The Company’s primary focus is to serve the underserved and unserved population in the hinterlands of India and customers. While the Company remains focussed on its key product segments (Housing, LAP, Other Secured & Unsecured), it is continuously looking at expanding its portfolio with the addition of scalable products where banks do not have a presence.

The business model in retail has, thus, been driven by balancing Growth, Risk and Profitability, with Customer at the centre. Our three foundational capabilities – Technology, Decision Science (Analytics) and Talent enable our retail lending business model.

Business model for retail

PEL leverages its technology and data driven robust underwriting and risk management processes to serve its 4.1 million customers and offers a wide variety of products designed for diverse needs of its customers. With presence across the risk-reward spectrum and a wide branch network, the Company is also able to cross-sell its products and increase awareness on retail products other than housing loans. While this strategy helps the Company reduce its cost of customer acquisition, it also leads to repeat and incremental business.

Parameterised lending with multiple checks, in-house score cards and AI/ML driven ‘ventile based’ decision-making enables the Company to underwrite and evaluate risks meaningfully. It sanctions loans after personal discussions and appraisals to ascertain payment capacity of the borrower. Real-time tracking through automated dashboards and a large on-ground collections team ensures efficiency.

STRENGTHS

Serving customers of “Bharat”

PEL’s target customer is the budget customer of Bharat, and its vision is to democratise credit to the real “Bharat” and the unbanked, under-banked and under-served sections of the society to help them achieve their goals and aspirations. The target customers are self-employed individuals or individuals earning salaries from the informal sector, predominantly residing in Tier 2 & 3 geographies of India and underserved / unserved by formal financial institutions for their credit needs. It is committed to serving this large section of the society which resorts to being manipulated by the hands of money lenders.

Our lending strategy

With a strong brand legacy and ample access to capital, the Company is well-equipped to handle market changes while staying true to its core values.

The lending strategy is defined by innovation, efficiency, and personalised service. The Company has built a strong branch-led presence, with an extensive network of DSAs (Direct Selling Agents) and connectors, ensuring localised access to financial solutions. The lending process uses detailed decision-making and thorough checks to meet each customer’s unique needs while effectively reducing risks.

Further, the lending strategy combines “High Tech” with “High Touch”, to create value for its customers and stakeholders. The Company enhances its “high tech and high touch” strategy by combining personalised customer interactions with advanced technology to achieve balanced growth, manage risks, and ensure profitability.

Serving the Under-served:

13,000+

Pin Codes served across India

83

New Branches opened in FY 2023-24

74%

Branches are in Tier 2-3 cities

The Company is steadily increasing its pan-India presence. Today, it has a wide distribution network which includes 490 conventional branches and 194 microfinance branches across 404 cities and towns in 26 states/UTs and is serving 625 districts. We are working on expanding its branch network further to 500-600 branches over the next couple of years. With our distribution and high-tech, high touch model, we continue achieve substantial growth at scale.

Customer Expansion

The customer franchise has been expanded to 4.1 million, up from 3.3 million YoY.

Operating Performance

Steady growth

As discussed earlier, the Retail AUM stands at ₹ 47,927 crore as of March 2024, growing by 49% YoY. The Company successfully built a well-diversified loan book across product categories and customer segments. The average ticket size of retail loans stood at ₹ 12.1 lakh for FY 2023-24. The Company witnessed strong traction in disbursements, which grew to ₹ 8,910 crore in FY 2023-24, up 30% from ₹ 6,828 crore in FY 2022-23. Disbursement yields also witnessed a marked improvement of 60 bps YoY at 13.8% during this period, over 13.2% in the earlier year.

