Financial Services

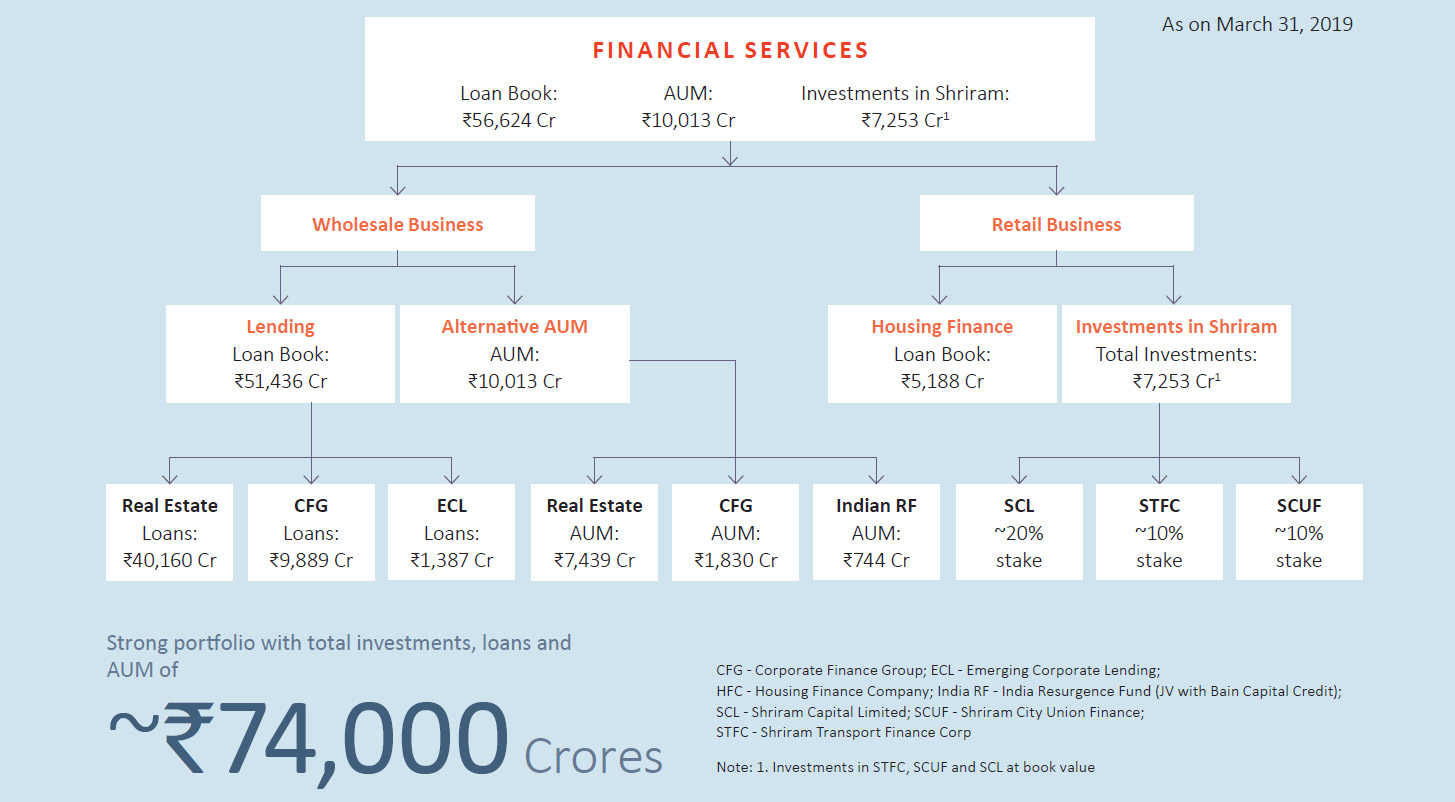

PEL's Financial Services business offers a complete suite of financial products to meet the diverse needs of its customers. The business has a diversified exposure across both wholesale and retail financing.

OVERVIEW AND FY2019 PERFORMANCE HIGHLIGHTS

PEL's Financial Services business offers a wide range of financial products and services to cater to the diverse needs of its clients. The Financial Services business has a strong portfolio with loans, alternative Assets Under Management (AUM) and investments of nearly `74,000 Crores as of March 31, 2019.

The Company has created its unique positioning in the financial services space, with a diversified exposure across both wholesale and retail financing, through its strong presence in the following sub‑segments:

Wholesale Lending

- Real Estate Developer financing loan book stood at `40,160 Crores

- Corporate Financing loan book (including education loans) stood at `9,889 Crores

- Emerging Corporate Lending loan book stood at `1,387 Crores

Retail Lending

- Strategic investments of `4,583 Crores in Shriram Group of Companies, which was valued at `7,253 Crores1 as of March 31, 2019

- Housing Finance loan book of `5,188 Crores, accounted for 9% of overall loan book

Alternative Assets Under Management

- Strategic partnership ventures with Bain Capital Credit, CPPIB, APG and Joint Venture (JV) with Ivanhoe Cambridge, a real estate subsidiary of Caisse de dépôt et placement du Québec (CDPQ)

- AUM of `10,013 Crores across various investment platforms and JVs

MARKET SCENARIO

In September 2018, the default on payment obligations by IL&FS Group companies on their debt instruments resulted in a system‑wide liquidity tightening. The default raised concerns over asset-liability mismatches at Non-banking Financial Companies (NBFCs), which traditionally relied on short-term market borrowings, such as commercial papers, to finance long-term assets. During the peak of the liquidity tightening situation, banks and mutual funds, which are among the largest providers of funds to NBFCs, became cautious and selective towards financing NBFCs.

Since then, lenders started to classify NBFCs into three broad categories based on their (i) performance track record of growth, asset quality and return profile, (ii) promoter’s reputation and commitment and (iii) balance sheet strength. The first category, of ‘best-in-class’ NBFCs, across the parameters mentioned earlier, continued to receive funds, although their cost of borrowing increased marginally. For the second category of NBFCs, which were relatively good, but not among the ‘best-in-class’, liquidity was available, but only selectively.

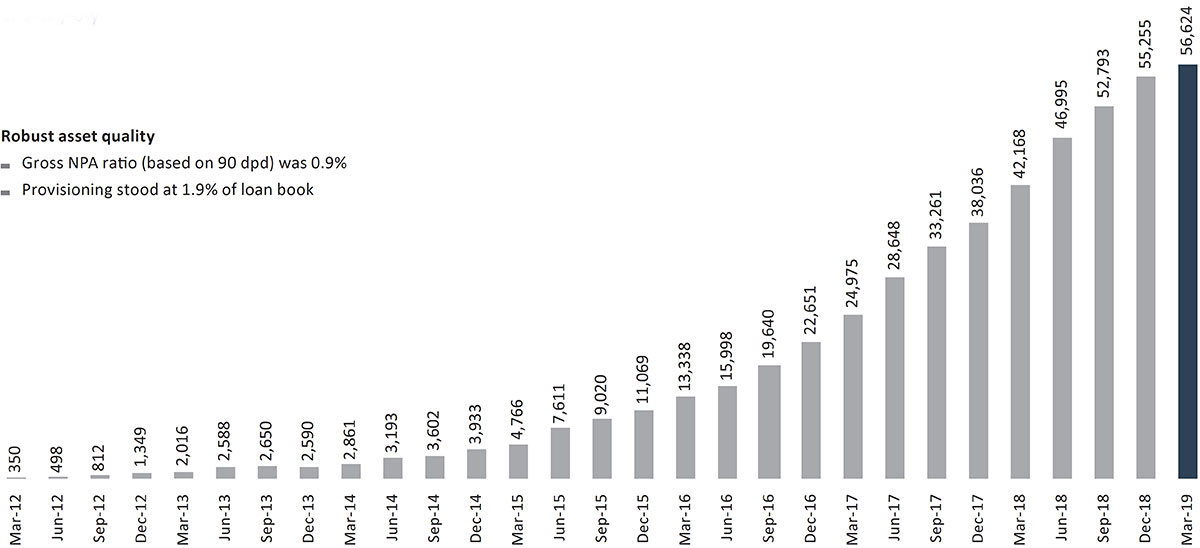

Continued Loan Book Growth and Consistent Expansion of Product Portfolio

Outstanding Loan Book (` Crores)

`56,624 CroresTotal loan book with growth

of 34% y-o-y

`29,762 CroresDisbursements in FY2019

`16,658 CroresRepayments in FY2019

Note: Carrying value till Dec'15 and amortised cost thereafter

For the third category of NBFCs, which were the relatively weaker ones, liquidity was not available and they were forced to sell their loan portfolios / businesses.

As a result of these funding constraints, only a few top-quality NBFCs could grow their loan book in H2 FY2019. Subsequently, interventions by the Reserve Bank of India (RBI) and the government helped relatively ease system-wide liquidity to a certain extent, particularly for good quality players.

