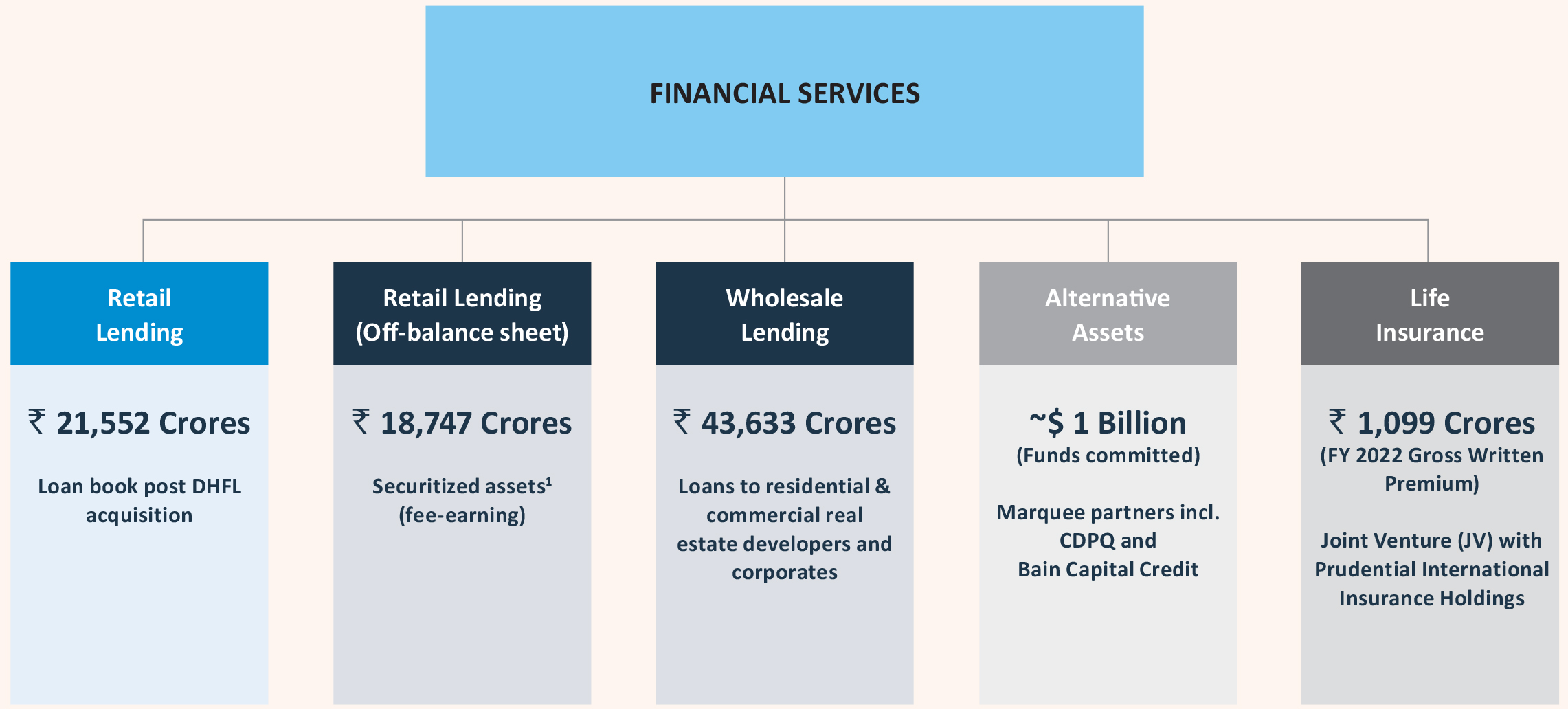

FINANCIAL SERVICES

The Company offers a wide range of financial products and solutions, with exposure across both retail and wholesale financing. As of March 31, 2022, the financial services business had an AUM of ₹ 65,185 Crores in the lending business.

Business Overview

Over the past few years, the Company has consistently diversified its exposure across both, wholesale and retail financing, through its strong presence in the following sub-segments:

Retail Lending

- A multi-product retail lending platform, which is ‘digital at the core’

- Significant increase in size and scale, post the DHFL acquisition

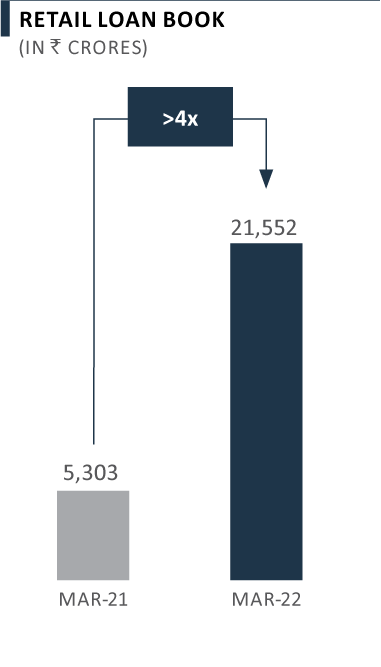

- Securitised, fee-earning assets (off-balance sheet) – acquired with DHFL

Wholesale Lending

- Loans to residential and commercial real estate developers, as well as a few corporates in select sectors

Alternatives

- Various investment platforms and JVs, with marquee partners

Life Insurance

- JV with Prudential International Insurance Holdings

As on March 31, 2022

Note:

(1) Acquired with DHFL and now managed by PEL

Market Scenario

The Indian economy witnessed real GDP growth of 8.7% in FY 2022, which surpassed the pre-pandemic level of FY 2020 by 4.7%. The recovery was broad-based, as all key constituents of aggregate demand, including private consumption, had recovered to their respective pre-pandemic levels. Also, India’s business confidence was elevated post recovery from the third COVID wave, with purchasing managers’ index (PMI) staying in an expansion zone. Furthermore, India’s exports had surpassed the $ 400 Billionmark in FY 2022. However, since March 2022, the global economy continues to face uncertainty amidst the Russia-Ukraine conflict, inflationary pressures, and a rising interest rate cycle.

According to the RBI, India’s financial system is maturing from a bank-dominated space to a hybrid system, wherein non-bank intermediaries are gaining prominence. In FY 2022, the NBFC sector witnessed a revival in loan growth1 to 10.3% as compared to 4.6% in FY 2021. Profitability for the sector also improved in FY 2022, as the sector’s ROE1 improved to 12% from 11% in FY 2021, on account of lower credit costs.

During the last few years, digital adoption across NBFCs and HFCs has been increasing, with focus on digital acquisition and on-boarding, partnerships with fintechs and technology being leveraged, to improve customer service. Adopting technological innovations across value chains will aid optimisation of resources and processes, reducing turnaround time, facilitating intuitive and automated decision-making, and ensuring accessibility of credit/loans for customers at rates tailored to their socioeconomic profile.

Also, the ‘retailisation’ trend across NBFCs is gaining ground, with several NBFCs announcing plans to increase their focus on retail lending. With Indian consumers going digital at an unprecedented pace, ‘digitisation’ across the customer life cycle is likely to increase significantly. This would give NBFCs a great leverage over traditional banking systems, and drive potential growth.

Furthermore, the NBFC sector has been facing increased regulatory oversight and push towards convergence with banks through various measures, such as scale-based regulation, realignment in asset quality classification, and Prompt Corrective Action norm. These will aid in better governance practices and structural strengthening of the sector, resulting in further harmonisation of the regulatory landscape across banks and NBFCs.

Larger NBFCs with liquidity support have continued to drive the sector’s overall credit growth. Between FY 2018 and FY 2022, large NBFCs have outpaced the overall NFBC sector, in terms of credit growth each year. We believe that NBFCs with strong parentage will continue to have better access to funding, and are well-positioned to navigate the changing regulatory environment. Moreover, the sector will witness further consolidation, as NBFCs with a strong capital base, low leverage, and high on-balance sheet liquidity, will continue to gain market share.