Multi-product strategy

Multi-product retail lending platform across the risk-reward spectrum - FY 2023-24

SECURED LENDING

Today, PEL has a diversified retail portfolio with keen emphasis on secured lending. Long duration loans continue to remain the core of PEL’s AUM, with its various touchpoints of Affordable Housing, MSME Loans and Used Car Loans. The Company caters primarily to the needs of the “Budget Customers” (self-employed, cash salaried, small business owners, and salaried customers) in Tier 2/3 cities with an average CIBIL score greater than 740. While being digital at the core, the business is distinguished by the high-touch intensity model. The proportion of self-employed to salaried customers stands at 58:42.

With three loan offerings, namely, affordable housing, mass affluent and budget housing, the housing loan business dominates PEL’s retail loan book, with 46% share of total retail AUM and 32% share in disbursements. The average disbursement yield is 11.1%. The Company has a wide bundle of product offerings across the risk-reward spectrum, catering to salaried and self-employed customers. Loan to value ratio is in the range of 61%, coupled with parameterised lending with multiple layers of checks at both branch and central level, ensuring better asset quality.

Today, the Company serves the real Bharat customers through its growing branch network, which has significantly expanded since the DHFL acquisition in 2021. With its unique technology and data-backed underwriting process, it strives to provide loans to the underserved population in the hinterlands of India, with limited access to formal credit. Use of alternate data and proxy surrogates to assess a customer’s true income and payment capabilities makes the process even more robust.

