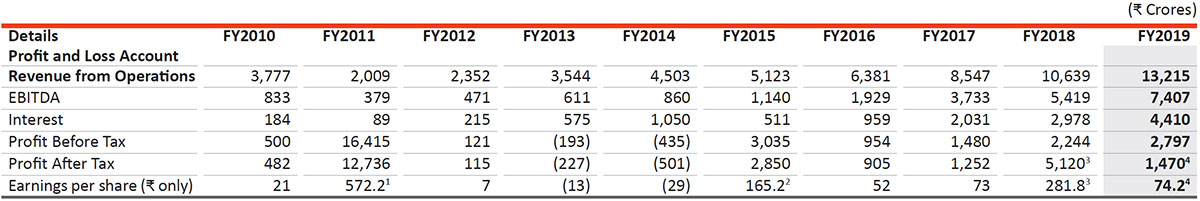

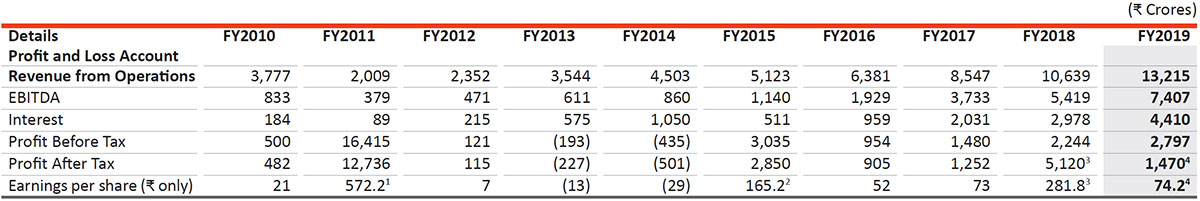

10 YEAR FINANCIAL HIGHLIGHTS

- Includes gain on account of sale of the healthcare solutions business and sale of subsidiary - Piramal Diagnostics Services Private Limited

- Majorly includes gain on sale of 11% equity stake in Vodafone India and amount written down on account of scaling back of investments in NCE research

- Profit after Tax includes synergies on account of merger of subsidiaries in Financial Services segment

- Profit after Tax includes non-recurring and non-cash accounting charge towards Imaging assets and non-recurring exceptional item

- FY2019, FY2018 and FY2017 results have been prepared based on IND AS & FY2016 results have been reinstated to make them comparable with the reported period. Prior period numbers are as reported in their respective period

- Buyback of 4,10,97,100 Equity Shares of `2 each at `600 per Equity Share.

- Net increase in Equity Share Capital on account of :

– A

llotment of 53,52,585 Equity Shares of `2 each to the shareholders of Piramal Life Sciences Limited (now known as Piramal Phytocare Limited) on demerger of its R&D NCE division into PEL

- Net increase in Equity Share Capital on account of :

– Allotment of 225,000 Equity Shares of `2 each to the Compulsorily Convertible Debentures (CCDs) holders

– Allotment of 7,485,574 Equity Shares of `2 each under Rights Issue

- Net increase in Equity Share Capital on account of :

– Allotment of 4,162,000 Equity shares of `2 each pursuant to conversion of 104,050 Compulsorily Convertible Debentures (CCDs)

– Allotment of 11,298 Equity Shares of `2 each under Rights Issue to the CCD holders out of the Right Equity shares reserved for them