High commitment from Promoter with

solid track record

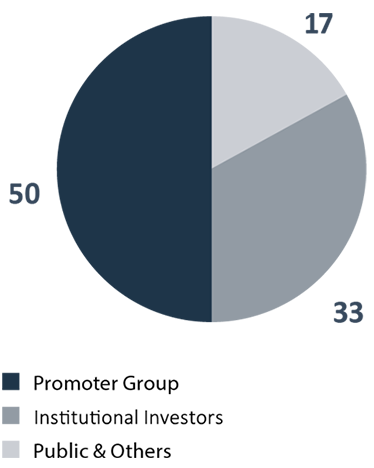

Promoter holding of nearly 50% serves as a strong foundation for the Company. PEL has the highest effective promoter holding amongst sizable financial institutions in India. Even during the fund raise in FY2018, the Promoter invested in the company through the rights issue.

PEL Shareholding Mix

As of March 2019 (%)

Under their leadership, the Company has consistently delivered strong performance across the long, medium and near-term periods.

Long term

24 %

Revenue CAGR for

31 years

29 %

Net Profit CAGR over

the last 31 years

28 %

Annualized Shareholder returns4

for 31 years

Medium term

28 %

Revenue CAGR over

the last 7 years

50 %

Net Profi t CAGR for

7 years

32 %

Annualized Shareholder returns4

for 7 years

Near term

27 %

Revenue CAGR for

3 years

29 %

Normalised Net Profit1,2,3 CAGR for 3 years

25 %

Annualized Shareholder returns4

for 3 years

Note: 1. FY2016 to FY2019 results have been prepared based on IND AS, prior periods are IGAAP

2. FY2019 normalised net profit excludes non-recurring and non-cash accounting charge towards imaging assets and non-recurring exceptional item

3. FY2018 normalised net profit after tax excludes synergies on account of merger of subsidiaries in Financial Services segment

4. Total shareholder returns are as on March 31, 2019. Assumes reinvestment of dividend in the stock (Source : Bloomberg)