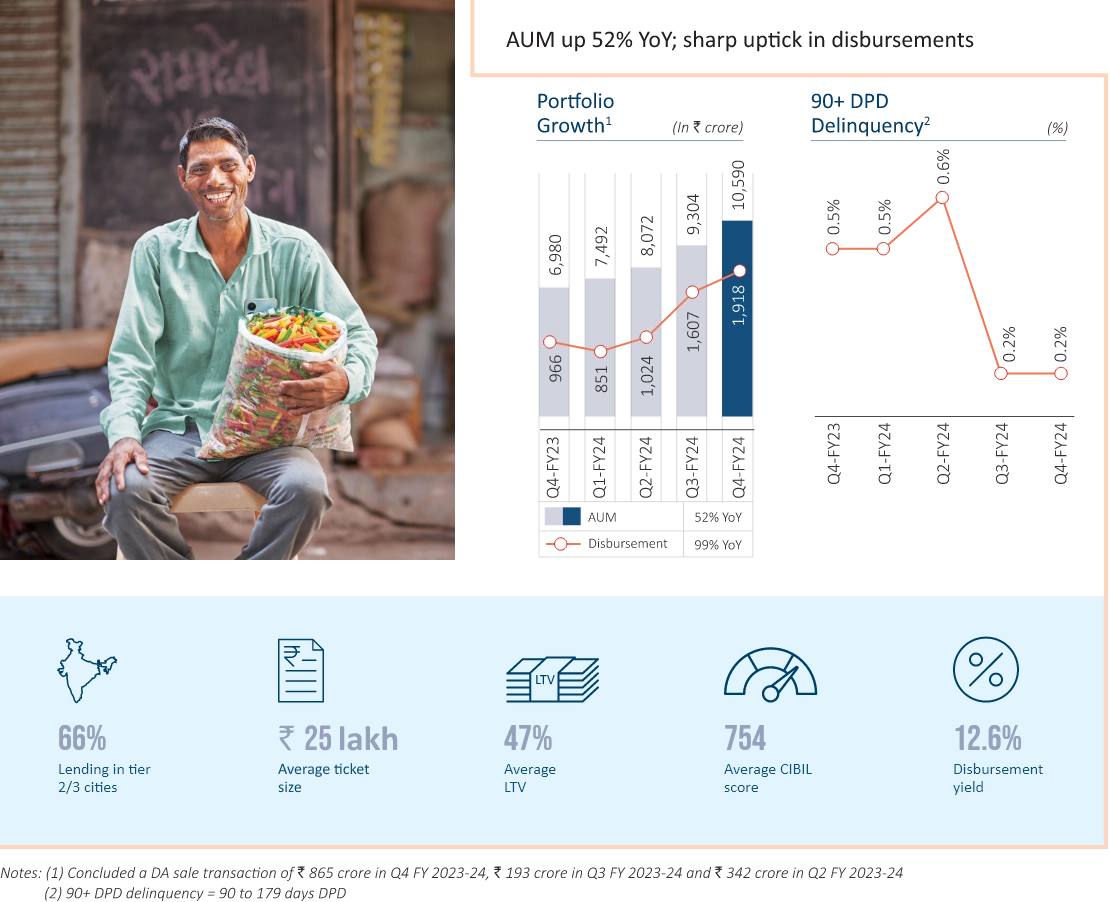

Under LAP segment, the Company offers three loan categories, namely, secured business loan, LAP and LAP plus largely to self-employed customers, with requirements ranging from ₹ 5 lakh to ₹ 4 crore. PEL has a granular and diversified loan book base. These customers avail credit facilities against property as the collateral. The loans are underwritten on the basis of projected business cashflows. Average LTV, at 47%, is thus lower than that for housing loans. Backed by government policies this segment is witnessing rapid growth.

With an average ticket size of ₹ 25 lakh, LAP accounts for 22% of the retail AUM and average yields of 12.6%. The Company provides its customers with superior tech-enabled services through the entire process from sales to disbursal. Digital processing using internal proprietary scorecard systems allows for faster disbursals. It uses robust analytical frameworks and best-in-class infrastructure for conducting customer analysis and quality, helping boost cross-selling of other products.