Note:

(1) BCG – India NBFC Sector Update FY 2022 (Jun-2022)

KEY HIGHLIGHTS – FINANCIAL SERVICES

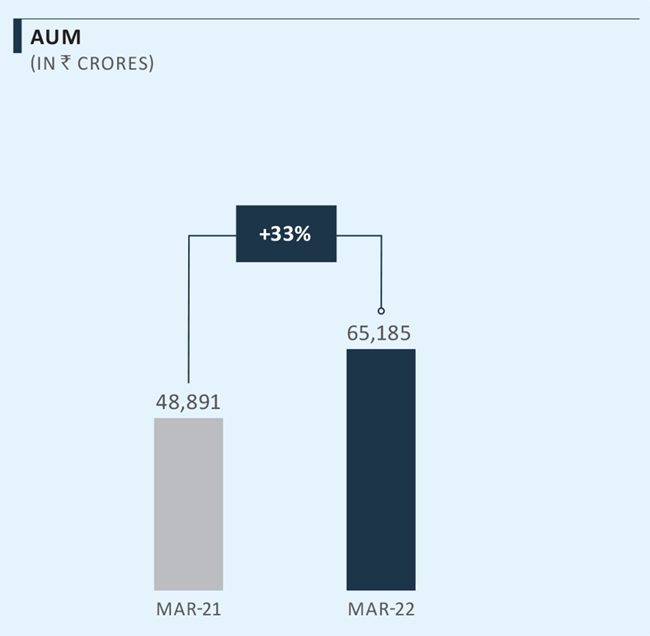

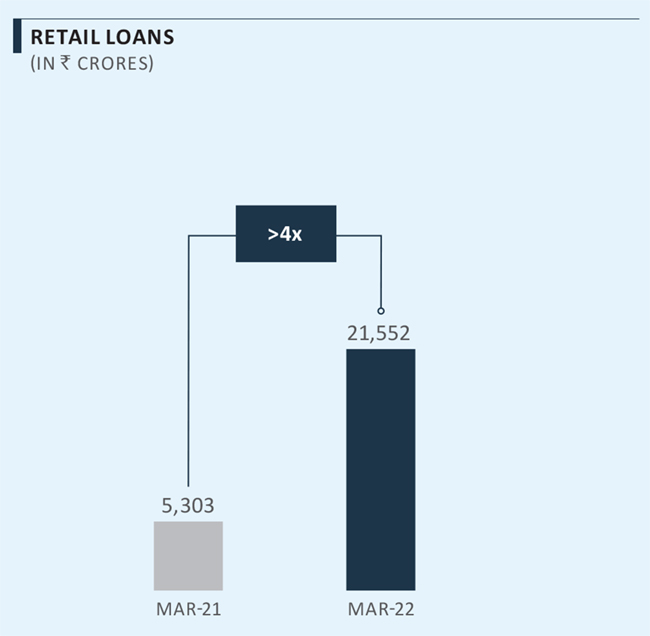

Significant AUM growth through the DHFL acquisition

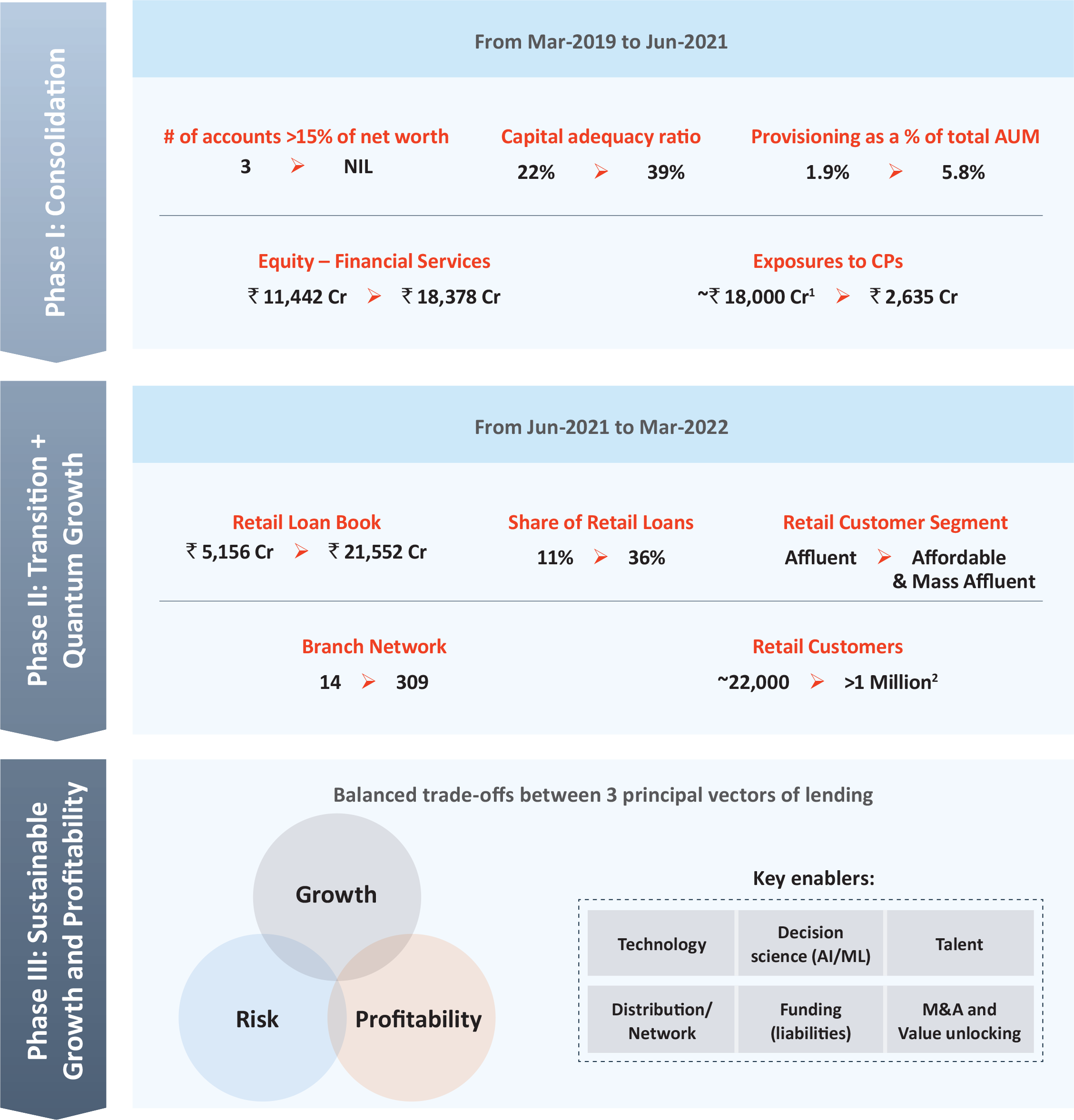

- Overall AUM grew 33% yoy to ₹ 65,185 Crores, and retail loan book increased >4x to ₹ 21,552 Crores as of March 2022, creating one of the largest HFCs in India

Significant improvement in loan book diversification

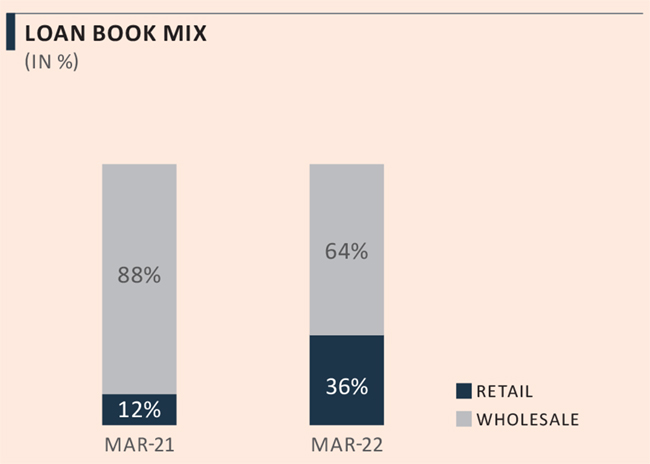

- Share of retail loans increased to 36% as of March 2022 versus 12% a year ago, as a result of the DHFL acquisition

- Share of retail to further increase in FY 2023. The Company aims to achieve a loan book mix of 2/3rd retail, loans and 1/3rd wholesale in the next 5 years