At the macro level, India’s GDP is expected to reach $5 Trillion in the next 5 years and it aspires to become a $10 Trillion economy by 2030. A significant pool of capital will be needed to fund this economic growth. As public sector banks remain capital constrained due to severe asset quality issues, NBFCs, along with a few private sector banks, will need to step in to support demand for growth capital.

Over the past couple of years, NBFCs have played a critical role in India’s economic growth, as they have been instrumental in extending credit to Micro, Small and Medium Enterprises (MSMEs), real estate and retail consumers. MSMEs account for 31% of GDP, 40% of exports and hire 25% of labour force. Banks lending to MSMEs have declined significantly and it is estimated that NBFCs will have to lend ~`2 Lakh Crores, or nearly 75% of the incremental credit demand, to MSMEs in the next 3-4 years. The real estate sector, which contributes more than 5% to GDP and hires 17% of labour force directly or indirectly, is also dependent on NBFCs and Housing Finance Companies (HFCs) for funds. Going forward, the latent credit demand of an emerging India will require NBFCs to fill the gaps where traditional banks have been wary to serve.

Additionally, higher credit penetration, increased consumption and digital disruption present significant opportunities for NBFCs and HFCs to tap their growth potential. PEL is well positioned to capitalise on this opportunity owing to its high capitalisation, high commitment from a reputed promoter, robust governance, conservative internal processes and deep sectoral understanding.

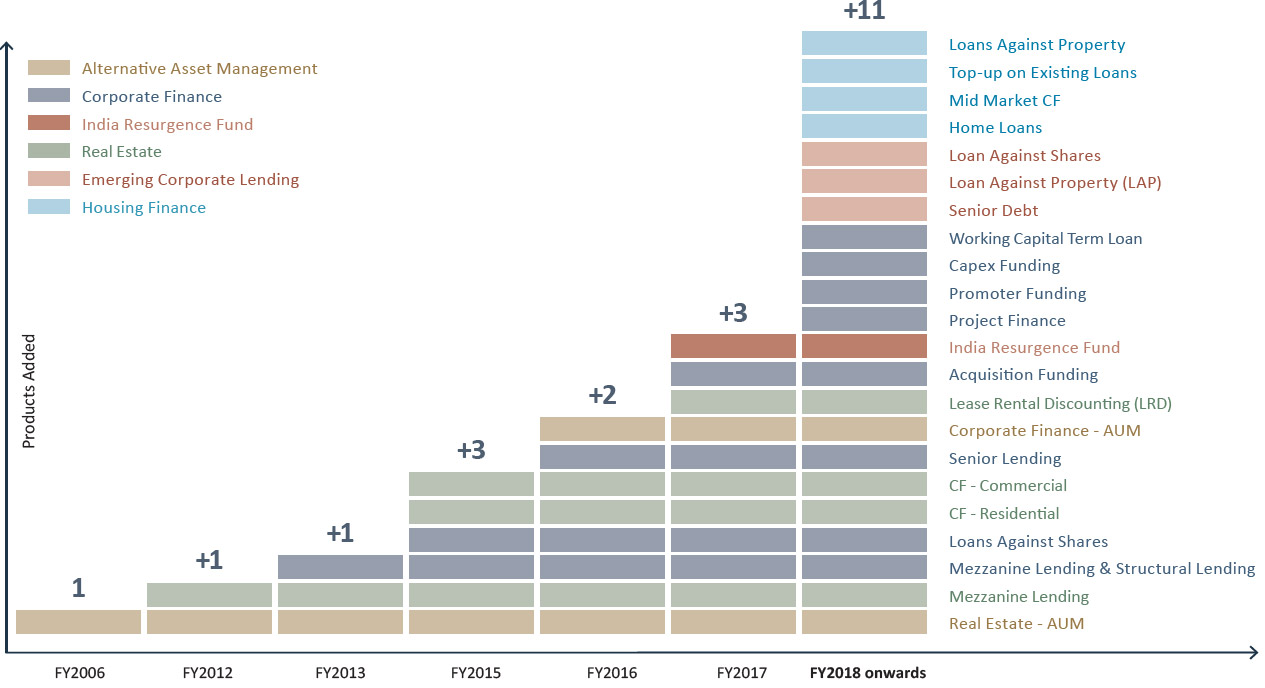

Total number of products – 22

CF - Construction Finance

KHUSHRU JIJINA

Managing Director, PCHFL

“Despite a system-wide liquidity tightening, we delivered a strong performance during the year and further strengthened our balance sheet. On the liability side, we demonstrated a strong ability to raise resources from a diversified set of investors and also substantially improved the borrowing mix by reorienting towards longer term funds. We will continue to further diversify our borrowings by tapping new funding sources, such as an External Commercial Borrowings (ECB), new bank lines, Tier II capital, etc.

Our asset quality remained robust even as we increased the granularity of our loan book with a significantly increased share of Housing Finance (to 9% from only 3% a year ago). We remain focused on further de-risking our portfolio and have already taken proactive measures to further strengthen the quality of our real estate loan book given the volatile market.

Going forward, we remain focused on delivering robust returns and are also proactively creating additional sources of fee income through asset aggregation opportunities, as we further reduce the overall risk profile of the loan book. We believe with long‑term funding locked-in, a diversified loan book and healthy asset quality, we are well positioned to capitalise on potential future opportunities.”

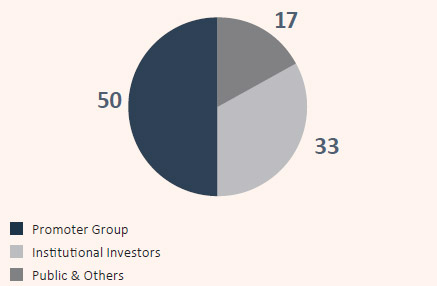

Strong Commitment from the Promoter Group

PEL Shareholding Mix (%)

As on March 31, 2019

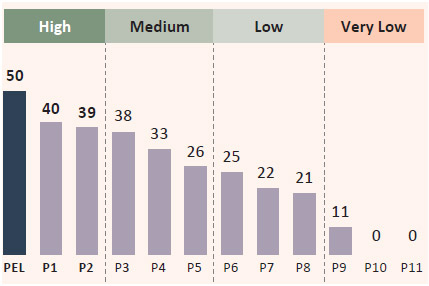

Comparison of Effective Promoter Holding* with Large NBFCs/HFCs1 (%)

As on March 31, 2019

* Estimated based on available disclosures. Effective promoter shareholding is defined as the stake of the promoter group in the Company, adjusted for any cross-holdings or indirect holdings through a holding company-subsidiary structure. In case of no single promoter/founder or promoter group, it has been considered as zero.

Note

- P1 - P11 represents the peer set, which includes (not necessarily in the same order) HDFC Ltd., LIC Housing Finance, Bajaj Finance, Indiabulls Housing Finance, Dewan Housing Finance, Aditya Birla Capital, PNB Housing Finance, L&T Finance, Mahindra & Mahindra Financial Services, Edelweiss and Cholamandalam Finance.

- Data for peers as on March 31, 2019.

- Data for Aditya Birla Capital as on June 30, 2018.

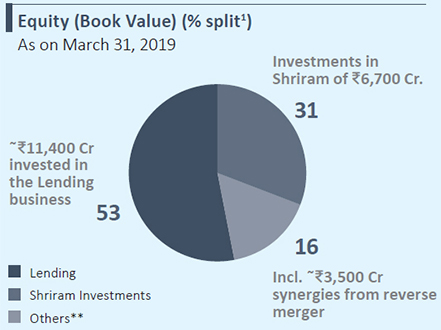

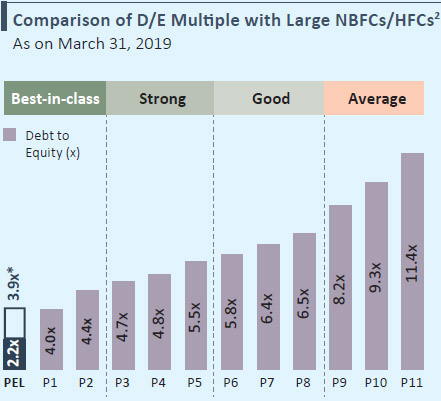

Among the Least Levered Large NBFCs in India

~`22,000 CroresTotal equity in the Financial Services

business vs. loan book of ~`56,624 Cores

* D/E multiple of 3.9x for PEL’s Lending business only. Overall D/E multiple for PEL’s Financial Services business was 2.2x, including investments in Shriram.

** Others includes DTA benefit from reverse merger and equity allocated to Alternative AUM business.

Notes:

- Based on estimated allocation.

- P1 - P11 represent the peer set, which includes (not necessarily in the same order) HDFC Ltd., LIC Housing Finance, Bajaj Finance, Indiabulls Housing Finance, Aditya Birla Capital, PNB Housing Finance, L&T Finance, Mahindra & Mahindra Financial Services, Edelweiss, Repco Home Finance and Cholamandalam Finance.

