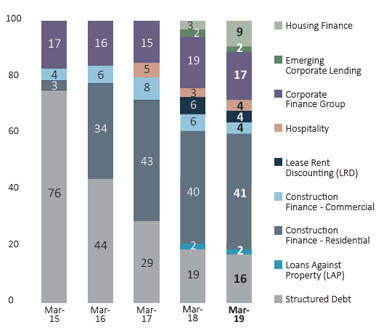

- Diversification of the loan book – wholesale RE loans (excl. LRD and Hospitality) contribute ~63% of overall loans vs. ~83% as on March 31, 2015

- Significant scaling-up of the housing finance business – loan book grew to `5,188 Crores as on March 31, 2019 from `1,210 Crores a year ago

- Housing finance presence in 15 cities through 16 branches

- Partnered with 740+ Direct Sales Agents and 1,850+ Connectors on the housing finance platform

- 28 Corporate borrower groups on our Corporate Finance Group (CFG) platform

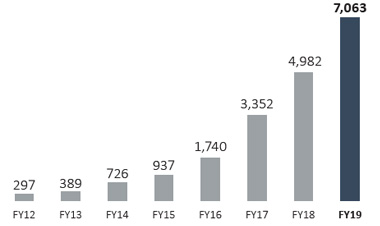

`7,063 Crores

Revenues

Loan Book

(` Crore)

Note: 1. On cash-tax basis and other synergies from merger

Consistently diversifying the loan book to reduce the risk profile (%)

Rapidly Growing Income from Financial Services

(` Crore)