Strong disbursement growth in retail lending

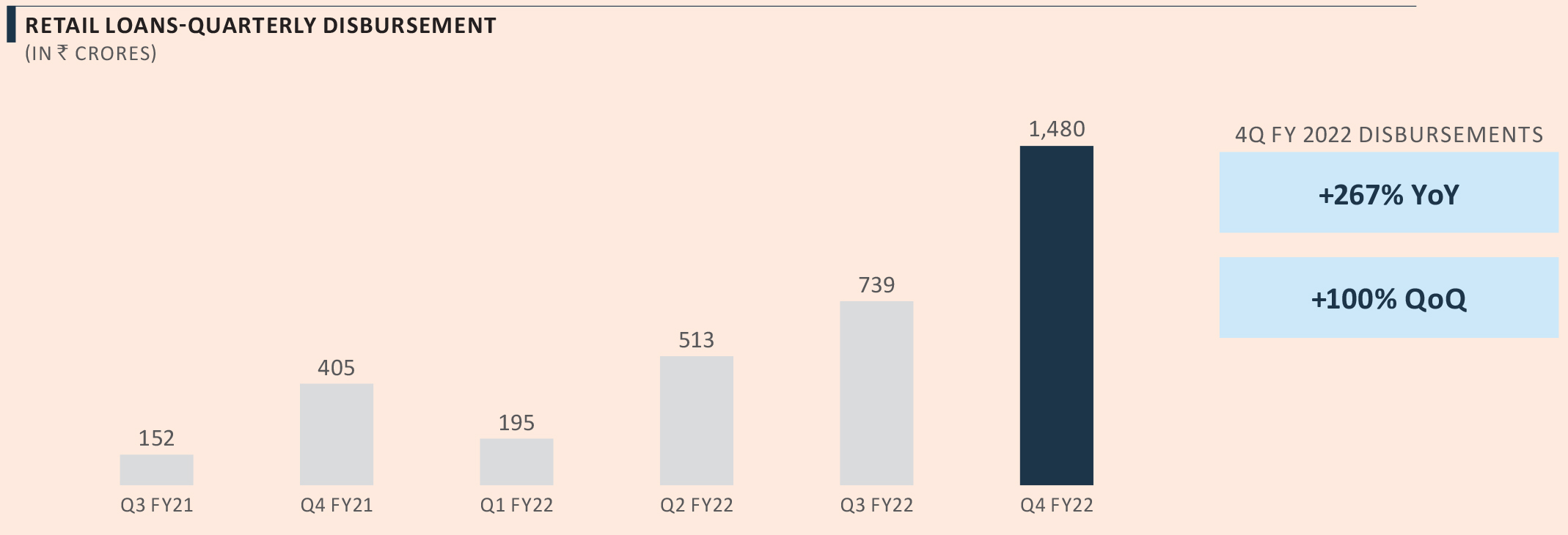

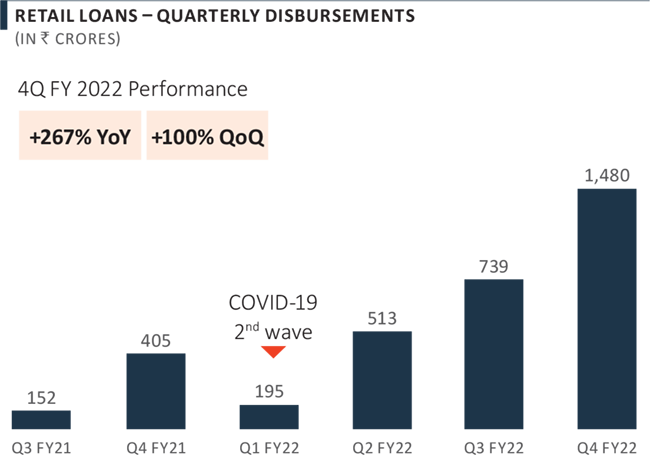

- Strong traction in retail disbursement, post the DHFL acquisition, with 100% qoq growth in Q4 FY 2022 to ₹ 1,480 Crores

- On-track to achieve disbursements of ₹ 2,500-3,500 Crores in Q3 FY 2023 (i.e., 5-7x of pre-DHFL acquisition levels)

- Retail lending to drive overall AUM growth in coming years

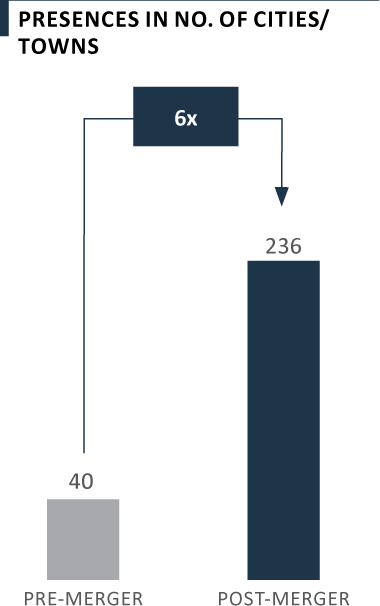

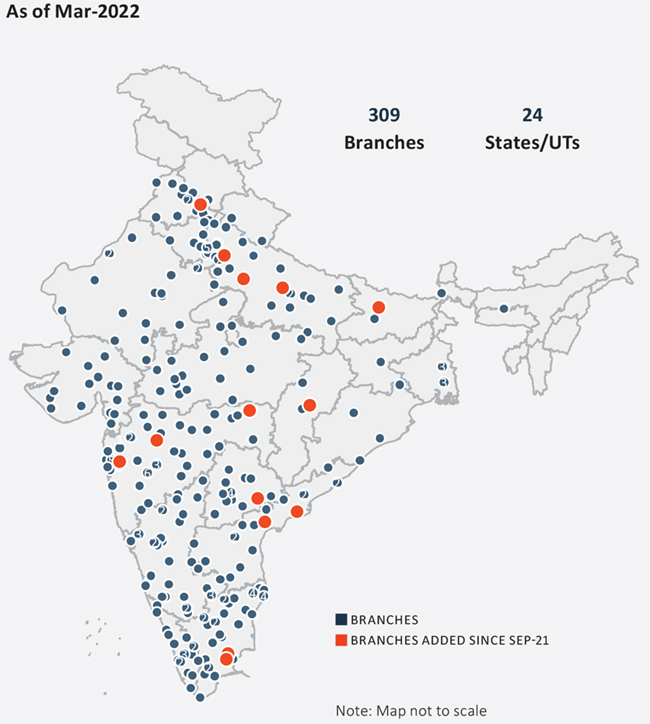

India-wide geographic footprint; significant progress on integration

- DHFL acquisition provides extensive distribution network, spread across tier 2/3 cities and towns

-

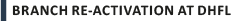

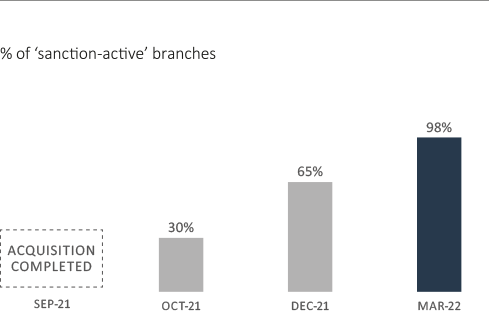

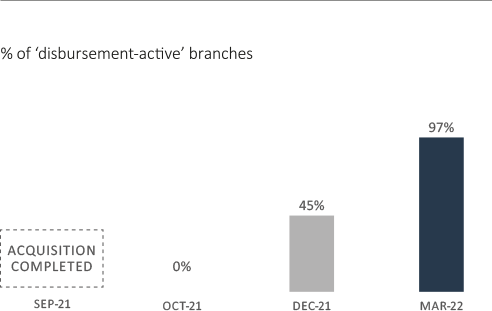

DHFL branches have been integrated and re-activated

- As of March 2022, 99% of the branches were ‘login active’; 98% were ‘sanction active,’ and 97% were ‘disbursement active’

- Plan to add 100 branches in FY 2023

- Plan to expand our presence to 500-600 branches with presence in ~1,000 locations in the next 5 years

~1 Mn

Customers

(Life-to-date)

309

States/UTs

Pan India footpoint

24

No. of

Branches

KEY HIGHLIGHTS – FINANCIAL SERVICES

Investing in capability-building initiatives

- Assembled a best-in-class team over the past few quarters across various businesses

- 3,000+ job offers rolled-out, post the DHFL acquisition

- Significant investment in technology/analytics hires - ~400 new hires in the technology and analytics team

- Set-up a Digital Centre of Excellence (CoE) in Bangalore

- Strong pipeline of partnerships at various stages of business build, as we scale-up embedded financing

