TRANSFORMED AND STRENGTHENED THE COMPANY

Capital raising and business model transformation

Since the beginning of FY 2020, despite a highly volatile business environment, the Company raised over ₹ 18,000 Crores of equity, significantly deleveraged the balance sheet, exited non-core businesses and made strategic choices to transform its business model. In September 2021, the Company completed the acquisition of DHFL, which was a major step towards transformation of our Financial Services business.

STFC: Shriram Transport Finance

PPL: Piramal Pharma Ltd.

Transition and quantum growth through the DHFL acquisition

The DHFL acquisition created one of the leading NBFCs in India, focused on affordable housing and MSME lending

- DHFL was the first financial services company in India resolved under the Insolvency and Bankruptcy Code (IBC)

- ~94% of the creditors of DHFL had voted in favour of Piramal’s resolution plan in January 2021

- Successfully completed the acquisition of DHFL in September 2021; total consideration of ~` 34,250 Crores was paid for the acquisition

Diversification

Transforming into a well-diversified lender, focused on becoming retail-oriented

Growth

Significant increase in loan book size, creating one of the leading NBFCs in India

Scale

Pan-India distribution network with an existing customer pool of ~1 Million customers

Customer Segments

Address financing needs of the under-served ‘Bharat’ market in affordable segment

Strengthens Liabilities

Reduces borrowing cost and further improves ALM profile

Capital Efficiency

Improves utilization of equity in the Financial Services business

DHFL acquisition - Key outcomes

As of March 2022

33%

AUM growth (post merger)

>4x YoY

Retail Loan Book growth (post merger)

36%

Share of retail loans vs. 12% as of Mar-21

309

Number of branches

24

States/UTs Pan India footpoint

~1 Mn

Life-to-date customers

DHFL branches integrated and re-activated as of March 2022

- Absorbed all 3,000+ erstwhile DHFL employees and integrated all branches

- As of March 2022, 99% of the DHFL branches are ‘login active’; 98% are ‘sanction active’ and 97% are ‘disbursement active’

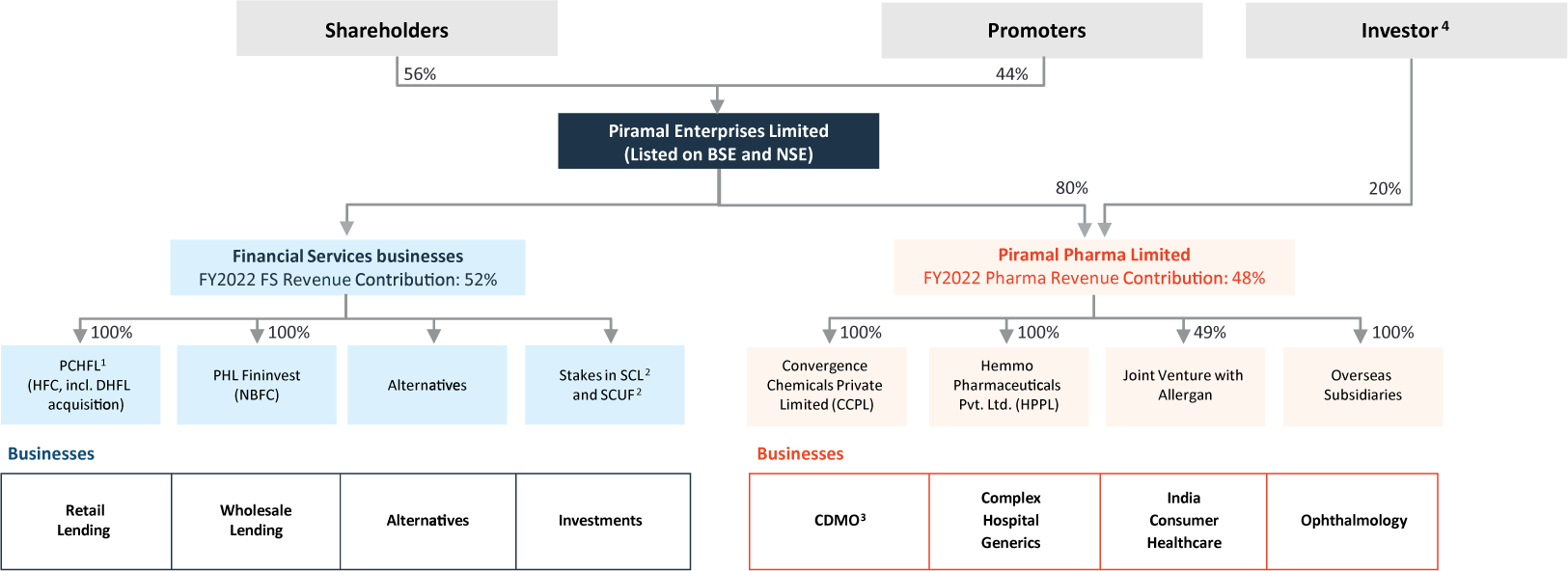

DEMERGER OF THE PHARMA BUSINESS AND CORPORATE STRUCTURE SIMPLIFICATION

Transforming from a multi-sector conglomerate structure into separate sector-focused listed entities in Financial Services and Pharmaceuticals

