PHARMA

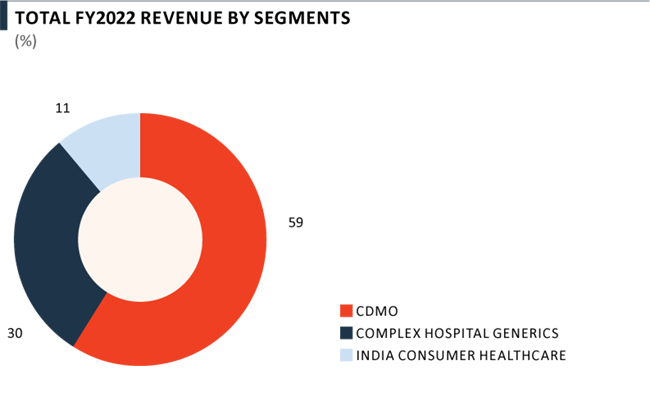

Piramal Pharma Limited (PPL), a subsidiary of Piramal Enterprises Limited, offers a portfolio of differentiated products and services through endto-end manufacturing capabilities across 15 global facilities and a global distribution network in over 100 countries. PPL includes an integrated Contract Development and Manufacturing Organisation (CDMO) business, Complex Hospital Generics (CHG) business, and India Consumer Healthcare (ICH) business, selling over-the-counter products in India.

Contract Development and Manufacturing Organisation (CDMO)

- We provide integrated drug discovery, production, and manufacturing services for both APIs and formulations from the start of product lifecycle to its commercial launch.

- Our diverse client base comprises global big pharma companies, emerging biopharma companies and generic pharma companies.

- Our development and manufacturing facilities are located in India, UK, US, and Canada.

- Manufacturing facilities have requisite approvals from global pharma regulatory agencies including USFDA (Food and Drug Administration), UK MHRA (Medicines and Healthcare Products Regulatory Agency), Japan PMDA (Pharmaceuticals and Medical Devices Agency), ANVISA (Brazilian Health Regulatory Agency), and Health Canada to supply products to respective markets.

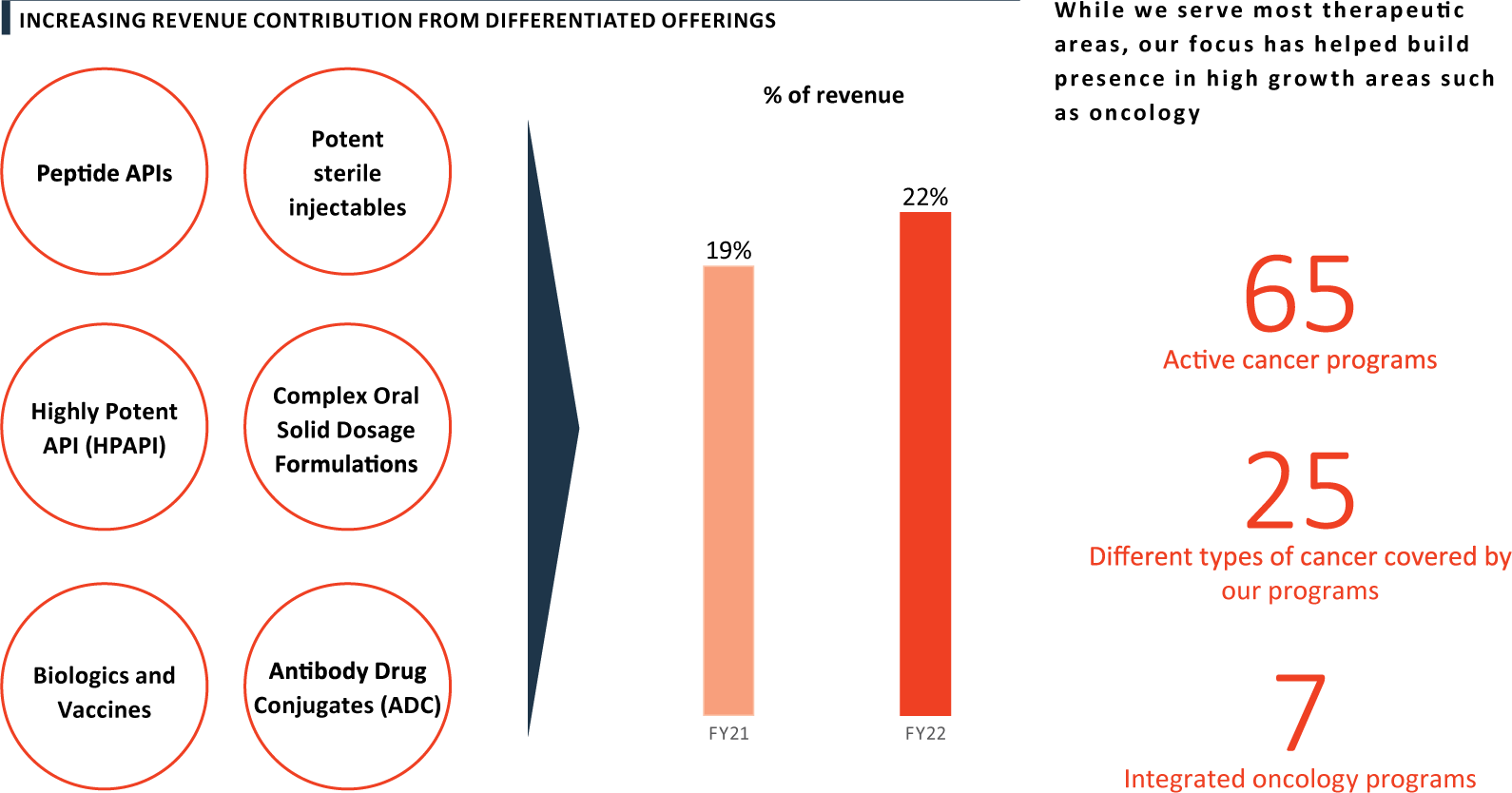

- The strong development and manufacturing capabilities include several niche areas such as handling of Highly Potent APIs (HPAPIs), Antibody Drug Conjugates (ADCs), Peptide APIs, Oral Solid Dosage formulations, Potent sterile injectables, and Biologics and Vaccines.