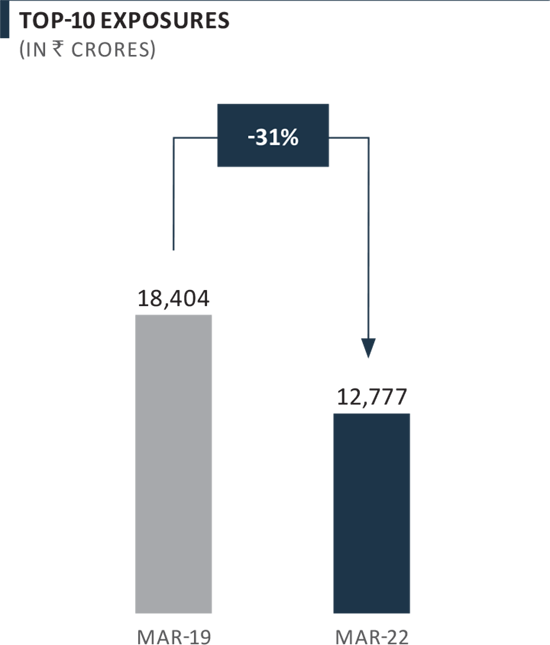

Increased granularity of the wholesale loans

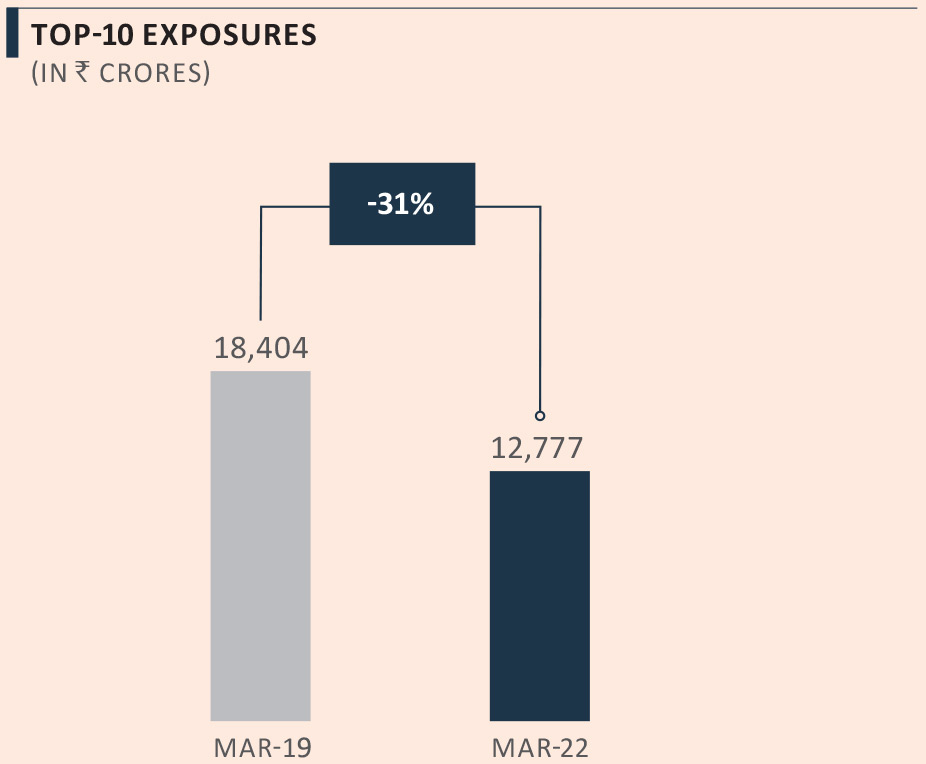

- Exposure to top-10 accounts reduced 31% since March 2019 (by ₹ 5,627 Crores)

- No account (net of provisions) exceeds 10% of financial services net worth, as of March 2022

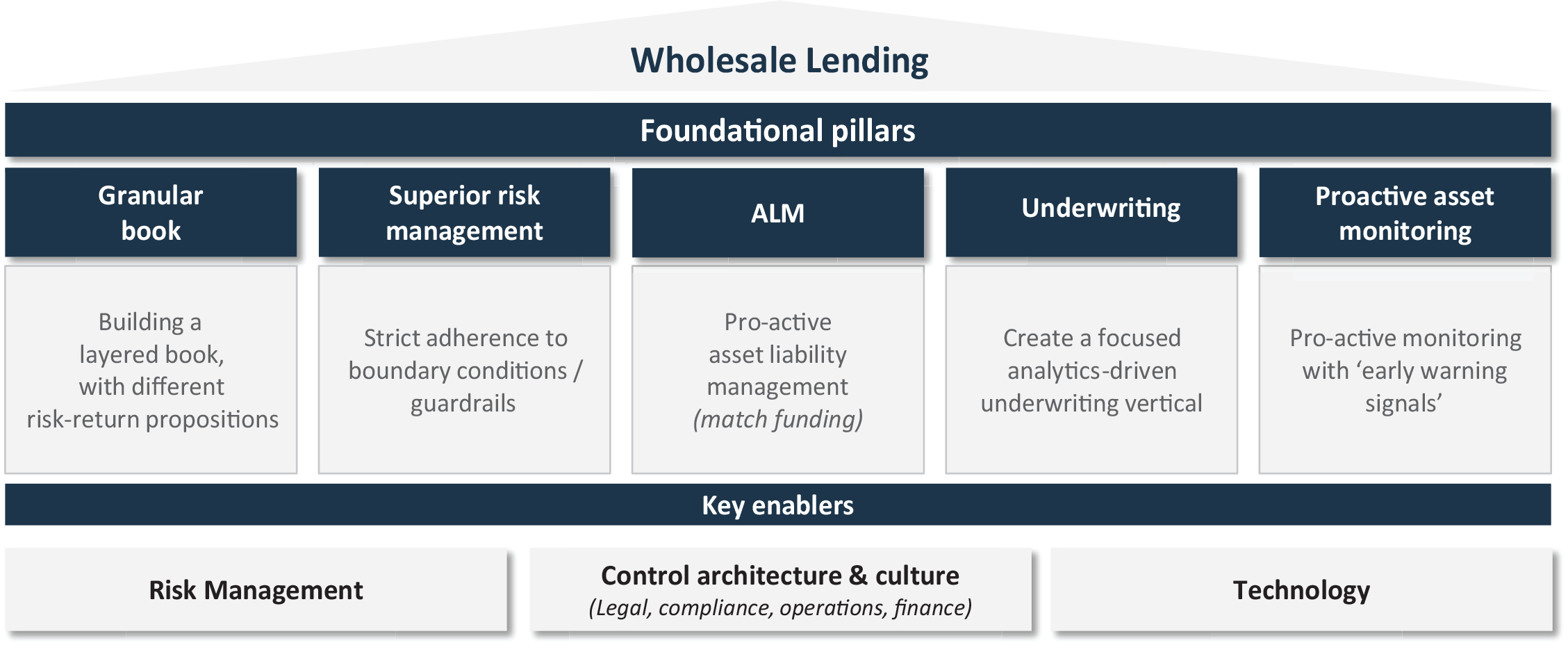

Set the foundation for ‘Wholesale Lending 2.0’

- We aim to cater to a large addressable market

- Currently, there are significant gaps in the wholesale credit market, with very few players

- We plan to build a granular wholesale book, using analytics-driven underwriting, and proactive monitoring using ‘early warning signals’

‘Wholesale Lending 2.0’

Calibrated approach, with focus on smaller loans to increase granularity

Cash flow-backed lending

High yield loans will be done under fund structure

Asset quality with conservative provisioning

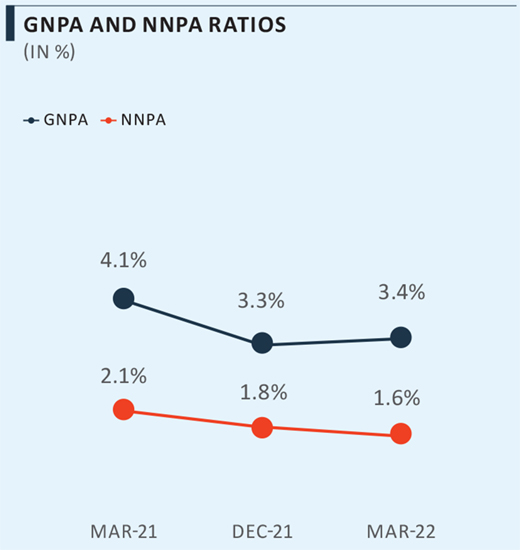

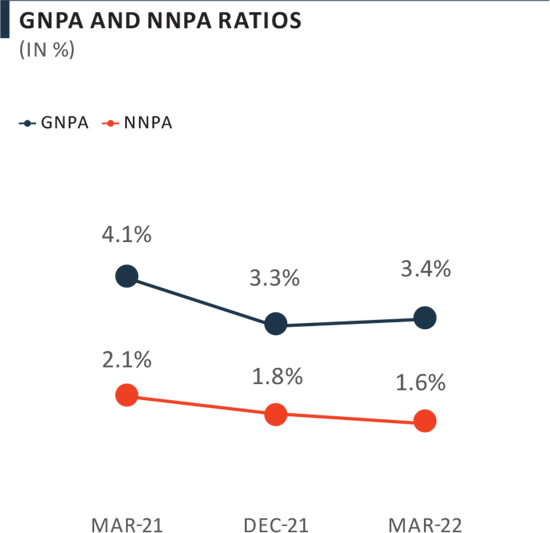

- Asset quality remained stable qoq as of March 2022, with GNPA ratio at 3.4% and NNPA ratio at 1.6%