- To create two separate sector-focused listed entities

- Both entities to have a leadership position in their respective sectors

- Expect to unlock significant value for shareholders

Key Outcomes:

- The pharmaceuticals business will get vertically demerged from Piramal Enterprises Limited (PEL) and consolidated under Piramal Pharma Limited (PPL)

- PHL Fininvest Private Limited, the non-banking financial company (NBFC) will be amalgamated with PEL to create a large listed NBFC in India

Demerger and subsequent listing of PPL on the Stock Exchanges is expected to be completed by Q3 FY 20232

| Key Milestones | Status / Expected Timeline |

|---|---|

| Board Approval | |

| Filing of Application with Stock Exchanges | |

| RBI Consent (on Scheme of Arrangement) | |

| Consent from Financial creditors | In progress |

| Consent from SEBI / Stock Exchanges | |

| NCLT Approval |

In progress1

(Order by Hon’ble NCLT to convene shareholders’ and creditors’ meetings) |

| RBI Approval (for NBFC license to PEL) | – |

| Approval from shareholders | – |

| Listing of PPL on Stock Exchanges | Q3 FY 2023 (expected) |

Notes:

(1) Order by Hon’ble NCLT to convene meetings of Equity shareholders, Secured Creditors and Unsecured Creditors in Jul-2022 for approving the Scheme of Arrangement

(2) Subject to shareholders, creditors and regulatory approvals

Strategic Rationale and Key Benefits

- Simplifies the corporate structure: Creates two separate pure-play entities in Financial Services and Pharmaceuticals

- Strengthens governance architecture: Dedicated Boards and Management teams for the two businesses

- Optimal capital structure for each business

- Facilitates businesses to independently pursue growth plans, organically and inorganically

- Enables better understanding of each sector-focused listed entity by the analyst and investor community

Pre-demerger

Notes:

(1) Piramal Capital & Housing Finance Ltd.