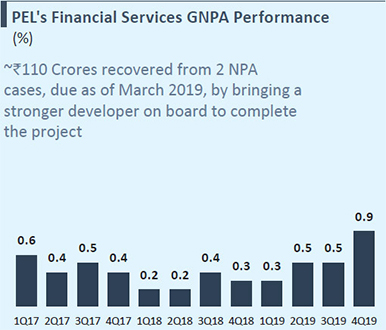

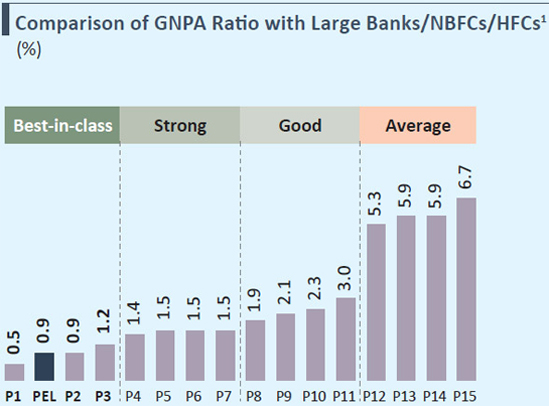

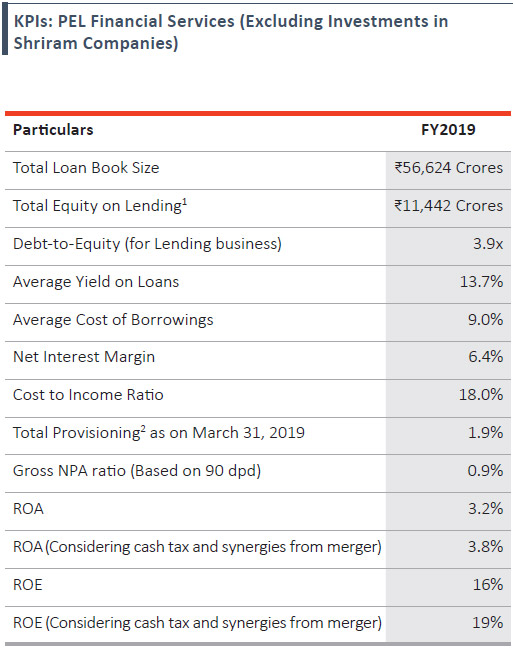

'Best-in-class' Asset Quality, as a Result of Robust Risk Management

Note:

- P1-P15 represent the peer set, which includes (not necessarily in the same order) HDFC Ltd., LIC Housing Finance, Bajaj Finance, Indiabulls Housing Finance, Repco Home Finance, Aditya Birla Capital, PNB Housing Finance, L&T Finance, Mahindra & Mahindra Financial Services, Edelweiss, Cholamandalam Finance, HDFC Bank, ICICI Bank, Kotak Mahindra Bank and Axis Bank.

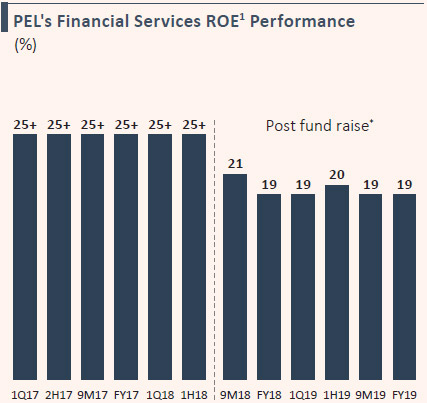

Delivering Strong Returns

* In 3Q18, ~`2,300 Crores was allocated to Financial Services from the ~`7,000 Crores fund raised. In 4Q18, the entire ~`5,000 Crores (of the estimated allocation) was allocated to the business.

Note:

- ROE calculation for PEL on a cash tax basis, considering the capital allocation from the fund raise

- P1-P15 represent the peer set, which includes (not necessarily in the same order) HDFC Ltd., LIC Housing Finance, Bajaj Finance, Indiabulls Housing Finance, Repco Home Finance, Aditya Birla Capital, PNB Housing Finance, L&T Finance, Mahindra & Mahindra Financial Services, Edelweiss, Cholamandalam Finance, HDFC Bank, ICICI Bnk, Kotak Mahindra Bank and Axis Bank.

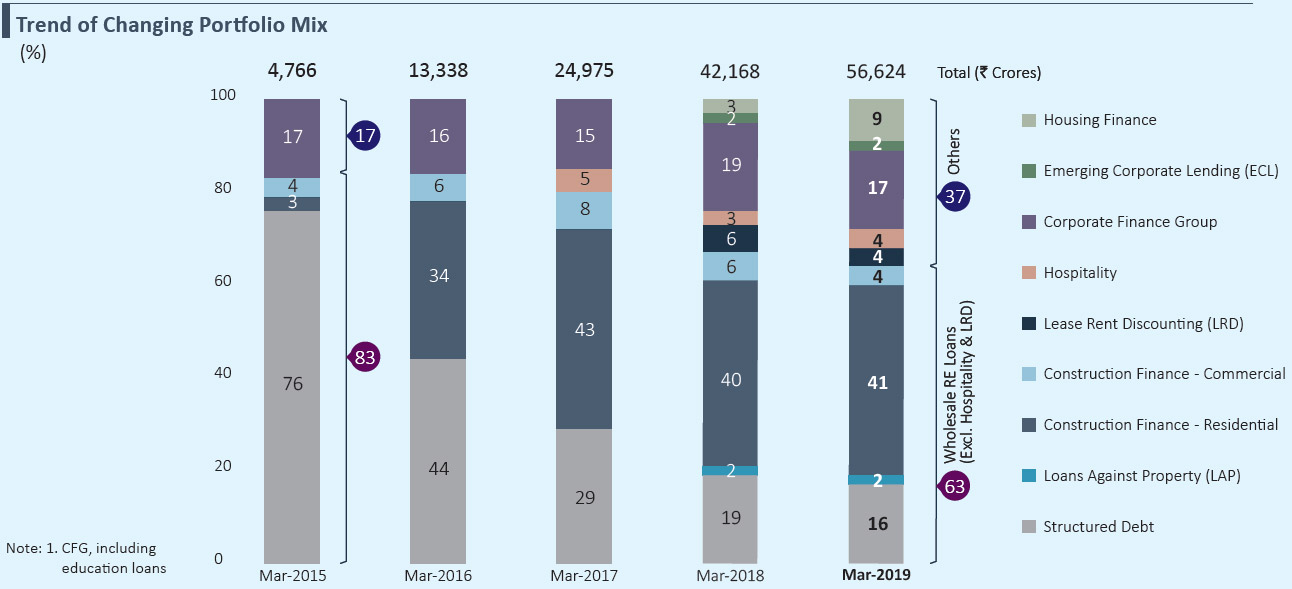

Continuous Loan Book Diversification: Increased Granularity to Reduce the Overall Risk-Profile

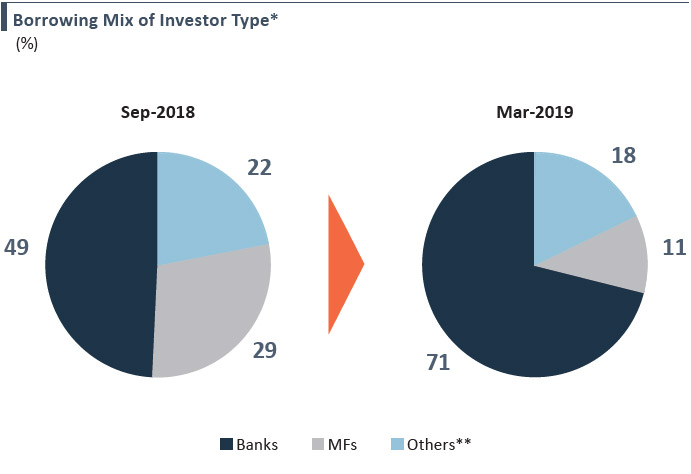

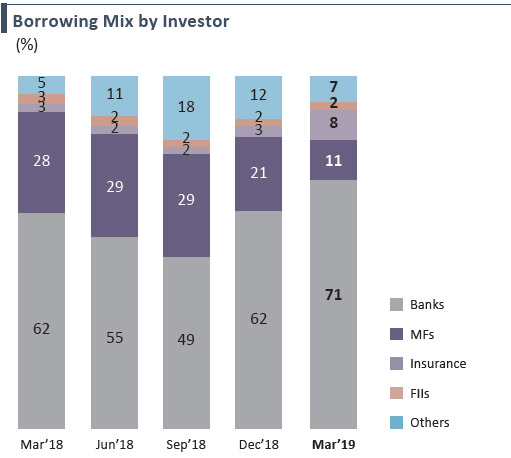

Diversifying Borrowing Mix: Shifted Borrowing Mix towards Long-term Funds

- Raised long-term funds amounting to nearly `16,500 Crores in the last two quarters

- Exposure to CPs has reduced to ~`8,900 Crores from ~`18,000 Crores as of September 2018

- Significant increase in borrowing from banks from 49% as of September 2018 to 71% in March 2019

- Simultaneously, reduced dependence on funding from MFs to 11% as of March 2019 from 29% as of September 2018