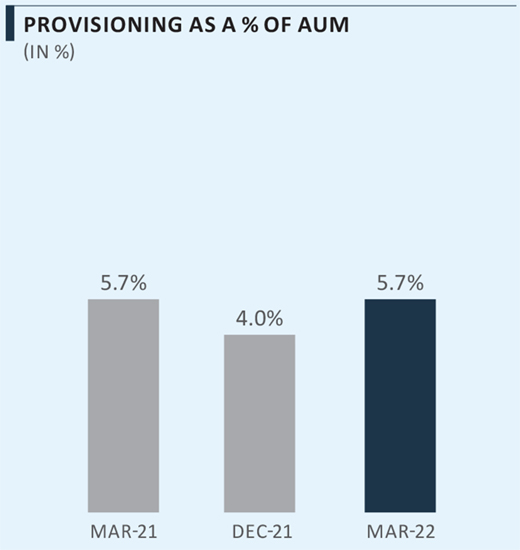

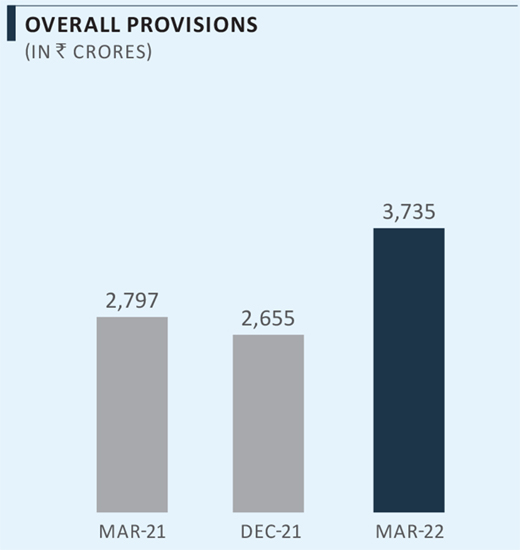

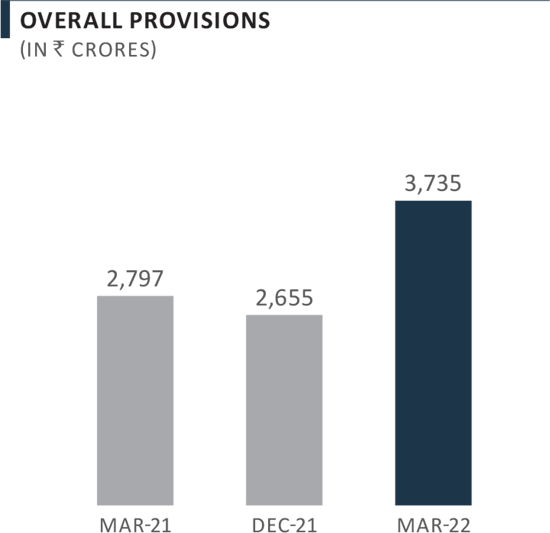

- However, we moved some of our non-real estate exposures to Stage 2 and thus, we have made additional provisioning and interest reversal totalling ₹ 1,037 Crores. As a result, overall provisions stood at ₹ 3,735 Crores (equivalent to 5.7% of AUM) as of March 2022.

KEY HIGHLIGHTS – FINANCIAL SERVICES

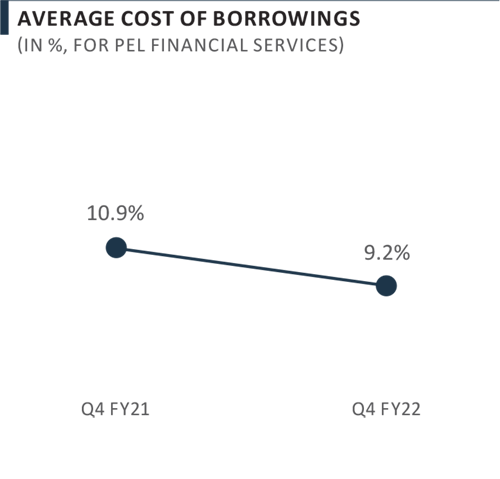

Declining cost of borrowings

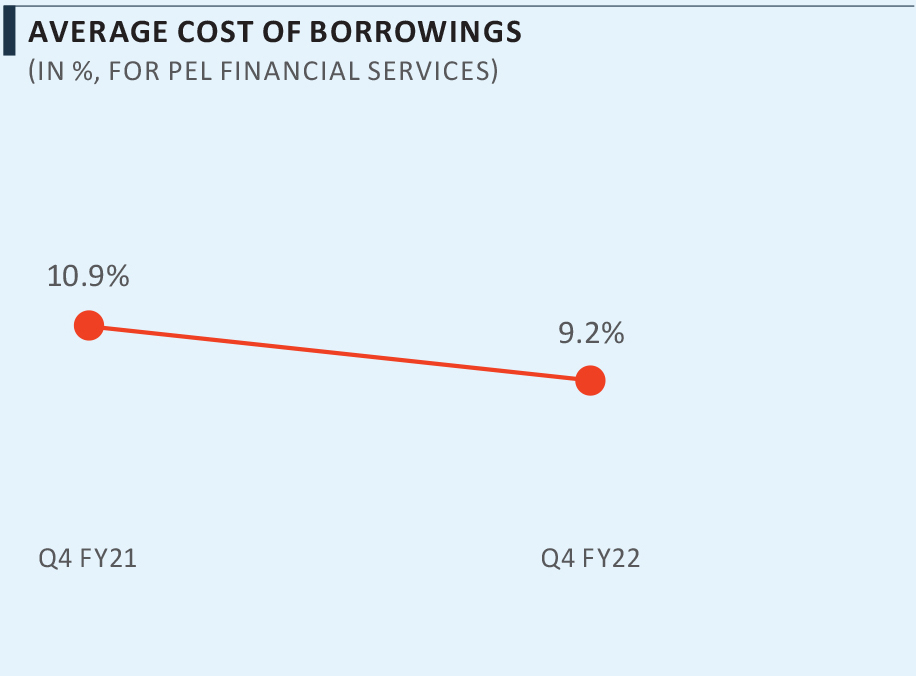

- Average cost of borrowings declined 170 bps yoy in Q4 FY 2022. It is expected to further decline in the near-to-medium term, driven by diversification of loan book