Complex Hospital Generics (CHG)

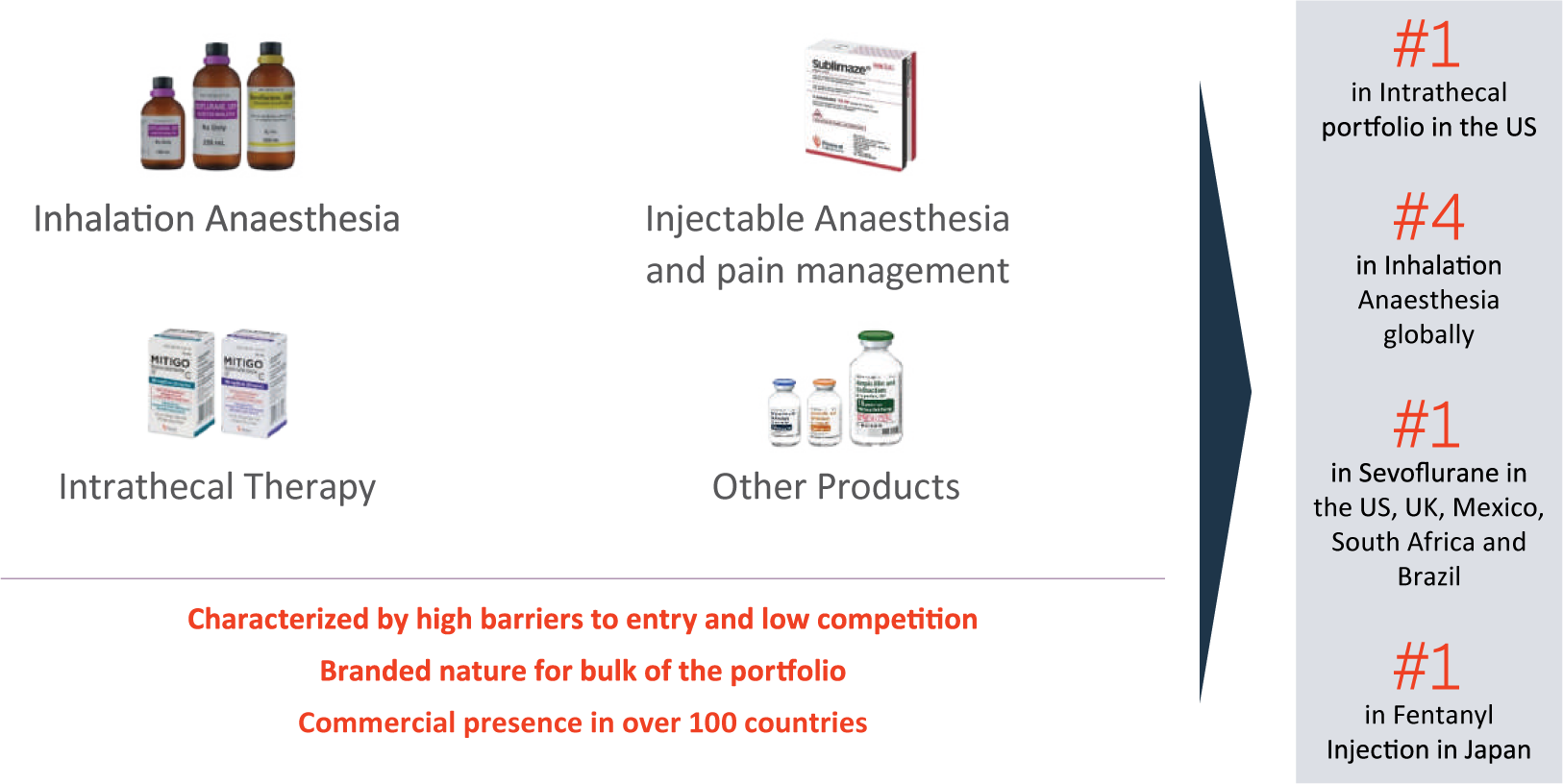

- Our hospital generics portfolio comprises Inhalation and Injectable Anaesthesia, Injectable Pain, Antibiotics and other medications, and Intrathecal Spasticity management drugs.

- We are one of the few major suppliers of Inhaled Anaesthetics with capability to manufacture all four generations of Inhalation Anaesthetic products.

- We have a growing portfolio and pipeline of several products at various stages of development and approval.

- The strong marketable capabilities allow us to distribute products in over 100 countries with (a) direct sales presence in the US, the UK, Italy and Germany and (b) strong local marketing partnerships in other markets, including Japan and South Africa.

India Consumer Healthcare (ICH)

- We are among the leading players in India in the self- care space, with established brands in the Indian consumer healthcare market.

- Our marquee brands include Little’s, Lacto Calamine, I-Pill, Polycrol, Tetmosol, Saridon and Supradyn across key OTC categories such as Baby Care, Skin Care, Women Care and Allergy Management, Gastrointestinal (GI), Vitamins, Minerals, and Supplements (VMS) and Analgesics.

- We have a wide market presence across India, with presence in ~2,00,000 chemists and cosmetics stores and 10,000+ kids, toys and gift shops covering all key markets, giving the Company chemist coverage greater than most OTC players.

- We have expanded Covid-care range over the last two years. The portfolio consists of disinfectant range under Triactiv (consisting of sprays, wipes, sanitizers, face masks), Covifind and VMS range under Ourdaily, and Pulse Oximeters. This has helped us maintain our growth momentum during pandemic times.

Market scenario

Introduction

The role of the pharmaceutical industry has become even more pronounced in the wake of the COVID-19 crisis. In these challenging and volatile times, pharmaceutical and healthcare companies play a vital role in facilitating the global supply of critical drugs while also planning for new vaccines and therapeutics. This makes the Pharma industry one of the most critical and most resilient industries during such health emergencies. The pharmaceutical industry has also been impacted both on the demand as well as the supply side. Even though the impact on the demand side may be short-lived, that on the supply side is expected to have long-lasting effects on the global pharma supply chain.

Several governments restricted the export of certain pharmaceutical products or inputs essential for manufacturing pharmaceutical products, at various times during the pandemic, aiming to concentrate limited supplies on domestic demand. When the pandemic was at its peak, the industry faced some difficulties, especially with regards to input materials being supplied from certain geographies.

On the demand side, pharma products are driven by underlying medical requirements, which are unlikely to change materially due to COVID-19. Fluctuations observed in the sales and procurement patterns are expected to continue only in the short-term. New opportunities have also emerged for the pharma industry, with increasing demand in certain categories such as hygiene products, preventive healthcare products and also with the creation of essential redundancies in the supply chain by global companies. Enhanced focus on regional and local manufacturing is expected to boost new opportunities for companies with global production networks, a track record for reliable supply, and sound ESG (Environment, Social and Governance) practices. Most companies are likely to focus on operational resilience, agility and transparency through a greater deployment of digital and analytical tools, along with the automation of processes.

Overall, the industry is undergoing unprecedented changes as the crisis begins to pass. Key regulatory agencies are considering product sampling at borders, reviewing the company's compliance history, sharing information with other governments and expediting speedier approvals of regulatory submissions. Securing the supply chain and ensuring business continuity while maintaining a strong focus on quality and compliance is the need of the hour. Pharma companies that can prepare for these changes with agility and set proactive controls and mechanisms in place, should emerge stronger, as the impact of the pandemic subsides.