(2) SCL: Shriram Capital Limited and SCUF: Shriram City Union Finance

(3) Contract Development and Manufacturing Organization

(4) The Carlyle Group

(5) Shareholding as of June 30th 2021

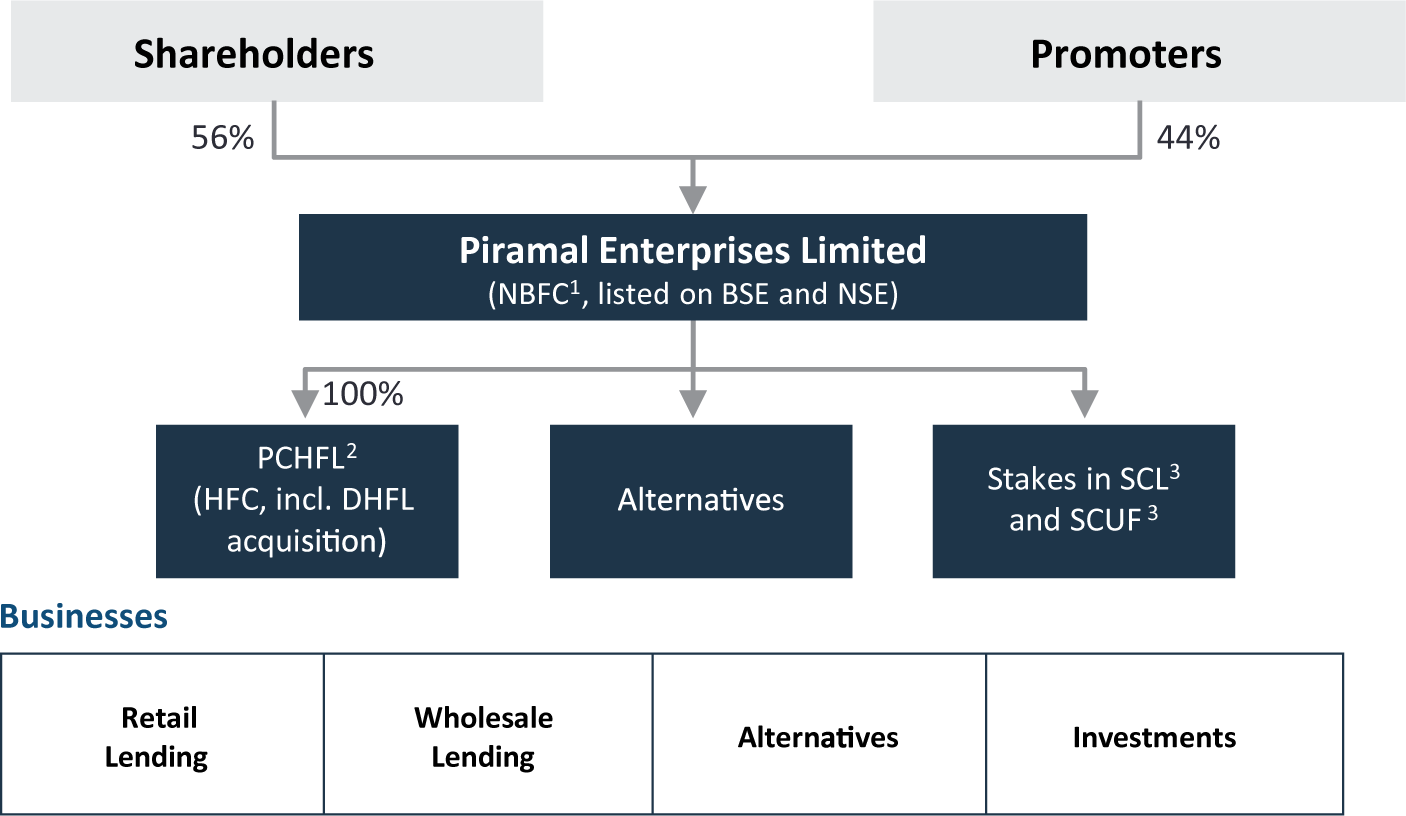

PEL TO BECOME LISTED NBFC POST DEMERGER OF PHARMA BUSINESS

PEL Structure - Post-Demerger

Notes:

(1) Subject to RBI approval

(2) Piramal Capital & Housing Finance Ltd.

(3) SCL: Shriram Capital Limited and SCUF: Shriram City Union Finance

(4) Shareholding as of June 30th 2021

PEL will be a large diversified listed NBFC, with significant presence across both retail and wholesale financing

- PHL Fininvest Private Limited, the non-banking financial company (NBFC), will be amalgamated with PEL to create a large listed NBFC in India

- PEL to become listed NBFC1 post demerger of Pharma business

- PCHFL (Housing Finance Company), will remain a 100% subsidiary of PEL

Strategic Priorities - Financial Services entity:

To transform into a well-diversified financial services business

- Aim to achieve a loan book mix of two-thirds retail and one-thirds wholesale in 5 years

- Focus on lowering cost of borrowings, driven by diversification of loan book growth and funding sources

- Further optimize capital utilization through loan book growth and inorganic initiatives

- Maintaining adequate provision to manage future contingencies

- Improve profitability through growth, lower borrowing costs, change in retail product mix and capital optimization

PPL WILL BE A LARGE INDIA-LISTED PHARMA COMPANY

PPL Structure - Post-Demerger

Notes:

(1) Contract Development and Manufacturing Organization

(2) The Carlyle Group

(3) Shareholding as of June 30th 2021

(4) Record date to be determined for PEL shareholders

PPL will be a large India-listed Pharma company, focused on Contract Development and Manufacturing, Complex Hospital Generics and India Consumer Healthcare

- Pharma business will get vertically demerged from PEL and consolidated under PPL

- CCPL and HPPL to merge with Piramal Pharma Ltd. to further simplify Pharma structure

- In consideration of the demerger, PPL shall issue 4 (four) fully paid up equity shares of PPL of ` 10 each, to the shareholders of PEL for every 1 (one) fully paid up equity share in PEL having a face value of ` 2 each, in accordance with the Share Entitlement Ratio4

Strategic Priorities - Pharma entity:

Track-record of building scalable differentiated pharma businesses with world class talent in attractive markets through profitable organic and inorganic growth

- Delivering consistent revenue growth and improving profitability

- Pursuing organic and inorganic growth opportunities leveraging fresh capital

- Maintaining robust quality culture across manufacturing/development facilities globally

- Continued focus on patient needs, customer experience, and ESG initiatives