* Data for PCHFL

** Includes insurance companies, pension funds, Foreign Institutional Investors (FIIs), NBFCs and others

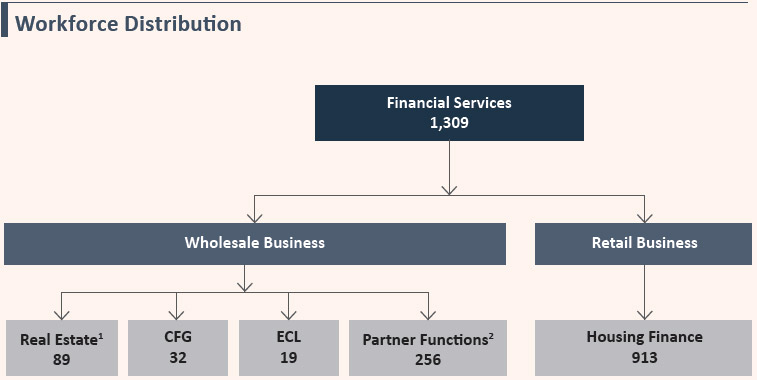

Management Depth: Highly Talented and Experienced Team

- Team of 1,300+ professionals, with a healthy mix of investing and operating experience, across both wholesale and retail lending

- The wholesale lending business headcount of ~396 employees includes dedicated teams for various ‘Partner Functions’ – such as Risk Management, Asset Monitoring, Legal and IT – which constitute nearly two-thirds of the overall headcount of the business

- Local teams in the cities where the Company operates

Note:

- Includes Capital Markets Advisory business

- Partner Functions includes Risk Management, Asset Monitoring, Legal, Treasury, Brickex, Human Resources, Information Technology etc.

Long-standing Partnerships with Global Firms: Strong Relationships Providing an Access to Patient and Intelligent Capital

JV with Bain Capital Credit to create a distressed asset investment platform, India RF, to invest in debt and equity across distressed companies

Partnered with Ivanhoé Cambridge, a real estate subsidiary of CDPQ, to provide long-term equity to blue chip residential real estate developers

Alliance with APG to invest in rupee-denominated mezzanine instruments issued by infrastructure companies in India

Strategic alliance with CPPIB to provide rupee-denominated debt financing to residential projects ; partnered to launch InvIT in India and focused on renewables

$100 Million investor in India Resurgence Fund; anchor investor in upcoming ECB issuance

WHOLESALE LENDING

REAL ESTATE DEVELOPER FINANCE

Market Scenario

In the last few years, the real estate sector has witnessed several regulatory and policy reforms, such as demonetisation, followed by the implementation of Real Estate Regulation (and Development) Act (RERA) and GST, and changes in accounting standards. Although these reforms reduced the pace of growth of the real estate sector in the near term, they are contributing positively towards healthy consolidation, increased transparency and sustained growth in the medium to long term.

However, increased compliance norms along with the recent liquidity tightening situation in NBFCs/HFCs have accelerated the consolidation in the real estate sector.

As the pace of consolidation picks up, the real estate sector is witnessing the following trends:

- Distressed developers are either partnering with or exiting to stronger players: Several distressed developers are partnering with stronger developers to either jointly develop projects or completely take over projects. Moreover, some of these distressed developers and NBFCs are even selling land banks at a steep discount. Also, several large Indian corporate houses are foraying into the real estate sector.

- Rising interest of Private Equities (PEs) as they are trying to fill the space vacated by struggling NBFCs: Real estate continues to remain an attractive sector – this is evident from the rising interest of PE firms. PE firms have invested nearly $1.8 Billion1 across 20 deals between October 2018 and March 2019.

- Market is shifting towards quality developers, amid faster consolidation in the real estate sector: With consolidation speeding up in the real estate sector, we see that the larger, well-organised developers, with balance sheet strength and delivery capabilities, are gaining market share. Market shares of top developers have improved across Tier I cities in India. They estimate that in CY 2018, the Top 10 developers in each of the Tier I cities cumulatively accounted for 34% of total area sold (on an average) versus only 24% in CY 20132.

PEL’s Positioning

PEL’s portfolio withstood the impact of RERA successfully, due to our developer selection criteria – i.e., partnering with top-tier developers in select micro-markets. Further, the platform’s ability to foresee market headwinds and swiftly adapt to changing norms has helped in creating a book that is resilient to market dynamics.

Going forward, real estate sales are expected to improve, driven by increasing end-user affordability and rising demand for projects by quality developers. In FY2019, residential real estate sales grew by 5% y-o-y across Tier I cities in India3. We are relatively better positioned to benefit from the pick-up in residential real estate sales, as our clients have a track record of superior project performance and a relatively high share in overall sales in the markets they operate.

Operational Performance during the Year

The real estate developer financing loan book grew 26% to `40,160 Crores as on March 31, 2019 from `31,833 Crores as on March 31, 2018. In FY2019, the Company’s incremental disbursements stood at `20,992 Crores, of which `6,692 Crores was disbursed in H2 FY2019. Also, `13,357 Crores was repaid / pre-paid during the year, equivalent to 42% of the opening loan book as of April 1, 2018, of which `5,893 Crores was in H2 FY2019.

Construction finance contributed nearly 64% to the real estate loan book and lending to commercial real estate, which includes construction finance, hospitality loans and LRD, now constitutes ~17% of the real estate loan book. LRD was at `2,318 Crores, constituting 6% of the real estate loan book.

In FY2018, the Company forayed into the hospitality sector, given the opportunities to invest in quality assets at good locations, which have thrived across business cycles. As of March 2019, PEL had committed nearly `2,109 Crores across marquee hotel assets in Gurugram, Bengaluru and Pune.

Note:

- Source: Venture Intelligence, ET Realty (April 17, 2019)

- Source: HSBC Research

- Source: Liases Foras

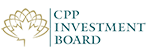

Reducing Developer Concentration

We also continue to make efforts to reduce developer concentration to lower the risk profile of our loan book. As of March 2019, our Top 10 developer exposures constituted less than one-third of our overall loan book.

Going forward, we plan to further reduce single borrower exposure. However, consolidation in the real estate sector and the shift in market share towards larger, well-organised, quality developers will create a significant opportunity for us to continue to work with Tier I clients and enable them to gain market share in this phase of consolidation.

Nevertheless, in our endeavour to reduce developer concentration, while continuing to participate in deals by these quality clients, we have created a pool of like-minded partners, such as foreign banks and pension funds, who will co-lend with us. We will also generate fee income through such co-investment deals, as we would take a lead in these transactions in terms of underwriting, asset monitoring and loan servicing.

CORPORATE FINANCE GROUP (CFG)

Market Scenario

In India, corporate lending covers a wide range of financing requirements, which were traditionally served by the banking system. However, over the last few years, with rising NPA levels especially in public sector banks, NBFCs have stepped in to fill the void. The share of NBFCs in the overall system credit increased to 23% in FY2019 from 13% in FY2012, according to a research house.

Wholesale and diversified NBFCs/HFCs continue to gain market share in corporate lending as a result of their ability to price risks, flexibility in loan structuring and faster turnaround periods.

Going forward, credit demand is expected to increase as the government plans to boost infrastructure spending by targeting ~$1.4 Trillion of capital investment in infrastructure by 2024. PEL’s CFG is well positioned to capture this growth opportunity and will likely benefit from its ability to offer customised solutions to customers and expand its product portfolio and sector coverage.

CFG’s Approach to Lending

We have established and strengthened the CFG business over more than 5 years by building a robust process framework and focusing on all aspects of a deal, i.e., sourcing, evaluation, approval, monitoring and exit. CFG has strengthened its investment team by increasing the team size and forming dedicated teams to evaluate specific sectors. The CFG underwriting process has multiple layers to analyse risk – starting with a deep dive sector study for each new sector followed by deal-specific due diligence and analysis.

CFG’s philosophy is to identify particular sectors and work closely with clients to develop credit solutions that tie in to the underlying cash flows of the business. Accordingly, the team started with infrastructure and renewable energy in FY2014, and over a period, has added cement, auto components, hospitality, logistics, cash management and various sub-segments within the manufacturing and services industries to its focus area.

The Asset Monitoring team is a four-member team, which works closely with portfolio companies to identify potential early-warning signals.

The Capital Markets and Advisory group was formed in April 2017 to develop deeper relationships with Indian corporates and engage with them on an ongoing basis. The objective of this group is to build a relationship-driven lending business, offering customised financing solutions across the risk curve. The Capital Markets and Advisory group houses the Corporate Client Coverage Group (CCG) and the Syndication Group (SG). CCG is responsible for developing and maintaining direct relationships with corporates on a pan-India basis across sectors and works towards originating deals across various products viz., project finance, senior debt, structured debt, loan against shares, mezzanine debt and acquisition finance. SG is responsible for the down-selling of underwritten transactions across the real estate and CFG platforms. SG works with various banks, financial institutions, mutual funds, NBFCs, Alternative Investment Funds (AIFs) and Foreign Portfolio Investments (FPIs) and has a strong network across the market. The syndication capability enables PEL to underwrite large transactions, thereby providing a comprehensive one-stop solution to clients. CFG has also strengthened its Deal Clearing Committee by on-boarding independent experts with decades of experience in corporate banking, private equity and credit research.