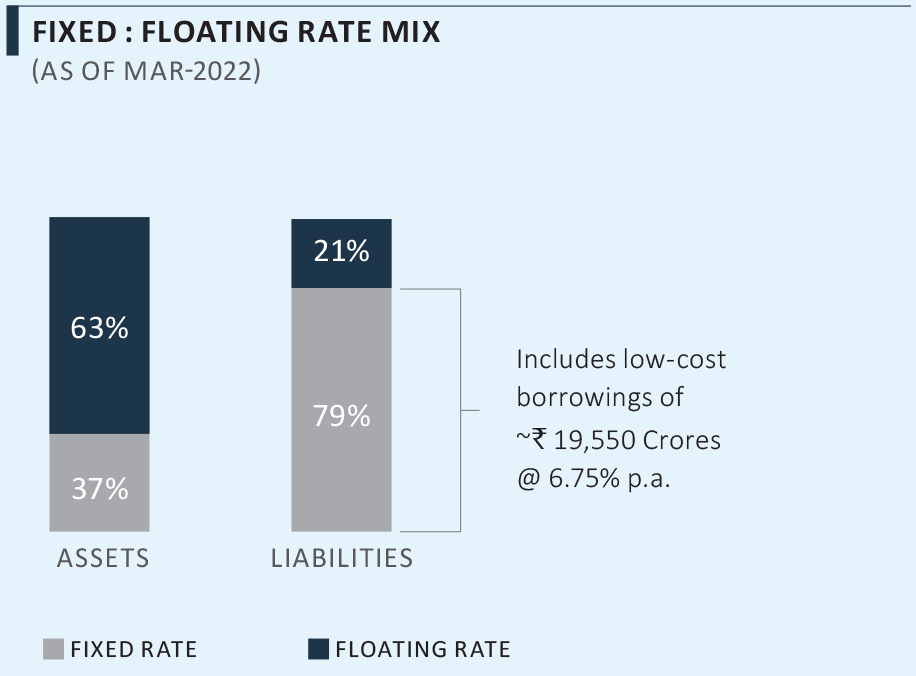

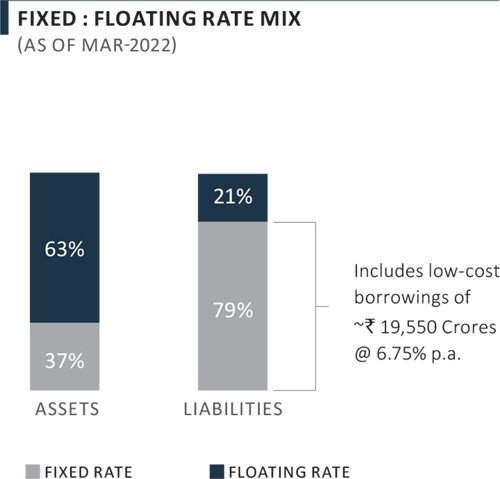

- Well positioned to navigate the rising interest rate environment, given 79% of borrowings are ‘fixed rate liabilities’ and 63% of assets are at floating rate

Improved capital utilisation

- The acquisition of DHFL enabled higher capital utilisation, reflected in the yoy change in capital adequacy ratio and leverage

- The Company aims to further optimise capital utilisation through loan book growth, tapping both, organic and inorganic opportunities, going forward

Fund management business with long-standing partnerships with marquee investors

- ~$ 1 billion of funds committed, across 2 funds – in partnership with CDPQ and Bain Capital Credit

- Scaling-up of existing funds and expansion of the product suite to boost income (through fee and carry)

| Fund | Partner / Co-sponsor | Committed / Deployed Capital |

|---|---|---|

| Piramal‘Performing Credit’ Fund |  |

~$ 1 BillionFunds committed; >50% deployed |

| IndiaRF (Stressed Asset Fund) |  |

Life Insurance JV with Prudential (US), an industry leader in the defense segment

- Piramal has a 50% stake in Pramerica Life Insurance (PLI) – a JV with Prudential International Insurance Holdings (acquired through the DHFL acquisition)

- The business has a robust balance sheet (solvency ratio of 404% as of March 2022)

- It also has an extensive distribution network, and a sizeable customer base of ~2.5 Million

Customer Base

~2.5 Mn

Embedded Value

` 1,802 Cr.

(FY 2022-end)

Solvency Ratio

404%

(FY 2022-end)

Agent Network

15,000+

Branches

134

Presence

28 States/2 UTs

Financial Services – Transformation Agenda

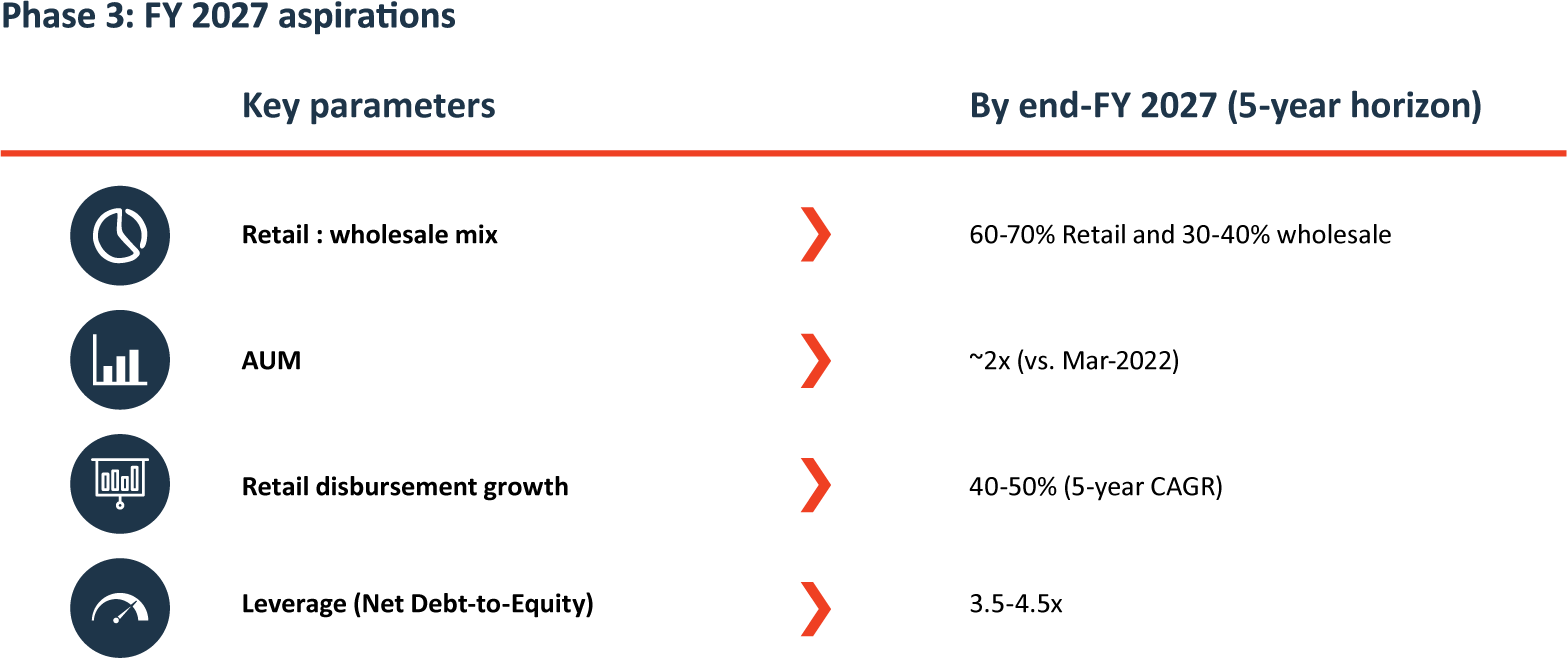

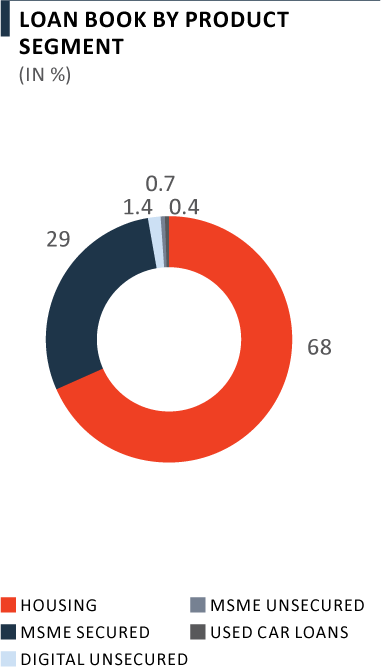

The transformation journey of our financial services business, over the last 2-3 years, could be categorised under three phases. With the acquisition and integration of DHFL, which was a major step in this transformation journey, we have now completed Phase I and II of this journey, and have embarked on Phased III.