Piramal Pharma business during the pandemic

The COVID-19 pandemic has been both a health as well as an economic crisis, deeply affecting the lives of millions around the world. The Company adapted quickly across its operations to support stakeholders during such a turbulent time. It remains cautiously positive in its approach towards managing any potential impact of the pandemic on its activities, and the distribution of its goods and services to patients and customers.

- The manufacturing facilities across India, US, UK, and Canada provide customers with flexibility and business continuity options.

- The Company prioritised workers' health and safety and implemented several measures for employee wellbeing, facilitating work from home for those whose roles did not require physical presence, introduction of hygiene protocols for visitors, and routine health and travel advisories.

- In the wake of COVID-19, business continuity plans were enabled across locations.

On the demand side

- The CDMO business grew despite the execution and supply chain related challenges due to Covid. There has been a healthy growth in the development order book.

- The Complex Hospital Generics business demonstrated significant recovery and grew 20% yoy despite several uncertainties and supply related challenges including rising material and logistics costs. In many key developed markets, including the US, demand for Inhaled Anaesthesia and Injectables is recovering. The Company executed multiple contract extensions with major GPOs in the US.

- In the India Consumer Healthcare business, rapid urbanisation is leading to higher disposable incomes, and young, urban consumers are open to spending more on better products. The retail landscape is shifting towards faster growing modern trade and e-commerce platforms. The Company is continuously investing in brand promotion and marketing and has successfully launched 40 new products and 18 SKUs. The Company’s presence spans 24 e-commerce platforms and 8,700+ modern trade stores. It also launched its own directto-consumer website, wellify.in.

On the supply side

- The Company’s teams have been working on a project to widen its vendor base and secure alternative suppliers for nearly two years, to mitigate supplier concentration and location risks in the event of future disruptions.

- Inflation is a harsh reality and there is a growing recognition and acceptance of the fact that cost increases will pass on to customers as well. In several instances, price increases have offset costs, although there is a lag effect due to inventories and in some cases, supply demand dynamics limit the ability to hike prices.

- The current conflict-ridden geopolitical situation has brought about volatility in global currencies, as well as in prices of crude oil, chemicals, raw materials and metals. The Company is monitoring the situation and taking pro-active steps to mitigate the extent of the impact.

- The Company’s strengthening of alternate channels and presence on e-commerce platforms has become increasingly crucial, as consumer attitudes toward retail outlets shift. Along with established trade channels, e-commerce is a key platform for new releases. Several new launches have been piloted on e-Commerce channels, taking the business to new levels.

KEY HIGHLIGHTS - PHARMA >

A long-term track record of sales growth and profitability

Notes:

(1) Pharma includes CDMO, Complex Hospital Generics and India Consumer Healthcare and certain Foreign exchange income/loss

(2) FY 2016 - FY 2022 results have been prepared based on IND AS, prior periods are IGAAP

Presence in attractive and large industry segments

Market is Driven by Sustainable Tailwinds

- Biotech and Mid Pharma emerging as an important customer category

- US and Asia Pacific witnessing higher growth of 7.7–8.5% p.a. over 2021–26 aided by new drug development

- Pharma companies increasing outsourcing to “integrated service providers”

Structural Growth Drivers

- Market is characterized by high barriers to entry

- Better pricing environment due to supply challenges

- Possibilities of entering into long term contracts with customers and GPOs

Structural Growth Drivers

- Fast growing base of young, urban consumers with increasing health consciousness

- Highly underpenetrated consumer healthcare market in India

- Evolving retail landscape and emergence of e-commerce channel

Global footprint with a diversified revenue base:

15

Manufacturing Sites

100+

Countries with Commercial Presence

~500

CDMO Customers

6,000+

CHG Customers (Hospitals)

Best-in-class quality track record

269

Total regulatory inspections1

36

USFDA inspections successfully cleared1

ZERO

OAIs1,2

~150

Annual customer audits1

Strong quality function with 1,000 people across sites and reporting directly to the Chairperson

Advancement journey from ‘Quality for Compliance’ to ‘Quality as a Culture’ , with a focus on systems, processes, technology and people

Notes:

(1) Since FY 2012

(2) OAI: Official Action Indicated

KEY HIGHLIGHTS - PHARMA

Proven track record of organic and inorganic expansions

Healthy ROI on Organic Investments

Growth capex across Discovery, Development and Commercial Manufacturing within CDMO

Investments to bolster capacity across key Inhalation Anaesthesia products in Complex Hospital Generics

Sales Promotion to drive consumer acquisition and loyalty on several brands in India Consumer Healthcare

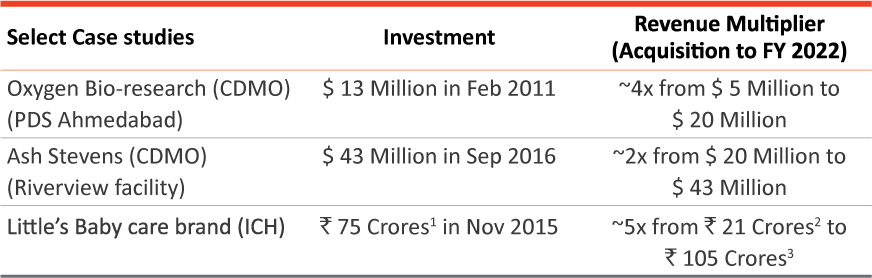

Track record of value creation from acquisitions

Successfully completed multiple organic growth initiatives and closed and integrated 15 M&A transactions in the last 10 years

Notes:

(1) Equivalent to US$ 10 Million

(2) Equivalent to US$ 3 Million

(3) Equivalent to US$ 14 Million

CDMO: Service offerings across the lifecycle of the molecule

Discovery

>90%

business from repeat clients

95

From North America and Europe

Development

172

Pipeline of molecules across phases 1, 2 and 3

46%

Development revenue from Phase 3 molecules

Commercial manufacturing

50+

APIs across therapeutic areas

65+

FDFs across therapeutic areas and dosage forms

Ability to manufacture across a wide range of scale in API as well as formulations

Presence across the value chain allows PPL multiple entry points with clients, resulting in a consistently high win-rate

CDMO: Increasing revenue share and attracting customers with our differentiated offerings

CDMO: Expansion of major sites through customer - led brownfield expansion

Note:

(1) Aurora, Pithampur, Riverview, Grangemouth and Morpeth are select cases of upcoming and completed capex investments across our global sites

KEY HIGHLIGHTS - PHARMA

Complex Hospital Generics: Leveraging a differentiated portfolio to gain market share and drive growth

Differentiated portfolio of 40 products spanning inhalation anaesthesia and injectable