Finally, CFG maintains a high focus on potential exit alternatives. While structuring a deal, CFG evaluates and factors in exit alternatives, with extensive exit rights ensured. Strong asset monitoring helps in timely exit. PEL taps its vast network to assist clients in providing exits and has a strong, six-member syndication team that facilitates down-selling.

CFG successfully exited or downsold deals amounting to `2,021 Crores in FY2019. The exited investments have ranged from `50 Crores to `1,000 Crores and spanned across sectors such as renewables, infrastructure, cement, warehousing and building materials. CFG downsold/syndicated sanctions to other NBFCs, banks and other financial institutions amounting to `627 Crores.

Operational Developments during the Year

CFG’s loan book grew by 20% to `9,889 Crores in FY2019 from `8,209 Crores in FY2018.

Initially, the products offered by CFG primarily comprised high‑yield structured credit solutions to the infrastructure sector. However, the business has gradually diversified its risk profile and now offers multiple solutions-, with Internal Rate of Return (IRR) ranging from 11% to 18%. The product suite has expanded from mezzanine and structured debt to promoter funding, capex financing, acquisition funding, senior corporate lending, project financing and loan against shares.

CFG continues to focus on creating differentiated product offerings based on client needs: takeover of the entire capital stack, growth funding, construction line, structured repayment profiles, special situations, etc.

EMERGING CORPORATE LENDING (ECL)

Business Overview and Market Scenario

The Emerging Corporate Lending (ECL) vertical was launched by the Company in FY2018 with the objective of catering to the financing needs of emerging and mid-market businesses in India.

ECL is a sector-agnostic platform and engages with clients from manufacturing to trade and services, offering funding with a ticket size of `10 Crores to `125 Crores. With the flexibility to offer multiple products at competitive rates, ECL is able to cater to the borrower’s requirements with customised solutions, in terms of security and repayment tenor to match the underlying cash flows of the business.

A Unique Approach to Lending

ECL has adopted a regional origination and a centralised underwriting model. Origination efforts are led by Senior Relationship Managers based out of Mumbai, Delhi, Chennai, Ahmedabad, Hyderabad and Pune, while the centralised underwriting team operates out of Mumbai. ECL is supported by dedicated teams from various partner functions—Legal, Asset Management, Credit Operations and Risk.

Key Differentiators

- Regional origination: Regionally dedicated teams, with presence in six cities and nine relationship managers, improve turnaround time for loan approvals and disbursals (executed deals with client relationships in 11 metros / Tier I and II towns)

- 'Solution' versus 'Product' approach: Ability to provide all products under one umbrella and also provide customised solutions based on client requirements while maintaining a rigorous underwriting process

- Robust risk management driven by centralised underwriting: Standardised underwriting practices across regions with focused sector approach

As of March 31, 2019, with 29 members across underwriting, investment, dedicated business operations, legal and asset management, ECL had executed 36 deals.

The ECL loan book stood at `1,383 Crores as on March 31, 2019.

RETAIL LENDING

RETAIL HOUSING FINANCE

Market Scenario

The housing finance market is expected to witness growth in the coming years due to under-penetration, increased urbanisation, favourable demographics, improving affordability due to the stabilisation of housing prices and higher deployment of funds towards housing loans by banks and NBFCs. Additionally government and regulatory impetus are likely to create a huge demand potential for the sector.

In the past few years, HFCs have been increasing their presence in the housing loan market. However, tight liquidity since September 2018 has forced HFCs to lower their disbursements and meet a sizeable portion of their funding requirement through portfolio sales. Housing loan portfolio growth of HFCs/NBFCs reduced to 13% y-o-y for the period ended December 31, 2018 versus 18% for the same period the previous year1. The total housing credit outstanding stood at more than ₹18 Lakh Crores as of December 31, 2018.

PEL leveraged this opportunity as the HFC business demonstrated robust growth during the year and remains well-positioned to capitalise on opportunities in the retail lending space going forward.

Note: 1. Estimates by ICRA

Key Developments during the Year

The HFC loan book more than quadrupled to `5,188 Crores as of March 31, 2019 from `1,210 Crores a year ago. Additionally, loans that are sanctioned but not yet disbursed stood at nearly `2,500 Crores as of March 31, 2019. During FY2019, the HFC business acquired ~`500 Crores of loan portfolios from other NBFCs/HFCs, capitalising on the opportunity created by the tightening liquidity situation. As on March 31, 2019, the HFC loan book accounted for 9% of the overall loan book versus only 3% a year ago.

Geographic Presence

The HFC business has a presence in 15 cities across India through 16 branches.

Customer Mix

As of March 2019, the average ticket size of home loans within the HFC business was ~`70 lakhs, with 59% of customers comprising of salaried individuals and 41% comprising of self-employed individuals.

Product Offerings

HFC offers a range of products to homeowners, homebuyers and construction finance to mid-size developers.

The business continues to expand its product offerings to cater to evolving customer needs. During FY2019, two new products were launched – AdvantAGE Loans and Bridge Loans. To service additional lead flows from alternative channels, tie-ups have been initiated with third parties.

The business also organised boot camps for new hires and regular training programmes for current employees have been undertaken by the HR team to boost employee productivity. A new-age IT system will be rolled out during H2 FY2020 under Project Elixir. The system will enable to underwrite a loan with minimal human intervention; e-loans will be operational in FY2020. The new system will enhance customer experience, facilitate productivity and improve cost efficiency.

Housing Finance: Focus Areas

- Significant opportunity from existing developer relationships: Our wholesale lending business is currently funding 439 projects of nearly 150 grade ‘A’ developers in key micro-markets across Tier I and Tier II cities. Tapping a fraction of these existing developer relationships creates significant growth opportunities for the Housing Finance business.

- Leveraging Brickex: Our in-house distribution arm, Brickex, is India’s leading B2B aggregation platform focusing on sales and marketing of Real Estate and Financial Services products with a network of 10,000+ distributors across Tier I cities. We continue to leverage this platform to source loans, resulting in lower customer acquisition costs.

- Focusing on Tier II and Tier III cities: Initially, the focus of the HFC business was primarily on Tier I cities. Going forward, we plan to increase our presence in Tier II cities gradually, by partnering with grade ‘A’ developers and aim to open 50% of our branches in these markets in the coming year.

- Extending loans to self-employed individuals: A large proportion of India’s workforce is self-employed and the Company has created a proprietary set of underwriting parameters to assess the credit worthiness of self-employed individuals. We aim to increase the share of self-employed customers to 70% in our customer mix, given that the category offers better yields.

INVESTMENTS IN SHRIRAM GROUP

Strategic Investments in Shriram Group Companies

PEL had made strategic investments in Shriram Group companies due to the Group’s strong business attributes and its leadership position in its focused segments.

Shriram Group is a leading player in the NBFC asset financing space, with AUM of $22 Billion+, 3,600+ branches and a customer base of 19 Million+ (as on December 31, 2018), primarily catering to unbanked and under-banked customers and with a strong presence in rural and semi-urban markets.

PEL had invested a total amount of `4,583 Crores in Shriram Group companies, which comprised `1,636 Crores for a 10% stake in STFC, `2,146 Crores for a 20% stake in SCL and ₹801 Crores for a 10% stake in SCUF. The book value of these investments was `7,253 Crores as of March 31, 2019.

These investments have strengthened PEL’s presence in Retail Financial Services, gaining exposure to businesses such as MSME lending, consumer and gold loans, general and life insurance, broking and retail asset management. Moreover, the strategic investment in Shriram Group companies also serves as an accessible, return-generating pool of capital for PEL’s future growth initiatives.

STRATEGIC PARTNERSHIPS AND ALLIANCES

JV WITH BAIN CAPITAL CREDIT

Indian Distressed Asset Market

For decades, India lacked efficient resolution mechanisms and enforcement laws for distressed companies. Previously, resolution mechanisms were ineffective as they neither drove real resolutions nor were they time bound. This eventually resulted in the incumbent stress of nearly ₹15 Lakh Crores, which adversely impacted capital availability and credit growth in the economy.

Under the Insolvency and Bankruptcy Code (IBC), introduced in 2016, a failure to pay dues on time by the borrower would result in a shift of controls to the hands of the creditor(s). The IBC aims to rescue and drive resolutions of defaulting borrowers in a time-bound manner, and provides a moratorium to facilitate the resolution and empowers creditors to take decisions on the resolution of borrowers’ debt, backed by the National Company Law Tribunal (NCLT).

As of March 2019, a total of 1,858 corporate debtors were admitted under the IBC and nearly `1.7 Lakh Crores of unpaid claims of financial creditors were resolved (yielding a 43% realisation on their admitted claims). Over the next six months, nearly `1 Lakh Crores of unpaid claims are likely to be resolved, once the final rulings on the ongoing litigations come in.