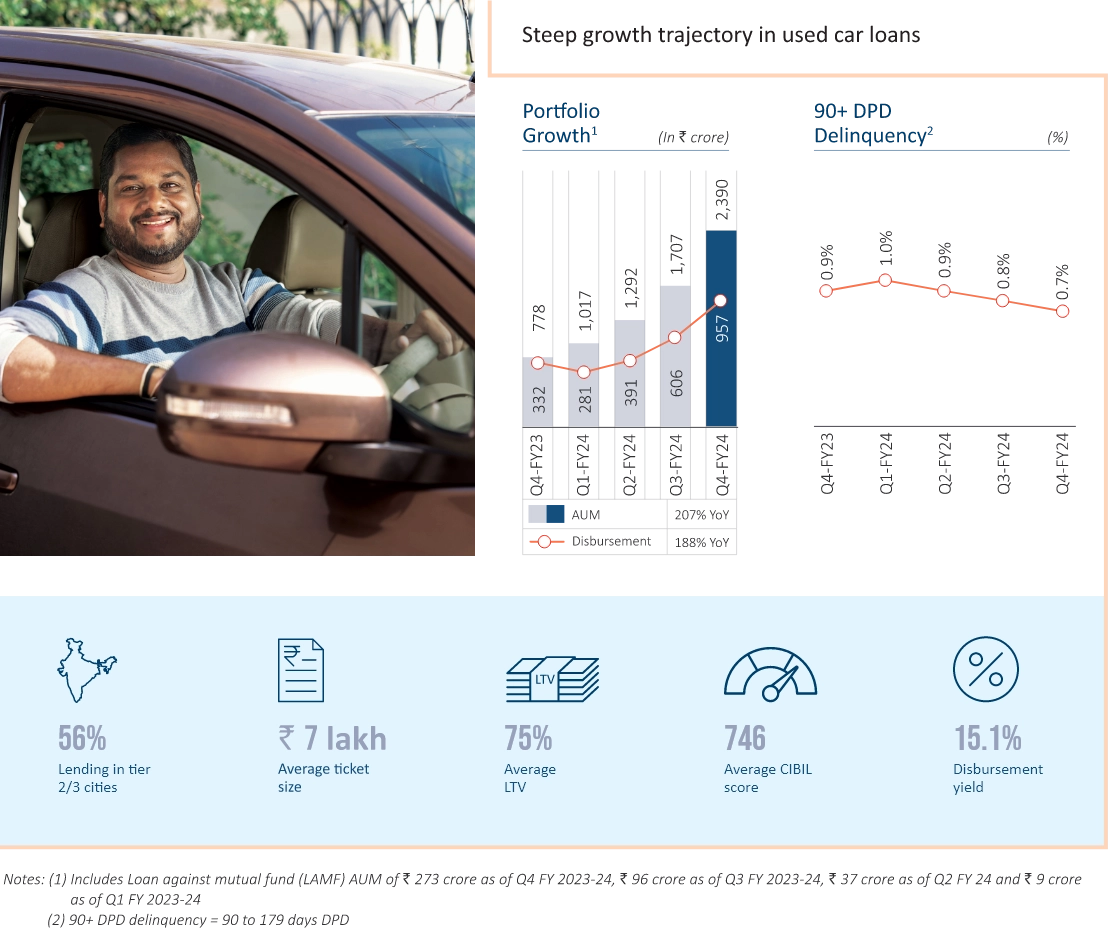

The Company offers sale purchase, Loan against car and Balance loan transfer with Top-up facilities for used cars to salaried and self-employed customers. Loans are provided to customers with credit history and to “new to credit” customers. The average ticket size of these loans is ₹ 7 lakh, constituting 5% share of the retail AUM, with high disbursement yield of 15.1%.

The Company uses its in-house developed technology-based analytics for scorecard evaluations and underwriting. Technology driven processes ensure faster turnaround time and quick disbursals, reducing customer touchpoints. These robust processes enable loan disbursement to at least 15% to 20% of the customers on the same day.

The Company offers used car loans through its vast network of 330+ branches, 1,100+ organic partners, platform aggregators and corporate dealers. The strong distribution network and unique customer prepositions have enabled PEL to outperform its peers and scale up comparatively 2.5-3x faster