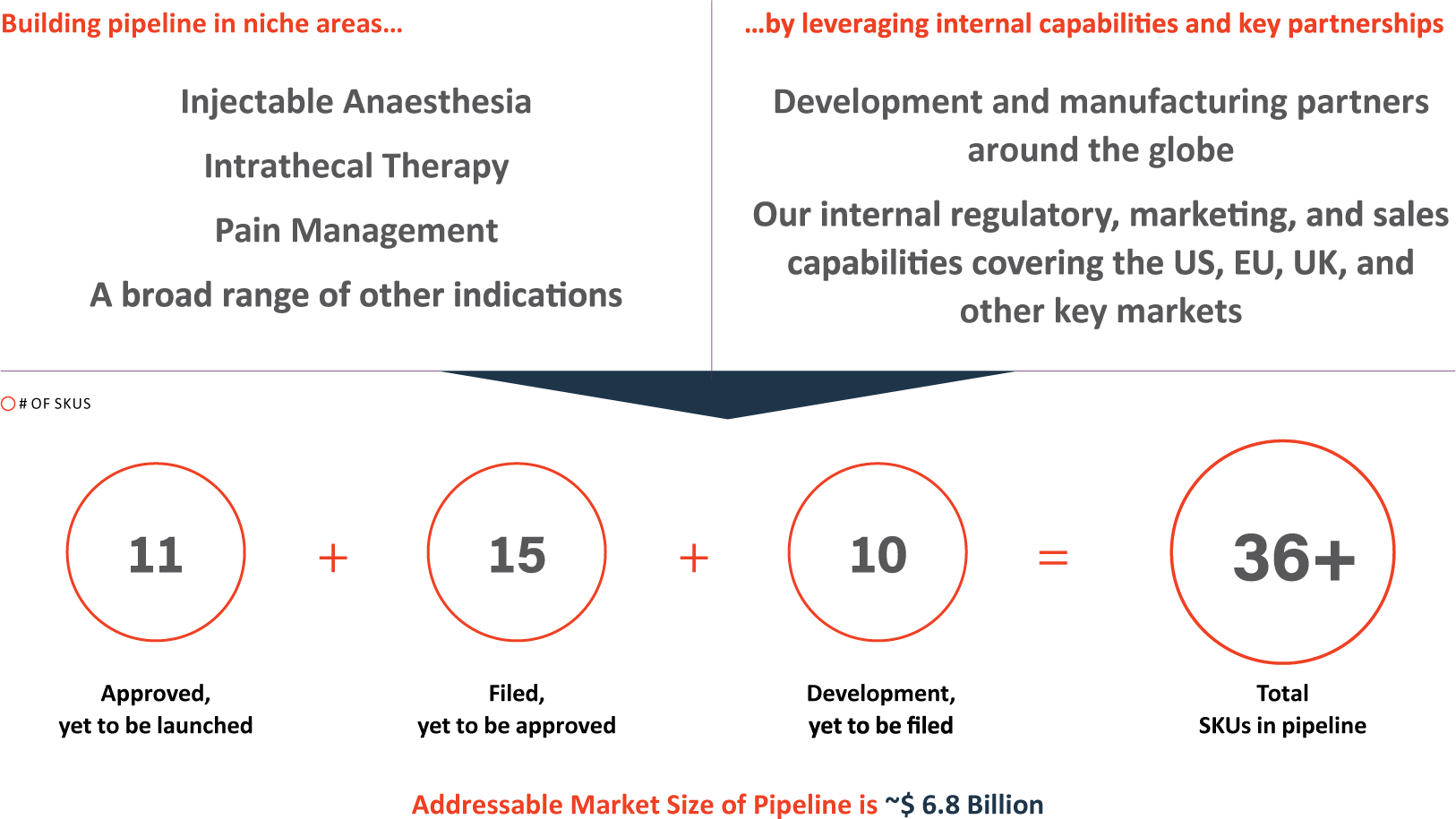

Complex Hospital Generics: Strong pipeline in niche areas with unique characteristics

India Consumer Healthcare: Focus on power brand with continuous investments in brand promotions and marketing

INVESTMENTS IN BRAND PROMOTION AND MARKETING…

India Consumer Healthcare: Launching multiple new products and brand extension and strengthening presence in alternate channel

CDMO - Contract Development and Manufacturing Organisation >

Market scenario

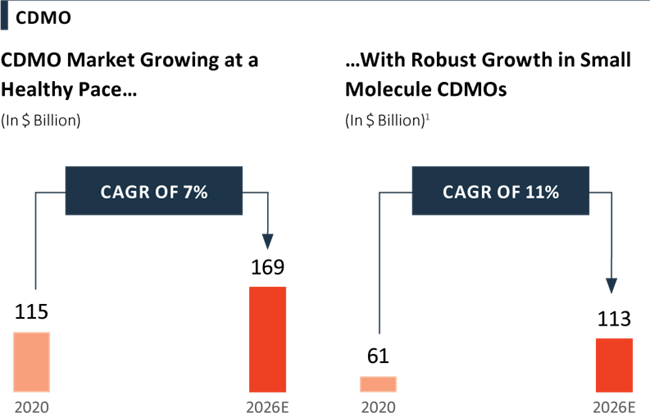

The total market value for Contract Development and Manufacturing Organisation (CDMO) services stood at $ 115 Billion in 2020 and is expected to reach $ 169 Billion in 2026, growing at a CAGR of 7%. Small molecules lead the pipeline contributing 70% to the CDMO market. The CDMO market is largely fragmented with several players and few companies occupying a significant market share. The competitive intensity is high, which leads to differentiation playing a key role. Companies displaying differentiated technologies, niche expertise with high barriers to entry, and strict regulatory requirements reap higher growth and margins. CDMOs that can deliver customer-centric, highquality, customised solutions across drug products and drug substances from various regions are distinguished from other industry players. CDMOs have been witnessing growth as pharmaceutical companies continue to increase outsourcing to ՙintegrated service providers՚ due to the following reasons:

- Increased focus on core competencies

- Transition to asset-light models

- Increased speed

- Access to technical capabilities

- Capacity constraints and regulatory requirements

- Comfort of increasing exposure with proven network of suppliers

Pharmaceutical firms are attempting to reduce their production and processing costs while concurrently de-risking their R&D activities and increasing the pace of delivery to markets. Outsourcing has evolved from a transactional activity to a strategic function. Increasing number of specialty and biotech companies are turning to service providers for help in order to avoid high fixed costs of in-house development and for building manufacturing facilities. Thus, CDMOs are an integral and rapidly expanding component of the pharmaceutical value chain.

Operational performance

PEL’s positioning

The Company’s CDMO business has presence across the value chain from drug research and clinical development to commercial production of active pharmaceutical components and formulations. This, coupled with the ability to manufacture across a wide range of APIs as well as formulations, allows for multiple entry points with clients, resulting in a consistently high win-rate for the Company.