With a large quantum of assets still to be resolved, in capital-intensive sectors such as power, steel, Engineering Procurement Construction, textiles, telecom and industrials, we expect distressed asset resolution to remain an overarching theme for the Indian economy. In turn, the sheer magnitude of distress and complexity requires active participation of third-party capital and best-in-class turnaround capabilities.

Fund Overview and Mandate

In August 2016, PEL entered into a JV with Bain Capital Credit to tap into Indian distressed market opportunity. PEL and Bain Capital Credit each committed $100 Million to India Resurgence Fund (IndiaRF), which invests capital directly into businesses and/or acquires debt of distressed businesses to drive restructuring with active participations in their turnaround. The Fund’s mandate is to look at all sectors, except real estate, for distressed assets. The preference is for businesses that have fundamentally strong growth prospects linked to India’s infrastructure and consumption needs and require restructuring.

The Fund aims to drive a resolution plan focused on specific financial and operational turnarounds with dedicated management oversight, as it looks to protect the sustainable debt value and maximise stakeholder value.

Our Differentiated Positioning and Strategy

Progress So Far

The Fund’s platform is fully operational and includes a licence for an asset reconstruction business.

In November 2018, IndiaRF concluded its first transaction by investing $156 Million along with its affiliates in a company in the marine chemicals business, in the form of debt and equity. The Fund’s investment has gone towards substituting current debt with more flexible commercials linked to a business turnaround, working capital financing and capex for business expansions into new lines of existing products and diversification into downstream derivatives over time. The Fund is working closely with the Company’s management to implement the turnaround plan.

IndiaRF, along with its affiliates, invested $144 Million in a pharmaceutical and vaccines player through non‑convertible debentures and share warrants in April 2019. The investment proceeds will be used for a one-time settlement with existing lenders, general working capital and growth requirements of the Company. Further, IndiaRF aims to work with the promoters and management team to provide long-term strategic solutions that enable an effective turnaround driving sustainable revenue growth and improvement in profitability.

PROGRESS ON JV WITH IVANHOÉ CAMBRIDGE

In February 2017, PEL had announced a strategic co-investment platform with Ivanhoé Cambridge to provide long-term equity capital to top-tier residential real estate developers across India. Ivanhoé Cambridge had committed an initial $250 Million for both pure and preferred equity transactions. PEL had committed to co-invest 25% of pure equity transactions and 50% of preferred equity transactions, with the balance coming from Ivanhoé Cambridge. The platform’s investment focus included the Mumbai Metropolitan Region, Delhi NCR, Bengaluru, Pune and Chennai.

In February 2019, Piramal and Ivanhoé Cambridge announced an equity investment of `500 Crores in a smart city being developed by a large developer, located in the Mumbai Metropolitan Region. This was the first deal through the Piramal-Ivanhoé Residential Equity Fund. The investment was made towards enabling the development of the second phase of the project, an established integrated smart city near Mumbai with over 4,500 acres of land under development across phases. While Phase I has already been delivered, the Fund’s investment is towards Phase II, which is spread across ~700 acres and is currently under development with a potential saleable area of ~57 Million sq. ft.

The Fund is evaluating several other deals with Tier I developers across Mumbai, Bengaluru, NCR, Pune and Chennai. The objective is to invest in high-quality real estate properties, with a long-term view to generate optimal, risk-adjusted returns.

PROGRESS ON STRATEGIC ALLIANCE WITH APG ASSET MANAGEMENT

PEL and APG Asset Management (a Dutch pension fund asset manager) have a strategic alliance for investing in rupee-denominated mezzanine instruments issued by India’s infrastructure companies and focus on operational and near-completion projects with limited execution risks and high visibility of cash flows coming from a portfolio of projects.

Under this 50:50 strategic alliance, PEL and APG jointly committed `4,745 Crores as on March 31, 2019. Of this, `3,799 Crores were disbursed jointly by APG and PEL across five deals in the renewable energy and infrastructure sectors. The investments were used primarily towards growth capital and to provide exit to existing investors. In the Renewable Energy space, the investments have helped facilitate an increase in capacity across the country.

PROGRESS ON STRATEGIC ALLIANCE WITH CPPIB

PEL has a strategic alliance with CPPIB Credit Investments Inc., a wholly owned subsidiary of CPPIB, to provide rupee debt financing to residential projects across India’s major urban centres. Under this alliance, PEL and CPPIB have jointly invested in one transaction in the NCR, which has been fully exited.

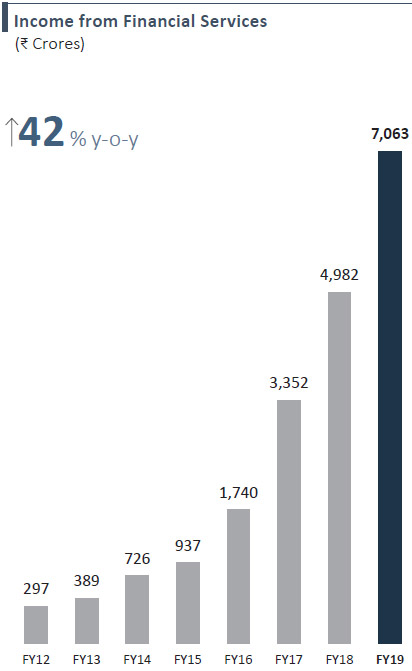

Financial Performance for the Year

Despite a challenging business environment, income from Financial Services increased 42% y-o-y to `7,063 Crores during FY2019. The growth in income was primarily driven by an increase in the size of loan book, which grew by 34% to `56,624 Crores as on March 31, 2019 versus `42,168 Crores as on March 31, 2018.

The increase in loan book was driven by strong growth across all business verticals, particularly Housing Finance – which grew to `5,188 Crores as on March 31, 2019 from `1,210 Crores a year ago.

The growth was accompanied by loan book diversification, geographic expansion and new product launches. The Wholesale RE loan book (excluding Hospitality and LRD loans) constituted ~63% of overall loan book as on March 31, 2019 versus ~83% as on March 31, 2015. The

Company has significantly diversified its existing wholesale lending portfolio with the addition of new products, entry into retail housing finance, widening of the CFG platform and the launch of Distressed Asset Fund, thereby reducing the overall risk profile of the loan book.

Asset quality remains healthy with a GNPA ratio of 0.9%, driven by the stringent underwriting parameters and robust asset monitoring systems built by the Company. Despite the healthy asset quality, the Company continues to be conservative, maintaining provisions of 1.9% of the overall loan book.

The Financial Services business continued to deliver a healthy ROE of 19% in FY2019 on a cash tax basis and considering other synergies from the reverse merger

Note:

- Including utilised synergies from reverse merger

- Provisioning numbers are in line with IND AS

BORROWING SIDE

Market Scenario & Key Developments

In September 2018, the default on payment obligations by IL&FS Group companies on their debt instruments raised concerns over asset liabilities mismatches at NBFCs. We saw banks and mutual funds become cautious towards financing NBFCs.

PEL was relatively better positioned during the liquidity tightening situation. The Company received sufficient liquidity from banks and mutual funds during this period of tight liquidity, due to the credibility of our Group, our balance sheet strength, relatively low leverage levels and strong track record of growth, asset quality and returns profile. Since September 2018, we have raised nearly `16,500 Crores through bank loans and Non-convertible Debentures (NCDs).

Funding Sources

The Company primarily sources funds through term loans, NCDs and commercial papers. Our borrowings are primarily long term in nature, with the predominance of term loans and NCDs in the funding mix.

The Company reduced its Commercial Papers (CP) exposure to ~`8,900 Crores as of March 2019 from ~`18,000 Crores as of September 2018.

Cost of Borrowings

The average cost of borrowings was 9.0% in FY2019, marginally higher from FY2018. The increase in funding costs reflects the system-wide liquidity shortage following the default by IL&FS in September 2018 and the shift in the borrowing mix towards long-term sources of funds.

We continue to closely monitor our borrowing costs by selecting the right mix of funding sources while carefully managing our asset liability profile.

Measures in the Pipeline to Strengthen Liquidity and Funding Profile

The Company is taking additional steps to further strengthen its liquidity position and diversify its borrowing profile. Some of these measures include (a) long-term funds from PSU institutions, (b) Tier II offering, (c) maiden ECB issuance, (d) foreign currency borrowings and (e) additional bank lines.

Capital Adequacy Ratio

As of March 31, 2019, PCHFL’s Tier I ratio was 27.2%, marginally higher than 26.9% as of March 31, 2018 and well above the minimum regulatory requirement prescribed by the RBI.