UNSECURED LENDING

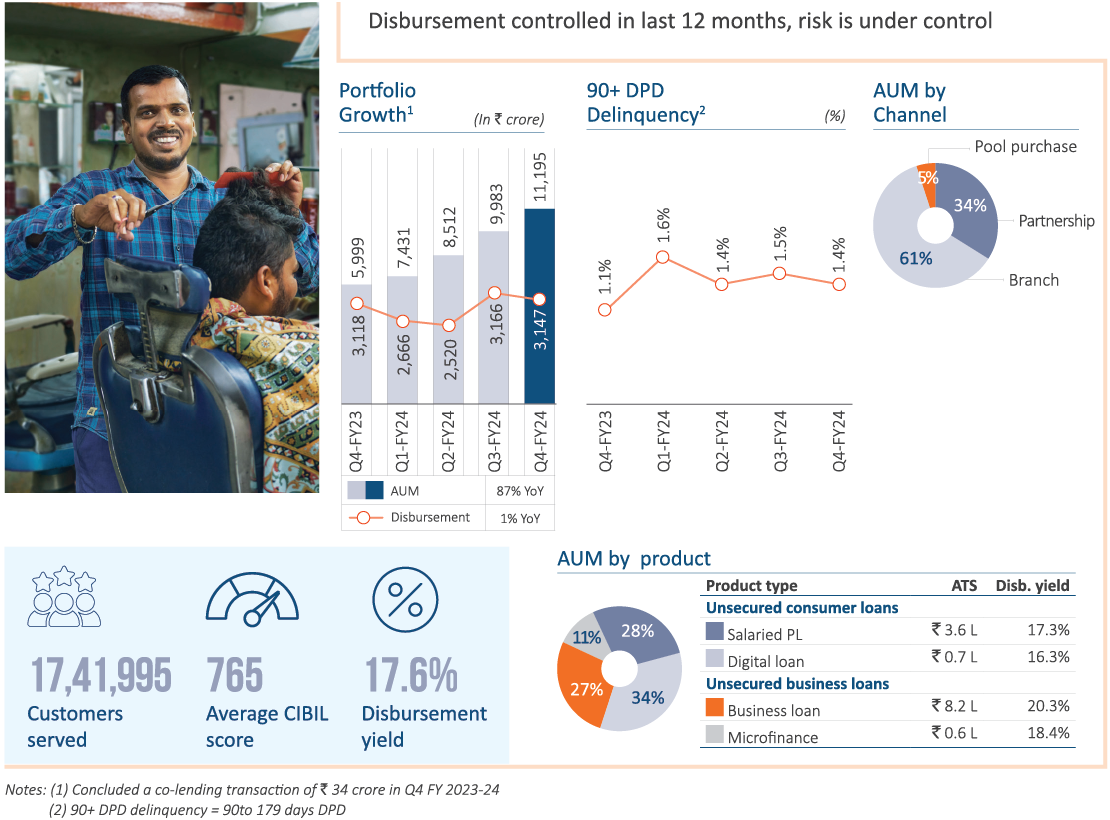

Unsecured loans primarily cater to the needs of customers with limited access to formal credit and those lacking proper documentation and no credit history.

Controlled Disbursements in Unsecured Lending

The Company is committed to enhancing the financial well-being of our customers through innovative and customer-centric loan products. Under Unsecured loans segment, the Company provides Business loans and Consumer loans.

Unsecured Business Loans

In our endeavour to empowering businesses and fostering economic growth, the company offers a diverse portfolio of Unsecured Business Loans. This segment is strategically designed to meet the unique financial needs of micro-enterprises and small businesses, which form the backbone of our economy. Our Unsecured Business Loans encompass both Microfinance and Business Loans, providing flexible, accessible, and hassle-free financing solutions to help businesses thrive and achieve their full potential.

Microfinance loans

This is a women-centric product offering loans to women entrepreneurs with monthly household incomes up to ₹ 25,000. This follows an exclusive partnership model, with a joint liability group of 4-10 members formed and with each member ensuring and guaranteeing the other members liability. These unsecured loans range from ₹ 10,000-60,000 with a tenure of 18 months to 24 months, and with yields ranging from 22% to 27%. The Company leverages technology to conduct immediate KYC checks taking ~30 seconds for a “go-no-go” decision based on proprietary rule-based score cards. Complete doorstep services is provided starting from educating about the loan facility, helping to complete the required paperwork and collections. PEL’s wide and diversified network enables it to be at various customer touchpoints, and further to better understand and assess their repayment capability and cash flows generated. Life and health insurances are also offered for the borrower and their family.

Business loans

For micro, small and medium-sized enterprises (MSMEs) aiming for growth and expansion, our Business Loans offer the ideal solution. These loans are designed to address a range of business requirements. With competitive interest rates, flexible repayment options, and a simplified application process, we empower businesses to scale new heights, drive innovation, and contribute significantly to the economy.

Unsecured Consumer Loans

Our Unsecured Consumer Loans segment is crafted to provide seamless and accessible financial solutions to meet the diverse needs of our customers. Within this segment, we offer Salaried Personal Loans and Digital Loans, ensuring that personal aspirations and urgent financial requirements are met with ease and efficiency. Our Unsecured Consumer Loans are not just financial instruments; they are enablers of personal growth, providing the necessary support for individuals to realise their dreams and improve their quality of life. By offering flexible, accessible, and efficient loan solutions, we strive to build lasting relationships with our customers, fostering trust and financial stability.

Salaried personal loans

The Company serves the needs of salaried individuals with good bureau behaviour through its vast distribution network. With an AUM of ₹ 3,125 crore, the company provides loans up to ₹ 20 lakh attracting zero foreclosure and part payment charges. These loans are given at rates as low as 12.99% through a complete centralised digital platform. The portfolio is driven by machine learning based score card and risk-based pricing ensuring low delinquencies.