Large part of the revenue is sticky in nature, with 70% generated from Commercial manufacturing. Commercial products under patent contributed $ 56 Million to revenue in FY 2022, up from $ 19 Million in FY 2019. The Company has a balanced Development revenue mix across phases, with robust growth in projects across clinical phases and 3.4x increase in the number of phase III molecules.

PEL serves a large customer base by leveraging global delivery capabilities through its extensive network of 13 facilities across the United States, Canada, the United Kingdom and India. The Company's diverse manufacturing footprint allows for close proximity to customers and markets, as well as cost-effective production.

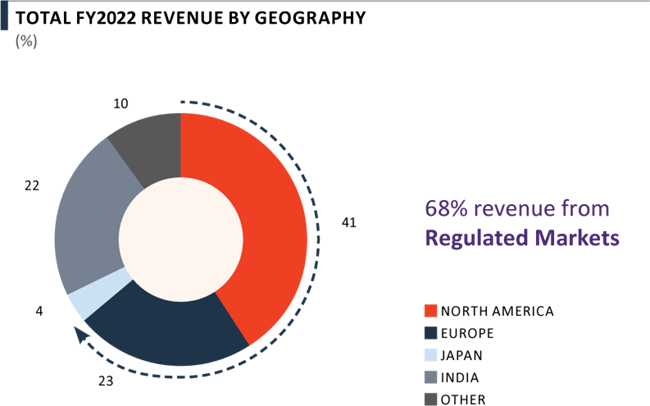

For both unique and generic pharmaceuticals, PEL is leveraging an ‘End-to-end Model’ to offer integrated services with a compelling value proposition - reduced time-to-market, reduced operational complexity and lower supply chain costs. This has resulted in a diversified blue chip customer base with 71% of revenue from Big Pharma, Emerging Biopharma, etc. and 75% of revenue from Regulated Markets, while still maintaining low revenue concentration and top 10 customers accounting for 39% of the Company’s FY 2022 revenue.

PEL’s long-term, loyal client relationships are rooted in its quality track record, cost effectiveness, and ability to provide differentiated offerings. Highly potent APIs, Antibody Drug Conjugates, Potent Sterile Injectables, and Hormonal Oral Solid Dosage Forms are among its unique offers. The revenue contribution from differentiated offerings is steadily increasing and stood at 22% of total revenues in FY 2022. While the Company serves most therapeutic areas, its determined focus has also helped build presence in high growth areas such as oncology.

Organic and Inorganic investments

The Company is expanding major sites through customer-led brownfield expansions and have committed $ 157 Million of growth-oriented Capex investments across multiple sites.

- At Aurora, PEL commenced commercial operations at its new blocks created to expand API capacities.

- At Pithampur, the Company launched a new production block for Oral Solid Dosage formulations in May 2022.

- PEL’s Digwal site has implemented various tools to unlock API manufacturing capacity and to support client needs in drug development and on-patent projects.

- In Riverview, it has announced expansion for drug substances, including HPAPIs.

- At Grangemouth and Morpeth, the Company has announced expansion for Antibody Drug Conjugates and for upgrading its API facilities.

PEL also continued to add capabilities through successful acquisitions.

- The Company acquired a significant minority stake in Yapan Bio, an India-Based CDMO providing expertise in Biologics and Vaccines. The investment in Yapan Bio allows the Company to broaden its service offerings in the fast-growing biologics CDMO space. Biologics capabilities can be synergistic with its Antibody Drug Conjugation capabilities.

- Piramal Pharma Limited acquired a 100% stake in Hemmo Pharma for ₹ 775 Crores and earn-outs linked to the achievement of milestones. As the Company continues to expand and grow its capabilities, this acquisition marks its foray into the development and manufacturing of peptide APIs, a capability that complements its existing service offerings.

Impact of COVID-19

- The pandemic has had a significant effect on the pharmaceutical and biopharmaceutical industries, affecting everything from clinical trials to supplies, production, processing, and the supply chain.

- As the global pharma industry attempts to solve challenges and capitalise on COVID-19-related opportunities, the CDMO industry is becoming increasingly relevant.

- Many pharma companies do not have idle capacities available to support unplanned demand. Furthermore, the companies are seeking to strengthen their supply chains and rebalance their operations.

- CDMOs have immediate, scalable ability to support these changes without the capital and time-cost of building new internal capabilities.

- As on-site visits to audit new partners is challenging in the short term, customers are approaching existing CDMO partners for new and additional work. This is enabling businesses to deepen existing partnerships, while forging new relationships becomes difficult.

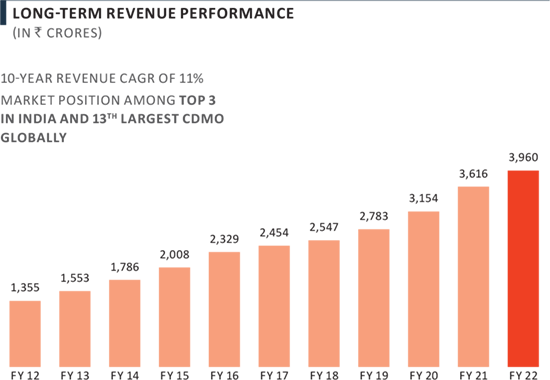

FY 2022 performance

In FY 2022, PEL’s CDMO business grew 10% yoy, marginally impacted by execution and supply related challenges.

- Revenues increased 10% yoy to ₹ 3,960 Crores.

- Growth rate and margins were impacted by execution and supply chain related challenges in terms of logistics, input material availability/costs and manpower shortages due to COVID-19.

- The Company witnessed healthy growth in Development Order Book and strong demand for API services across geographies.

- 75% revenue was generated from the regulated markets of North America, Europe and Japan

- Acquisition of Hemmo Pharmaceuticals and Yapan Bio has helped add new technologies and capabilities in peptides and large molecules, including vaccines and gene therapy, to the Company’s global offerings.

- The company expanded capacities at major sites through brownfield expansions and committed $ 157 Million growthoriented Capex investments across multiple sites.

CDMO Full Year Revenue Performance

Complex Hospital Generics >

Market scenario

The Complex Hospital Generics market has a total size of over $ 50 Billion. Generic injectables represent ~20% of the US generic market.

Capabilities in injectables are harder to acquire and capital intensive. Due to high entry barriers such as high initial investments for supplying and sustaining medical devices such as vaporisers, as well as dedicated production facilities for difficult-to-manufacture products, competition remains limited as compared to traditional generics.

Furthermore, a considerable portion of each of these categories is made up of institutional group purchasing organisations (GPOs) or tender-based industry, both of which are extremely relationshipbased and highly technical. These factors create hurdles for lessexperienced competitors and new entrants. The high cost and operational burden of injectable capabilities increases the possibilities of long-term contracts with customers and GPOs.