Borrowing Mix for PCHFL

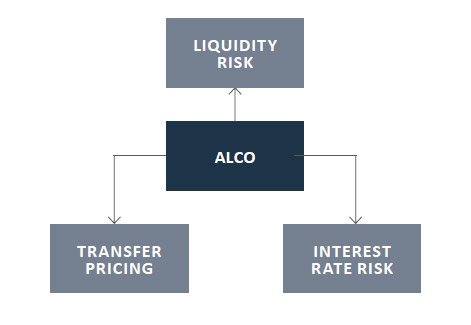

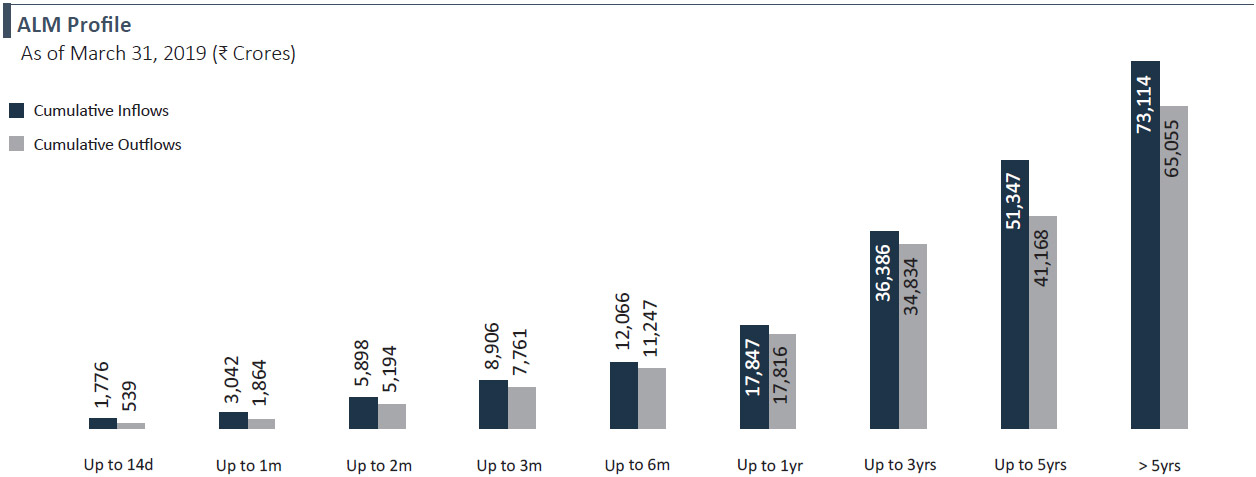

Asset Liability Management (ALM)

The Risk Management team and the Treasury team had initiated the ALM process for the Financial Services business. The Board has approved the ALM Policy and its formation, including scope and responsibility of the Asset Liability Management Committee (ALCO). The ALCO includes the Company’s senior management and an external industry expert, and defines the strategy for managing liquidity and interest rate risks in the business.

As per regulatory requirement, the ALCO has been set up for the subsidiaries to deliberate the strategy for managing liquidity and interest rate risks in the business. The responsibilities of ALCO include:

- Monitoring the implementation of the ALM Policy and regulatory and prudent gap limits and ensuring adherence to RBI/NHB guidelines issued in respect to the ALM management.

- Monitoring market conditions in terms of interest rate scenario, analysing its impact on the balance sheet and accordingly recommending the actions needed to manage the risk and comply with prudent gap limits. It reviews the interest rate gap statement and the mix of floating and fixed rate assets and liabilities.

- The in-house economist presents a forward-looking interest rate view based on which the Risk Management Group (RMG) prepares a scenario analysis to assess the short-term impact of interest rates on Net Interest Income (NII). This helps ALCO decide the strategy to mitigate interest rate risks promptly.

- Monitoring liquidity position both on static and dynamic basis (projected disbursements and contracted inflows and outflows) and deliberating on actions required (if any) to ensure enough liquidity under all potential scenarios. It assesses the static liquidity gap statement, future asset growth plans, tenor of assets, market liquidity and pricing of various sources of funds. It decides on the optimal funding mix, taking into consideration the asset strategy, and focuses on diversifying sources of funds.

- The ALCO meetings are held as and when needed depending on the market conditions and generally, at least once every quarter.

Liquidity Risk

The ALCO assesses the static liquidity gap statement, future asset growth plans, tenor of assets, market liquidity and pricing of various sources of funds. It decides on the optimal funding mix taking into consideration the asset strategy and a focus on diversifying sources of funds.

Interest Rate Risk

The ALCO reviews the interest rate gap statement and the mix of floating and fixed rate assets and liabilities. The in-house economist presents a forward-looking interest rate view based on which the RMG prepares scenario analysis to assess the short-term impact of interest rates on NII. This helps the ALCO promptly formulate a strategy to mitigate interest rate risks.

Status of ALM

- The ALM required to be maintained for subsidiaries complies with the regulatory requirement in respect to prudential gap limits

- In respect to liquidity, there is adequate cash surplus and unutilised bank lines being maintained at all times

WAY FORWARD

Strategic Priorities

Focus Areas

- Further increase granularity of the loan book by growing the share of retail loans

- Housing Finance accounts for 9% of the overall loan book as of March 2019; expected to increase to 15% by March 2020

- Raise additional long-term funds from public sector institutions

- Reduced exposure to CPs

- Tap new sources of funds such as ECB, Tier II capital and foreign currency borrowings, while adding new bank lines

- In case of larger deals, co-invest with strategic, like-minded partners, such as foreign banks and pension funds

- Take the lead on driving co-investment deals in terms of underwriting and servicing

- Maintain ‘best-in-class’ asset quality

- Continue with conservative provisioning and a high provision coverage ratio, much higher than industry standards

- Generate additional fee income to boost ROE:

I. Co-investments in large deals with like‑minded partners

II. Creation of asset-aggregation platforms

ASSET QUALITY

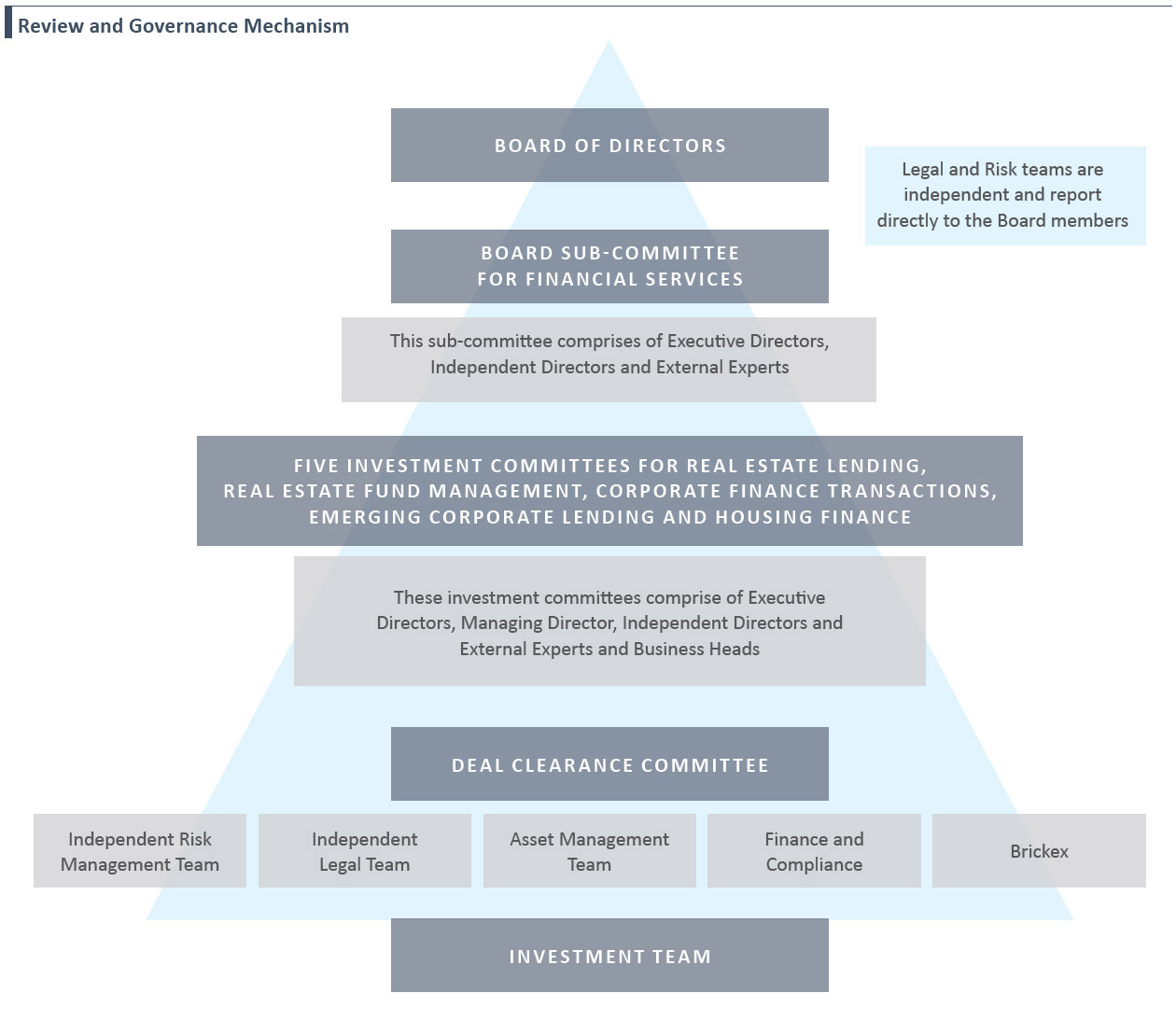

PEL has a strong risk management framework and robust asset monitoring in its -Financial Services business. The risk management framework spans across the pre-qualification and pre-approval stage, whereas asset monitoring takes place throughout the life cycle of an underlying project. As part of our Review and Governance mechanism, Risk and Legal teams are independent and report directly to the Board. The Investment Committees, apart from Executive Directors and Business Heads, also include Independent Directors and External Experts.