Digital loans

Embracing the digital revolution, our Digital Loans cater to the tech-savvy consumer who values speed and convenience. With a fully online application process, instant approvals, and swift disbursals, these loans are designed to meet immediate financial needs without the traditional paperwork and delays. Our Digital Loans provide a seamless borrowing experience, ensuring that financial support is just a few clicks away.

We operate our Digital Loans through a robust in-house platform as well as Digital Embedded Finance, through strategic partnerships with leading fintech and consumer tech firms. This dual approach allows us to leverage the strengths of both in-house capabilities and external expertise to offer superior digital lending solutions and allows us to tap into the extensive customer bases of our partners, providing more individuals with access to our digital loan products. With advanced algorithms and data analytics, we ensure quick credit assessments and instant loan approvals, delivering a frictionless borrowing experience for our customers.

Digital embedded finance

Based on strong partnerships with fintech NBFCs, transaction platforms, and MSME platforms, the Company has a well-established and robust Digital Embedded Finance business, with many programmes which are 100% digital. Since inception, the Company has served over ~1.4 million customers through this channel. These consumer and merchant loans are aimed at embedding credit as a micro service. Most new customer additions happen through digital channels and partnerships. The Company aims to establish itself as the preferred lending partner for the consumer and merchant ecosystem, offering personalised financing solutions to customers. To further enhance its reach, it has launched mobile apps on Android and iOS.

The Company uses in-house highly modular technology developed using generic APIs (application programming interface) that allow agility and complete integration. It delivers customised solutions with the help of a business-rule engine which supports joint product development with its partners. The use of proprietary policies, fraud and underwriting models for real-time decision-making ensures healthy asset quality. The Company has built deep in-house collections capabilities, covering 13,000+ pin-codes.

Leveraging our team’s deep understanding, technology and analytics, we tightly monitor risk in our digital lending business. We have further built safeguards in commercials of our partnerships. Thus, almost 85% of our business is credit protected. Overall, these measures led to timely interventions to manage risk and to mitigate P&L impact in case risk increased in any of the cohorts.

Programmes Live Across Various Categories

Our Key Live Partners

Credit protection in digital lending

~85% of digital loan disbursement is credit protected1

Fibe (EarlySalary), acquired as a part of DHFL acquisition, is a leading fintech player, offering consumer loans catering to lifestyle and other needs. As of March 2024, Fibe had an AUM of ₹ 4,064 crore and a customer base of 7.55 lakh, primarily serving young, aspirational tech-savvy Indian customers.

The Company launched ‘Piramal Innovation Lab’, a state-of-the-art Centre of Excellence for Technology and Business Intelligence in Bengaluru. This is aimed at creating innovative products to cater to the finance requirements of the under-served ‘Bharat’ market. As of FY 2023-24, over 350 professionals are employed in this 36,000 square feet lab, enabling the creation of a vibrant ecosystem of product developers, data scientists, fintechs, start-ups and tech innovators.

Success Stories

Sunil Kumar Pandey shares his personal loan experience with Piramal Finance, highlighting the ease of our fully digital process that eliminates the need for physical visits.

Scan the QR code to know more

P. Nagmani shares her journey of securing a digital loan and the positive impact of our financial solutions.

Scan the QR code to know more

Wholesale 2.0 Lending

As part of the corporate transformation, PEL judiciously downsized its legacy Wholesale Lending operations and channelised its efforts towards establishing a diversified and more granular Wholesale 2.0 portfolio, backed by cash flows and assets. It refers to loans sanctioned under new real estate (RE) and corporate mid-market loans (CMML).

Wholesale 2.0 - revamped model leveraging the sector tailwinds

Some of the residential and commercial projects funded by us in Mumbai

The Company offers customised and structured products in real estate to large and small developers with strong local presence and offers loans to mid-size corporates. This helps us deepen our relationships with the existing customers and on-board new developers. The business has delivered a promising start with real estate AUM growing by 327% YoY to ₹ 4,243 crore.