Operational performance

PEL’s positioning

Inhalation Anaesthesia, Injectable Anaesthesia, Pain management, Intrathecal treatment, and other injectables are all part of the Company’s Complex Hospital Generics business. PEL is leveraging its differentiated portfolio spanning Inhalation Anaesthesia and Injectables to gain market share and drive growth. During the year, the Company maintained a strong market share in key regions, and also maintained the following leadership positions:

- #1 in Intrathecal portfolio in the US

- #4 in Inhalation Anaesthesia globally

- #1 in Sevoflurane in the US, UK, Mexico, South Africa and Brazil

- #1 in Fentanyl Injection in Japan

PEL leverages relationships with a global network of partners for sterile injectables and has vertical integration for Inhalation Anaesthesia. The Company has a defensible and differentiated portfolio across these key hospital-focused products and a strong pipeline of over 36 SKUs with an addressable market of $ 6.8 Billion in various stages of development. PEL’s goods are sold in over 100 countries, as it serves hospitals, surgical centres, and veterinary clinics.

Through vertical integration, cost-effective and scalable infrastructure, and solid relationships with developers and manufacturers, PEL continues to expand its supply chain capabilities. The Company has been procuring Key Starting Materials (KSMs), Active Pharmaceutical Ingredients (APIs), and Completed Dosage Forms from partners across the globe to increase supply.

During the year, the Company executed multiple contract extensions with major GPOs in the US, and achieved strong Inhaled Anaesthesia sales in the US, despite several supply chain related challenges including rising material and logistics related costs.

Impact of COVID-19

From time to time throughout the year and in different geographies, COVID-19 continued to have direct and indirect impacts on demand:

- Lockdowns imposed across key markets impacted the resumption and volume of surgeries.

- A shortage of healthcare workers, both due to COVID-19 and other factors, impacted the rate of surgical procedures.

- Cost and complexity of the Company’s operations increased, especially cost/availability of key starting materials along with increased challenges in logistics and distribution.

Despite the headwinds of COVID-19, inflation and economic pressures, the Company has grown revenues at 20% yoy in FY 2022. While PEL expects most of these challenges to continue in the near term, its growing product portfolio combined with increasing access to additional markets, and its continued agility in meeting customer and patient expectations, creates a lucrative position for the Company to outperform in the long run.

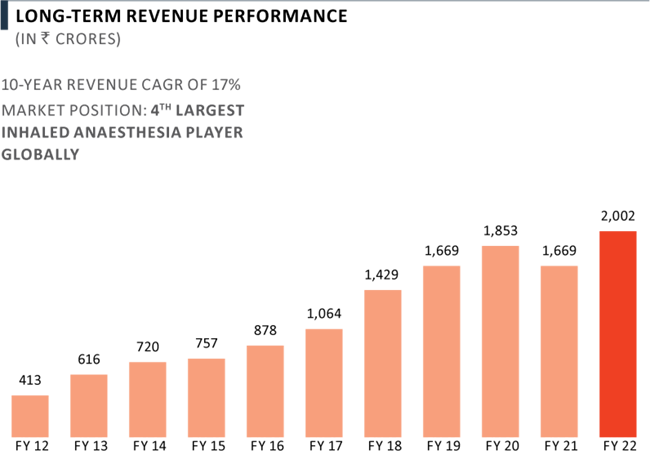

FY 2022 performance

The Complex Hospital Generics business revenue grew by 20% yoy to ₹ 2,002 Crores during the year, due to demand normalisation for most of the Company’s products.

- PEL has delivered strong sales of Sevoflurane and Isoflurane in the US.

- It has maintained its market share in the US for Intrathecal portfolio.

- The Company has executed multiple contract extensions with major GPOs in the US.

- PEL is witnessing supply chain related constraints due to longer lead times, rising input prices and higher costs of logistics.

- The Company has a strong pipeline of new products, including 36+ SKUs in various stages of development and approval.

Complex Hospital Generics Full Year Revenue Performance

Indian Consumer Healthcare >

Market scenario

In India, the health-focused branded consumer industry is worth ~$ 19 Billion. Due to a young, urban population with increasing health consciousness, digital revolution, retail disruptions, and its continued value-seeking behaviour, the consumer healthcare market in India has grown significantly. With the increase in lifestyle ailments, the segment is expected to continue growing at a significant rate in the years ahead. Because of the exposure, tailored positioning, and nearly endless shelf space given by e-commerce platforms, online shopping is on the rise.

The Indian healthcare sector is growing at a brisk pace due to its increasing coverage, services and surge in expenditure by public as well private players.

Operational performance

PEL’s positioning

PEL’s business has evolved into a diversified portfolio of attractive brands including analgesics, skin care, VMS, kids' wellness, digestives, women's health, and hygiene and protection. Our business has an addressable market size of $ 7 Billion.

The Company is witnessing a strong performance in power brands, which contributed 57% to the FY 2022 revenues. The revenue from power brands grew 37% yoy to ₹ 424 Crores for the year. These brands include Saridon, Supradyn, Lacto Calamine, Little’s, Tetmosol, i-Pill and Polycrol. During the year, Little’s crossed ₹ 100 Crores and Tetmosol crossed ₹ 50 Crores in revenues.

The Company operates on an asset-light model with a diverse distribution network comprising multiple channels including chemists, grocers, modern trade, e-commerce, and kid's stores. The items are distributed by an established commercial infrastructure, which is well-entrenched in traditional channels, with a presence in ~200,000 chemists and cosmetics stores and 10,000+ kids’ toys and gift shops. The Company’s products are also available in more than 8,700 modern trade stores and 24 e-commerce portals.

The Company has made investments to improve its distribution and customer acquisition. There are dedicated teams for ‘chemist only’ and ‘cosmetics and chemist channel’. PEL has 100% tech-enabled sales coverage to enhance the productivity of field force. There is a direct coverage of toy stores to enhance depth and visibility.

During the year FY 2022, the Company launched 40 new products, such as brand extension products, Home Covid Detection Kit, and a new brand CIR (Care is Rare) in Geriatric Care category, along with 18 new SKUs. It also launched its own D2C e-commerce website, wellify.in. PEL is increasingly leveraging e-commerce to launch new products and 7 of its products are rated #1 in their respective categories on Amazon.

Impact of COVID-19

The pandemic has prompted several lifestyle changes around the world, and the shifts are also visible in India's consumer healthcare industry. The modern Indian consumer, concerned about their health and safety, is attempting to prepare for the new normal. The buying behaviour of the Indian consumer has also changed, enabling the growth of e-commerce.

The COVID-19 pandemic is propelling market areas like preventative healthcare and personal hygiene to newer heights. To enhance immunity, consumers are increasingly looking for preventative healthcare items such as multivitamins and ayurvedic supplements. Personal hygiene items have gained popularity and are projected to become an important element of the Indian consumers' monthly grocery baskets.