Phase I: Consolidation (March 2019 to June 2021)

In Phase I, we built a resilient business model in the wake of liquidity tightening, COVID-19 and other macro-economic headwinds. During this phase, the business focused on:

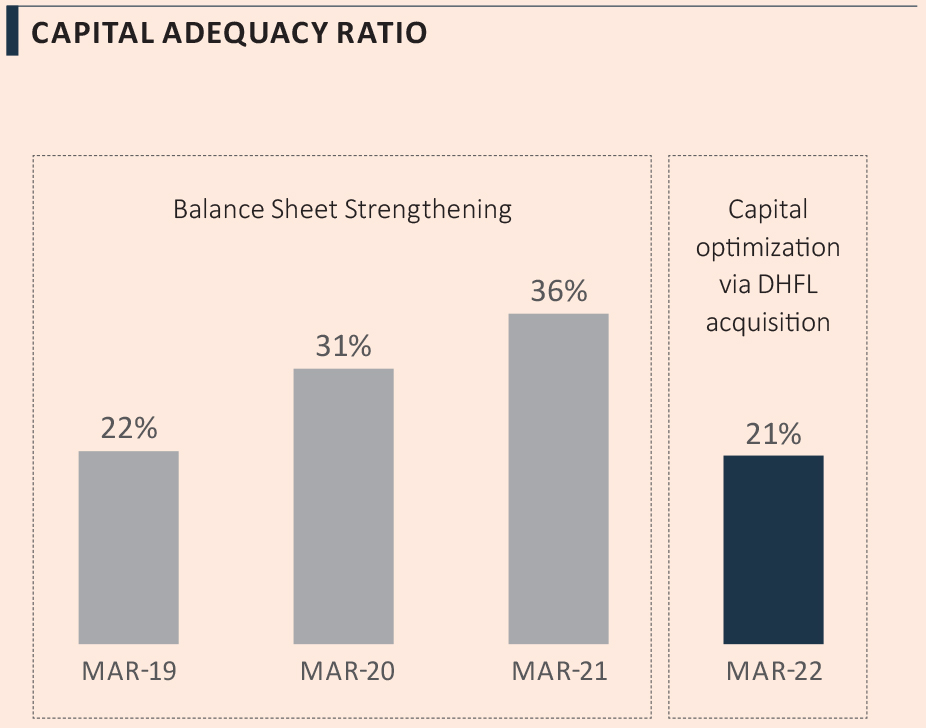

- Improving capital adequacy and deleveraging: We raised significant amount of capital and deleveraged the balance sheet, thereby increasing the capital adequacy ratio to 39% as of June 2021 versus 22% as of March 2019, making us one of the most well-capitalised NBFCs/HFCs in India.

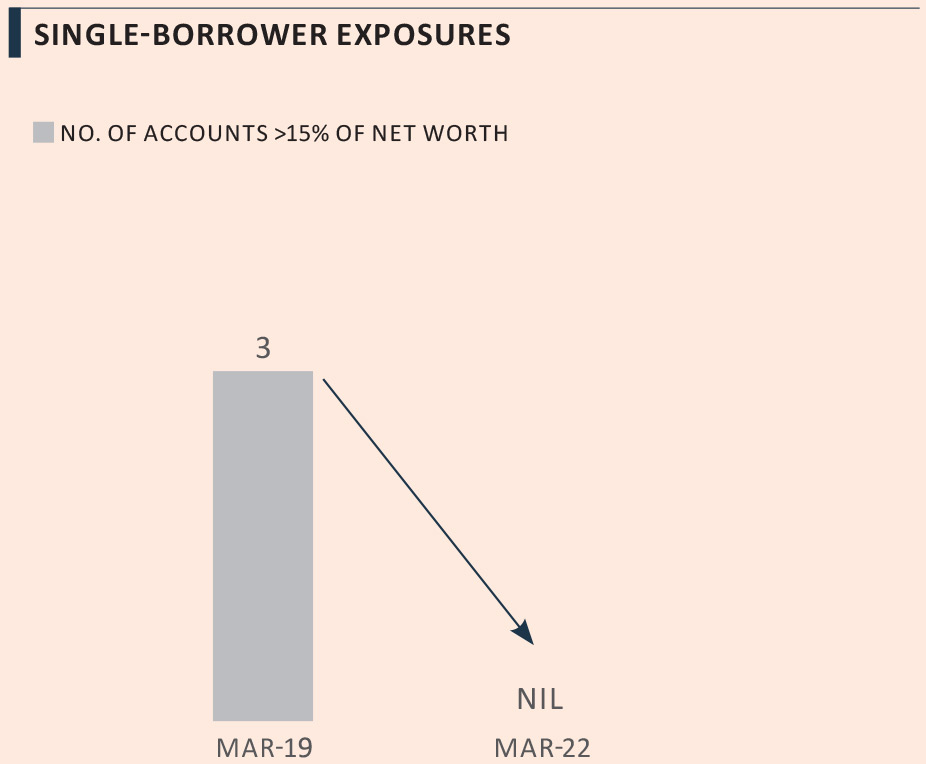

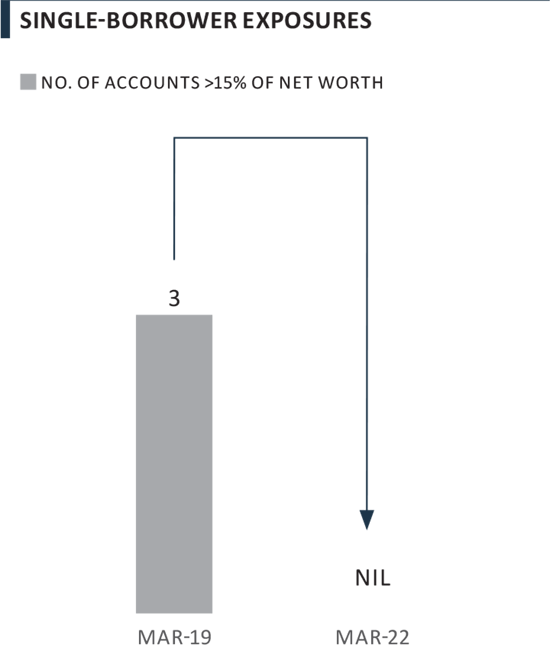

- Making the wholesale book more granular: We reduced large single-borrower exposures, and as a result, no loan book exposure exceeds 15% of the financial services net worth.

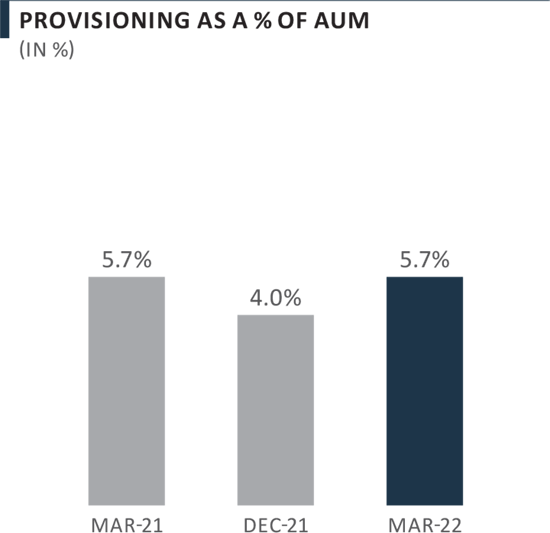

- Increased provisions: In Q4 FY 2020, at the onset of the COVID-19 pandemic, we created ₹ 1,903 Crores of provisions, based on a stressed case scenario analysis. As a result, provisioning as a % of AUM increased to 5.8% as of June 2021 versus 1.9% as of March 2019.

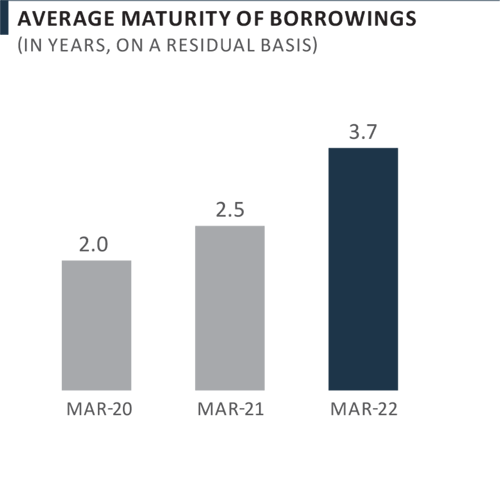

- Strengthening liabilities side: We also continued to diversify the borrowing mix towards stable, long-term funding sources. We raised ~₹ 34,000 Crores of long-term borrowings between March 2019 and June 2021, and replaced most of our short-term CP borrowings. This led to a much stronger ALM profile, with significant positive ALM GAP across all time-period buckets.