The team for monitoring corporate lending comprises members with multi-sectoral and multi-product expertise, tracking various sectors and managing multiple projects across India.

Pre-sanction Process

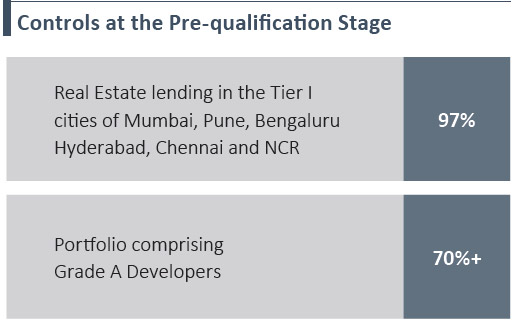

At the pre-qualification stage of financing projects, the Company is very selective of the developers or businesses to which it provides funding. It takes into consideration a multitude of factors i.e., management risk, business risk, financial risk as well as structural risk. Specifically, factors such as the promoter’s track record, market reputation, balance sheet and the status of the projects/business are taken into consideration. It primarily selects projects that are located in select micro-markets in Tier I cities of India.

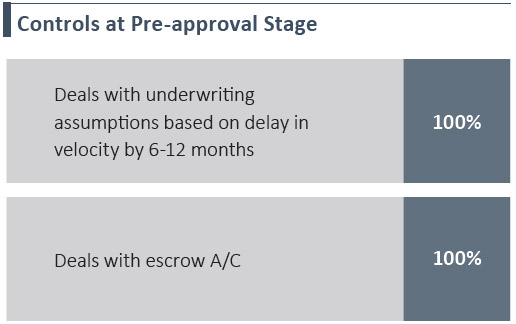

At the pre-approval stage, the Company analyses the potential investment by leveraging Brickex, our in-house real estate distribution arm, to verify price, ticket size and sales velocity assumptions. For corporates, detailed due diligence of business and its financials are conducted along with detailed market feedback. Moreover, every potential investment is subject to a standard risk scoring system by the Risk team to measure risks associated with the investment.

Also, our long-standing strategic partnerships with marquee investors such as CPPIB, CDPQ and APG, who independently assess each investment, serves as an external validation of our investment thesis and decisions. The financing is structured in a manner that links the disbursements of loans to the milestones linked to sales/ collection of rental income, etc.

The Company maintains independence among the Risk, Legal and Investment teams so that investment decisions can be overruled by its Risk or Legal team, if required. In addition, its investment committees include independent directors and third-party external experts who keep an independent check on the quality of the transactions.

The Company maintains a healthy security and cash cover, which varies across deals, based on its conservative underwriting assumptions, with the ability to enforce security. Also, all our deals follow the escrow mechanism and hypothecation of receivables, resulting in visibility and control of project-level cash flows.

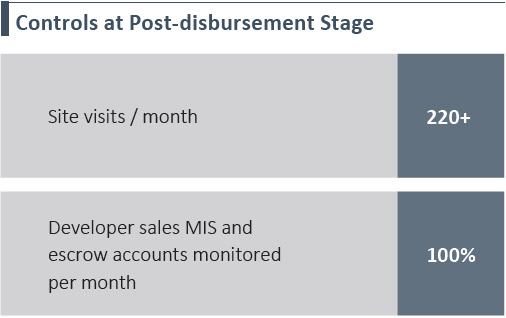

Post-sanction Process and Asset Monitoring

As part of its constant asset monitoring efforts, the business has set up dedicated local teams in cities where it has investments. The local teams constantly assess the performance of each project from the time of its initial investment up to the Company’s exit or completion of such investment. Most importantly, this helps the business continuously ‘cure’ its investments by proactively measuring actual progress versus underwriting assumptions and immediately react to any deviation, no matter how small, by taking a range of remedial measures such as increasing security, modifying business plan, adopting a new marketing strategy, changing the sweep ratio of the designated escrow accounts or proactively seeking a refinance in some cases.

100%Project-level escrow accounts monitored every month, along with developer sales MIS and periodic site visits, across our real estate deals

This is the most important factor in maintaining a low incidence of Gross NPA ratio.

The team is monitoring more than 400 real estate projects, developed by 175 developers, including mid-market developers.

For Corporate Lending, the Company has adopted the best practices from real estate monitoring. As corporate lending has diversified into multiple sectors, there are sectoral experts who not only help in investments but also in the monitoring process. The team for monitoring corporate lending comprises members with multi-sectoral and multi-product expertise, tracking various sectors and managing multiple projects across India.

The Asset Monitoring team critically analyses the key set of triggers such as financials, operational performance, regulatory changes and macro-economic factors and highlighting the Early Warning Signals (EWS). The early-warning predictive model helps in identifying deals that

could potentially go into stress in the next six months. Further, by leveraging both the Company’s proprietary data as well as the rich external data sources, the team identifies ways to minimise NPA risk.

The Risk team also periodically assesses the risk levels of its investment portfolio by measuring a project’s performance against certain factors including sales velocity, pricing of the project, approval timelines, ability to meet principal and interest obligations, and site visit findings. This allows the teams to map and monitor the portfolio-level risks and accordingly adjust overall exposure in each city or region/micro-market.

All deals in the portfolio are categorised under one of the four categories:

- Green: Deals where there are no major concerns

- Yellow: Deals that need to be monitored closely for the next six months

- Amber: Deals where stress is envisaged over the next six months

- Red: Deals where payments are overdue / default

The teams devote significant time post disbursement to detect and react to early warning signals. Monthly EWS meetings are held to highlight cases that require management attention.

Moreover, the Asset Monitoring team constantly loops in learnings based on that existing data set to enhance the underwriting for new deals.

Physical Presence at Site

‘Ears to the Ground’ Approach

- Periodic site visits (monthly/quarterly)

- Construction status

- Real time feedback to team

- Micro-market analysis / sector updates

- PMC & Board Meetings

- Engagement with Lender’s Engineer

Operating Performance

Adherence to Business Plan

- Actual v/s budget (sales velocity, selling price, collection, costs)

- Cash cover ratio (actual v/s budget)

- Sales trend analysis

- Operating and financial analysis

- NOC issuance

- Escrow statement

EWS Meetings

EWS Identified

- Project performance

- Key issues highlighted

- Action items

- Market trends

- Regulatory developments

- APG portfolio updates

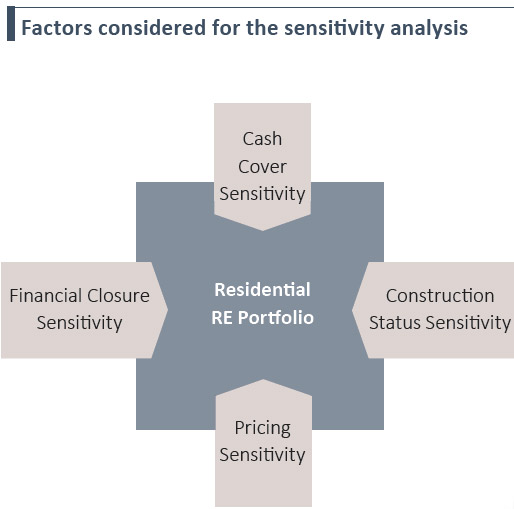

Stressed Case Sensitivity Analysis – Residential Real Estate Portfolio

Post the liquidity tightening event in September 2018, as part of the EWS framework, we proactively conducted a stressed case sensitivity analysis on our residential real estate portfolio – testing it against hypothetical, worst case scenarios during the year. Some of the key factors considered for the scenario analysis were a significant decline in sales price, severe fall in sales velocity and anticipated delay in project completion by more than 6-12 months.

The results of the sensitivity analysis indicated that for a small number of our deals – 18 out of 242 deals – some proactive measures were required to be taken, to avoid any potential asset quality issues, under stressed scenarios. We made significant progress in addressing most of these 18 potential cases identified as part of the sensitivity analysis and some of the key pro-active measures included were:

- For 8 deals, a stronger developer was brought on-board, either through sale or a joint development agreement to complete the project

- For 3 deals, we have taken over additional security or have been able to monetise the additional security

- For 2 deals, we received capital infusion from a private equity player or from the promoter

- For 2 deals, the Company is getting itself completely re-financed

- For 2 deals, we initiated legal action under NCLT, while we have also started to monetise the project

- For 1 deal, we provided a composite ‘work out’ solution, which was a combination of a top-up loan to provide working capital and a land sale