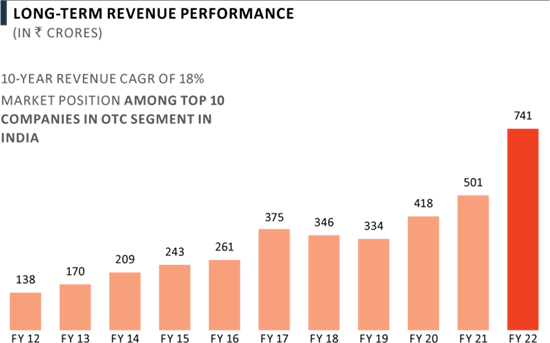

FY 2022 performance

- Achieved sales of ₹ 741 Crores in FY 2022, delivering 48% yoy growth, despite the challenges presented by COVID-19.

- PEL is investing in marketing and distribution capabilities for power brands like Saridon, Lacto Calamine, Polycrol, and Little’s.

- The Company witnessed a strong performance in key brands; Tetmosol powder featured among the top 10 talcum powders on Amazon.

- PEL launched 40 new products in FY 2022 and 18 SKUs. New products since April 2020 contribute to 15% of sales in business.

- The Company maintained its strong focus on e-commerce, with a presence on 24 e-commerce platforms and the launch of its own Direct-to-Customer website, wellify.in.

- The Company improved demand and distribution by leveraging analytics and Sales Force Automation tools.

India Consumer Healthcare Full Year Revenue Performance

Quality and Compliance >

At Piramal, we are overwhelmed by the trust our customers, patients and their families have placed in our products. Committed to consistently deliver the product with high-quality standards, we have built a strong quality culture and established an exemplary Quality Management System (QMS) framework that is implemented across all facilities, contract manufacturing sites, and suppliers.

Our compliance and governance model closely monitors the compliance and key performance indicators through audits and periodic review of Quality and Customer dashboard. With consistent track record of regulatory accreditations, embracing latest technology, adoption of innovative process and hiring worldclass talent, help us to remain attractive to customers as preferred partners. Continual improvement in systems, practices, infrastructure, and people strategy is the DNA to keep pace with the dynamic regulatory framework.

Patients are at the center of quality decisions we take on product disposition. Our established complaint process ensures we respond appropriately to product quality queries by patients and customers. Our post-marketing Pharmacovigilance system closely tracks risks, if any, with the products and all products continue to remain under the low risk and high benefits bracket.

Staying Ahead of the Regulatory Curve

The dynamic regulatory landscape coupled with greater scrutiny by regulatory authorities continues to be a key challenge for the pharmaceutical industry. The COVID pandemic threw a major challenge on people retention within quality organization owing to the attractive market situation. We have rolled out several initiatives to enable retain and hire key talent in quality space. People situation is under a good state of control now. Sites are also actively tuned to host on-site inspections by regulators like FDA and others and also our customers. PPL addresses the evolving regulatory requirements by establishing even higher internal standards that ensure perpetual inspection readiness. Over the past several years, the Company has successfully cleared 36 USFDA audits, 269 total regulatory inspections and 1,377 customer inspections. The Company’s internal search engine closely tracks any upcoming regulatory guidance at its nascent stage and updates the global quality guideline well before time to enable the site quality system to align with the new regulation in a timely manner.

Quality-centric Culture

At PPL, ‘quality’ is viewed as an integral part of the Company’s identity and as one of the most important aspects of its brand that dictates the Company’s culture, hires, and policies. The Company employs a 3-tier quality governance model to prevent dilution of the quality bandwidth while enabling central, regional and local controls. To provide due authority and enablement to the Quality group, this group is permitted to operate independently and reports to the Board. The Quality team is competent, multi- layered and capable of handling different compliance challenges with strategies spearheaded from its central cell. Quality continues to be a collective responsibility of all functions across the organisation.

Quality Tool Kit

In order to maintain a sustainable Quality System throughout all sites, PPL uses patented tools to identify site quality health, site audit readiness index and the site’s data integrity compliance. The tools are periodically updated to incorporate checkpoints in-line with current regulatory requirements. Data from site quality metrics are processed by Central Governance team using an algorithm to arrive at a numerical score and identify focal points. Periodic and designed reviews keep close track of site systemic health. The quality of products manufactured at CMO locations is closely tracked by the CMO governance model thereby ensuring that it measures to the Company’s quality standard.

Key Highlights of FY 2022

- Quality Long Range Plan is documented specifying core quality objectives to be achieved in upcoming years and the actions outlined to enhance Piramal Quality systems and practices. It is a dynamic document that evolves over time through periods of improvement and will help Piramal to develop greater internal efficiencies, meet emerging customer requirements, and adapting to changing market conditions and regulatory landscape.

- Digital Transformation of Quality Systems and Processes: Top-down business priorities analysis and bottom-up maturity assessment has been done to identify Key focus areas for digital transformation for maximum compliance and business impact. Digitization and Automation plan is in place to enable better transparency and improved decision making by automating manual processes.

- Corporate Quality Structure: In order to ensure that our quality processes continue to drive execution of our long range plans, a sustainable organization in the quality function is formed. The expanded quality structure will focus on strengthening quality governance and compliances, driving quality excellence, providing technical support to businesses and implementing a robust data integrity framework.

- Integration and culture transformation of acquired sites continue to be an area of focus as we expand our businesses in-organically. Teams are systemically working to transition systems and culture at the acquired sites to Piramal quality standards. Detailed time-bound plans are laid out, executed and tracked. As a business, this has been an ongoing phenomenon and we are well equipped to perform such integrations effectively.

Patient Centricity, Customer Centricity, and Consumer Centricity

Building a patient, customer, and consumer-centric organisation is of utmost importance to the Company. One of the six important Piramal Success Factors the organisation strives to instill in all its people is that of 'Serving Customers.' The Company strives to win the hearts of patients and customers by providing high-quality products and services.

PEL’s expertise in patient, customer, and consumer-centricity is driven by its fundamental principles of knowledge, action, care, and impact. PEL has built credibility through this strategy, which includes medicine, the use of technology, frequent surveys, and workshops.

CDMO

- Customer-centricity incorporated within a strategic business function

- All customer needs are handled by a single point of contact

- Company-wide initiatives towards customer-centricity, including senior management involvement, one-on-one customer mapping to the leadership team for top customers, implementation of necessary software, and quarterly surveys and seminars

- Dedicated forums for patient awareness

- Customer Satisfaction Survey

Complex Hospital Generics

- Recognising the voice of patients and customers

- Balancing operations with the concerns and needs of customers and patients

- Shift in culture to position patients at the center of decision-making

- Patient self-awareness surveys

- Patient centricity forum

- Periodic customer communication

India Consumer Healthcare

- Increasing self-care accessibility for a wider audience via traditional distribution channels and e-commerce

- Using media and direct contact to ensure product recognition and awareness among consumers and retailers

- Decision-making based on firsthand research, tailored studies, and data analytics

Good Distribution Practice

We have received WHO Good Distribution Practices (GDP) Certification for demonstrating our commitment to good practices and excellence in all aspects of our service. Two of our units in India i.e., Pithampur and Digwal were awarded GDP certification in 2019 and 2021 respectively. It serves as a quality assurance system for pharmaceutical warehouses and distribution centers, as well as an assessment of risk in supply chain operations.