New real estate loans: capitalising on the market gap and leveraging our strengths

Average ticket size¹/loan ₹ 141 crore

Average loan tenor3 4.5 years

Notes: (1) Based on sanctioned value (2) Average yield % includes fee income (3) Based on sanctioned value & represents average door-to-door tenor

Building blocks for Wholesale 2.0 Lending comprise – 1) overhauled organisational structure; 2) use of automation and analytics; and 3) formal and templated process for credit review at loan and portfolio level.

- Under the revised organisation structure, the Company had created a Credit Team in 2022 to focus on deal underwriting for better decision-making as per sand box/gating criteria. The Asset Monitoring team was transitioned into Asset Management to enhance the proactive management and oversight of assets. This team took over deal ownership, although the Origination Team continues to engage with clients to ensure continuity of engagement, which is crucial for generating repeat business. This approach allows for a more in-depth understanding of market nuances and regulatory dynamics. Technology adoption has streamlined the various internal processes in the deal life cycle and the analytics-driven decision-making is only a tool to assist the underwriting/decision-making process taking cues from past deal experience.

- The team uses technology across analytics (e.g., decision trees, price prediction, use case discovery, sales analytics), visualisation (several customised dashboards), origination (e.g., workflow simplification, deal lifecycle management, document automation), credit & operations, asset management and finance

- Strict adherence of formal review of sandbox conditions, proposed funding, borrower’s financials and balance sheet, project, security, risks, and other relevant metrics at individual transaction level. Along with this, regular portfolio level monitoring is carried out to track overall performance and formulate strategy

The business is performing well, in line or ahead of underwriting, as reflected in prepayments. Since inception, all deals sanctioned under the new book 2.0 have been regular with on-time interest servicing and accelerated repayments, reflecting the quality of underwriting/structuring in terms of deal analysis.

Building a robust book by lending to established developers offers more flexibility in the use of proceeds, which can be particularly beneficial for developers who need to adapt to changing market conditions or project requirements. The Company has also been capitalising on the market gap by expanding its reach to mid-tier developers in existing cities like Mumbai, Bengaluru, Hyderabad, NCR, Chennai, and Pune. This is aimed at bringing down the cost of borrowing by reducing reliance on informal lending avenues for developers. The large developer finance business has also expanded into newer geographies like Karnal, Meerut in NCR, Lucknow which has seen traction in the physical real estate market in the recent past.

The Small Developer Finance (SDF) business has been set up as a part of the growing wholesale credit franchise to focus on mid-market and affordable residential housing projects with less than ₹ 200 crore revenue in low penetrated markets in Tier 1 outskirts and Tier 2&3 cities. Committed to retaining its leadership position in real estate financing space, the Company with its strong underwriting capabilities has been able to penetrate newer cities like Ahmedabad, Nashik, Gandhinagar, Vadodara, Chandigarh, and Jaipur. This move will transform the landscape of developer financing in Tier 2&3 cities, complementing the Company’s vision to democratise credit for all sections of the society and to cater to a larger addressable market.

Through the CMML line of business, PEL offers credit solutions to non-real estate clients. The team acts on sector-agnostic credit proposals and leverages its deep expertise in the lending business to offer customised solutions for financing needs. Since its inception, the segment has supported businesses across personal care, shipping, power, fintech, and logistic sectors, addressing their specific funding requirements that are inadequately met by existing products in the market. The portfolio performance has been robust in terms of collection efficiency.

Corporate mid-market lending: building a granular book backed by cash flows

Average ticket size1/loan ₹ 59 crore

Average loan tenor3 3.2 years

Notes: (1) Based on sanctioned value (2) Average Yield % includes fee income (3) Based on sanctioned value & represents average door-to-door tenor

Wholesale 2.0 Lending at this scale, is already a profitable business for the company with healthy yields, controlled opex and strong asset quality.

2.3x

Growth from FY 2022-23 to FY 2023-24

.webp)