Demonetisation, RERA

and GST

How were the Financial Services and Real Estate sectors impacted?

Demonetisation

(announced in November 2016)

- The Real Estate sector was one of the most affected sectors, as a sizeable proportion of transactions by tier-3 and tier-4 developers were in the form of cash prior to demonetisation.

- Loans disbursed by NBFCs declined significantly in November 2016, as compared to the monthly average disbursals during April-October 2016. According to the RBI estimates, disbursements declined 15% for asset finance companies and 25% for loan companies.

RERA

(finalised in October 2016 and enforced nationwide in May 2017)

- The implementation of RERA, although increased transparency across the Real Estate sector, aggravated the slowdown of residential real estate launches and sales in 2016-2017.

GST

(implemented in July 2017)

- While GST simplified the tax treatment for the economy and has potentially benefited the end-customers, inadequate IT infrastructure, lack of clarity on input-tax credit and anti-profiteering provisions resulted in a slowdown in real estate sales and additional compliance burden for developers.

The impact of these

regulatory and policy

changes was the most

prominent in H2 2017,

which led to a significant

decline in sales and new

launches in the

real estate sector.

How did PEL perform?

No significant impact on sales of our developer portfolio

Our clientele constitutes of quality tier-1 developers in large cities where we operate and they were relatively less impacted by these regulatory and policy changes.

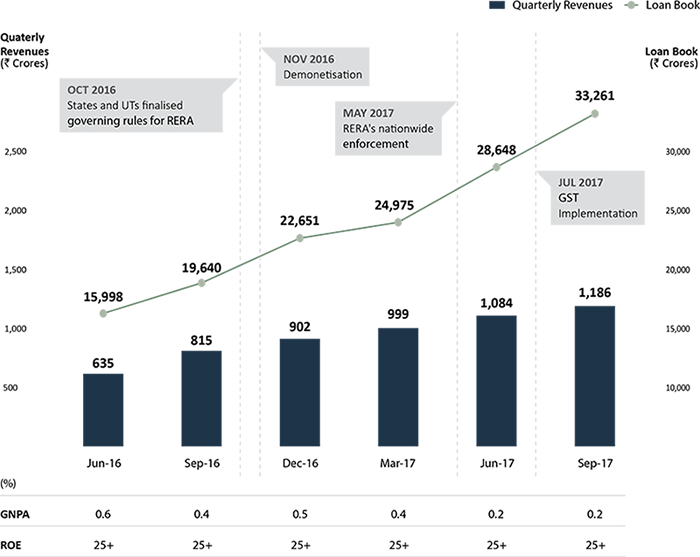

Hence, PEL’s Financial Services business continued to demonstrate strong performance, navigating these headwinds

The business posted healthy loan book growth, while maintaining robust asset quality, which resulted in strong returns during the period.

Note: Year-to-date ROE for the respective periods.