Summary

Quality is a collective responsibility at PPL and is ingrained in the organization’s DNA. The Company continues to invest in hiring worldclass talent, technology, innovation, automation, infrastructure and enhance Quality oversight across all PPL sites. The roll out of Quality Long Range Plan along with expanded Quality Structure and Quality Initiatives helps to retain strong regulatory credentials and ensure competitive edge.

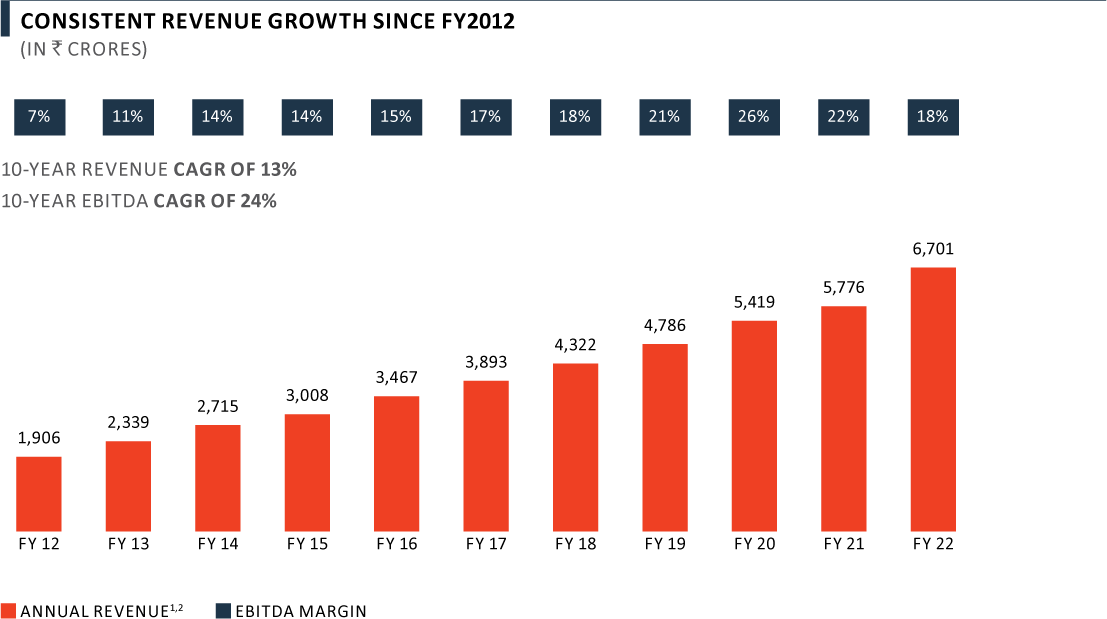

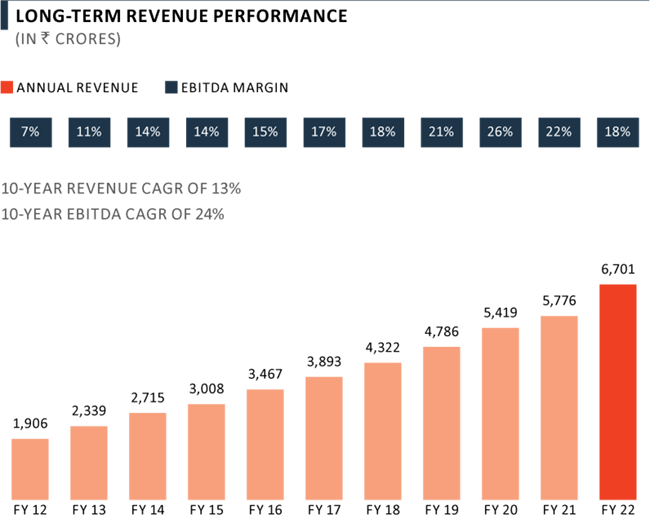

Financial Performance

Revenue from Pharma business grew by 16% yoy in FY 2022 to ₹ 6,701 Crore on account of high growth in Complex Hospital Generics and India Consumer Healthcare business, which was partly offset by lower performance in the CDMO business. Revenue has grown at a CAGR of 13% over the last decade, now contributing 48% to overall PEL revenue mix. The Pharma business has delivered a strong growth in EBITDA margins from 7% in FY 2012 to 18% in FY 2022.

Key Strategic Priorities >

Track record of building scalable differentiated pharma businesses with world class talent in attractive markets through profitable organic and inorganic growth

Delivering consistent revenue growth and improving profitability

Pursuing organic and inorganic growth opportunities leveraging fresh capital

- Capacity expansion across multiple sites

- Acquisitions of niche manufacturing capabilities for CDMO

- Add new complex hospital generics through in-licensing, acquisitions and capital investments

- Organically and inorganically add Consumer Healthcare products to further leverage India-wide distribution platform

Maintaining robust quality culture across manufacturing/development facilities globally

Continued focus on patient needs, customer experience, and ESG initiatives

Pharma Growth Drivers

PEL has identified key drivers for future growth across its three businesses.

CDMO

- Partner with customers as 34 phase III projects transition development to registration to commercial

- Support growth of 18 on patent commercial products

- Increase revenue share and attract customers with differentiated and niche offerings such as Highly Potent APIs, Peptide APIs, Potent Sterile Injectables, ADCs, Complex OSD, biologics & vaccines

- Continue above average win-rate for emerging biopharma, large pharma and generic customers

- Integrated services across the drug life cycle to increase customers stickiness

- Enhance production capacity through brownfield expansions

- Continued institutional focus on sustainability

Complex Hospital Generics

- Line-extensions within Sevoflurane for select EU markets, increasing market share in US and continued geographic expansion

- Global roll-out of Desflurane and leveraging the strong GPO position for other inhalation anaesthesia products in the US

- Continue growth in emerging and other key markets

- Transition to new CMOs to improve growth and profitability

- Strong pipeline of new products, including 36+ SKU’s at various stages of development & approval

- Launch new complex hospital products, leverage global distribution network, build strong customer relationships.

- Identifying product market opportunities in new markets

India Consumer Healthcare

- Strengthen Sales through Tech enablement

- Capability building for improvement in market servicing

- Growing Powerbrands through media and launches

- Utilizing E-commerce as launch vehicle for key new products

- Acquire brands to build scale and leverage fixed cost structure

- Improve scalability through traditional and modern trade and sales strategies