Phase II: Transition + quantum growth:

In Phase II, between June 2021 and March 2022, the business transitioned from a wholesale-driven to a diversified business, post DHFL acquisition. There were three components to this phase:

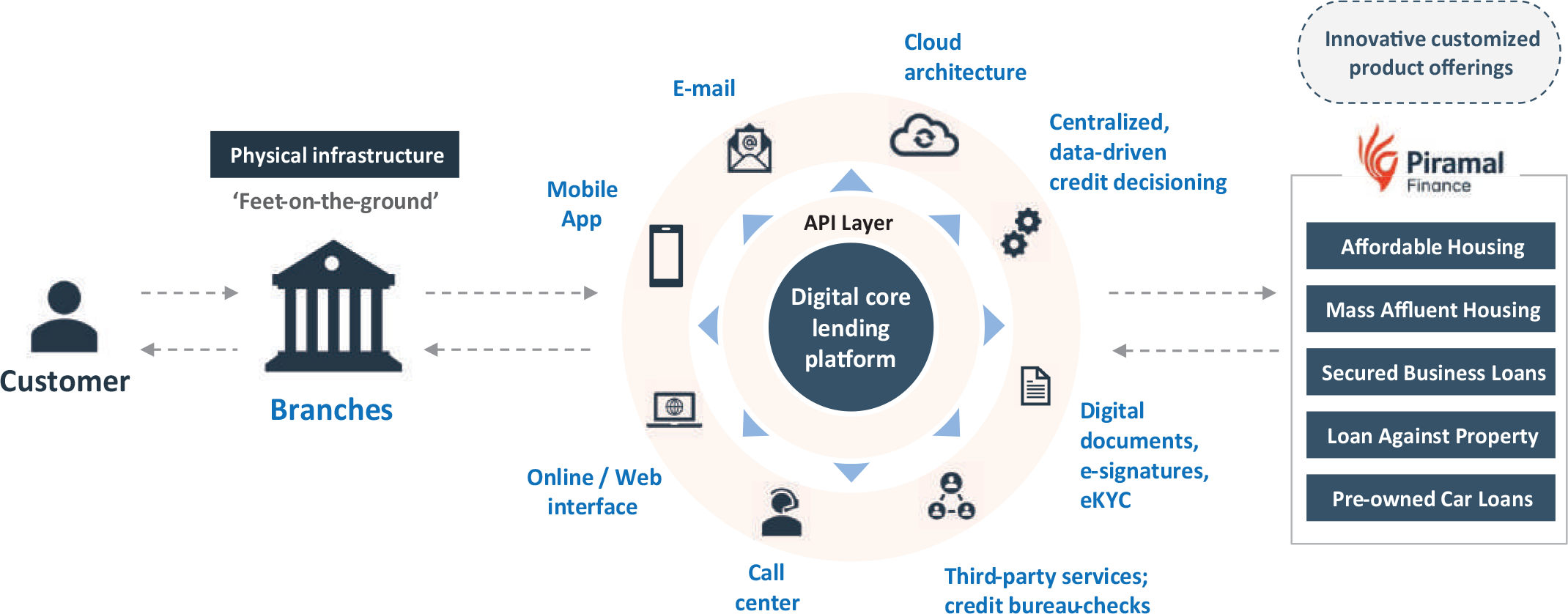

- Organic build-out of the retail lending business: In 2020, we embarked on the journey of building a technology-led retail lending business, which is ‘digital at its core’ and ‘phygital’ (i.e., physical, as well as digital) at the customers’ end. In November 2020, we launched our multiproduct retail-lending platform and pivoted the business towards affordable and mass-affluent categories, in tier 2 / 3 cities, while making the book more granular.

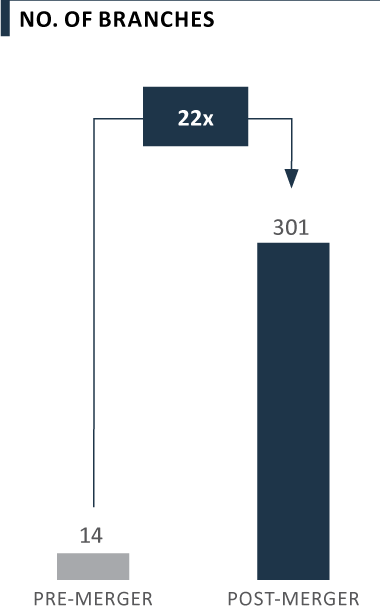

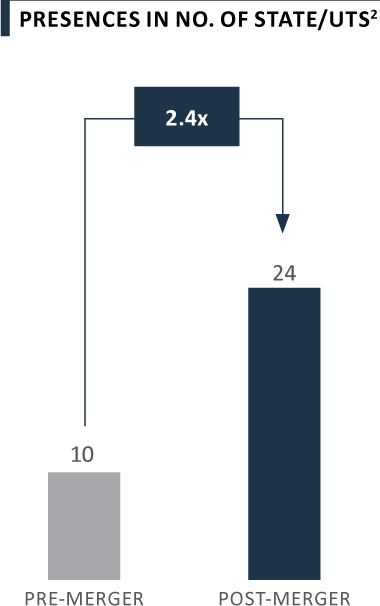

- Significant loan book growth and scale through the DHFL acquisition: In September 2021, we completed the acquisition of DHFL, which led to significant increase in retail loans (~4x increase in book post-merger) and loan book diversification – as the share of retail loans increased to 36% (post-merger) versus 12% as of March 2021. The acquisition also created a platform with pan-India presence, with 301 branches across 24 states / union territories, and access to a customer pool of ~1 Million.

- Increased loan book granularity: In addition to improving the granularity of the wholesale book, by reducing large single-borrower exposures, the granularity of the retail loan book also improved with average disbursement ticket size of ~₹ 13 lakhs in Q4 FY 2022.

Phase III: Sustainable growth and profitability

With the DHFL acquisition and integration now complete, we are now embarking on ‘Phase 3’ of our transformation journey, and have put in place the appropriate levers for superior performance in future. In Phase III, the focus will be delivering sustainable growth and profitability. Our approach to building and managing the financial services business will be focused on creating a balance between the three principal vectors of the business – growth, risk, and profitability.

Financial Services – Phases of transformation

Notes:

(1) Exposure to Commercial Papers (CPs) as of Sep-2018

(2) Life-to-date customers

Retail Lending >

Market Scenario

India’s household debt-to-GDP at 12% has been significantly lower than Brazil (30%), China (56%), US (75%), and the UK (84%). This indicates significant untapped growth potential and a large market opportunity in retail and MSME lending.

Indian retail credit market1 stood at ₹ 44 Lakhs Crores at the end of FY 2021 reflecting 18% Compounded Annual Growth Rate (CAGR) since 2017. While home loans at ₹ 21 Lakhs Crores form the largest sub-segment, business loans and personal loans are witnessing a robust demand. Retail and microfinance constitute a sizable portion, contributing to more than 50% of the total lending market.

The retail lending market is estimated to double in the next four years, driven by the growth of small ticket retail loans. Furthermore, the growth is expected to come from tier-2 and tier-3 cities, where enquiries are growing 2.5x faster than tier-1 cities.

The Indian mortgage market is significantly under-penetrated at nearly 12%, as compared to 18-70% for most other countries globally. While the public-sector banks still have the largest share in the Indian mortgage market at 42%, HFCs have been steadily gaining market share in the past decade, and now have ~35% market share. Lower ticket-sized loans (up to ₹ 25 Lakhs) accounted for ~40% of the total home loans as of March 2020, and there is huge demand in the tier-2 and tier-3 cities from informal salaried or self-employed customers. These customers remain significantly under-served. The government has also taken up several measures to promote affordable housing.

Moreover, timely interventions by the government, position the housing finance segment for growth in the future.

During the last two years, the growth in the residential housing market has been driven by improving affordability, rising disposable income, low interest rates, and particularly, demand from first-time home buyers and home-buyers, looking to upgrade the size of their homes to accommodate requirements to work-from-home. It is estimated that India’s urban population is expected to grow to 814 million by 20502 as compared to 410 million in 2014. Furthermore, it is estimated that 25 million units of affordable housing will be required by 2030.

Personal loans, MSME loans, consumer goods loans, and credit cards, are the key other segments which have seen a strong growth post COVID-19. In FY 2022, the market share3 of NBFCs remained stable across most product segments – 19% in personal loans, 20% in MSME loans, 47% in auto loans, 24% in gold loans, and 41% in microfinance.

We believe that NBFCs/HFCs are strongly positioned to meet the evolving needs of the customers with last-mile reach, domain expertise, and lower turn-around-time (TAT), enabled by improved risk management capabilities, adequate growth capital, and ‘next-gen’ tech infrastructure.

Notes:

(1) TransUnion CIBIL

(2) UN World Urbanization Prospects (2018)

(3) BCG – India NBFC Sector Update FY 2022 (Jun-2022)

Retail Lending Business

Our retail loan book has increased >4x yoy post the acquisition of DHFL to ₹ 21,552 Crores as of March 2022. In addition, we are also managing off-balance sheet, securitised retail assets worth ₹ 18,747 Crores as of March 2022.

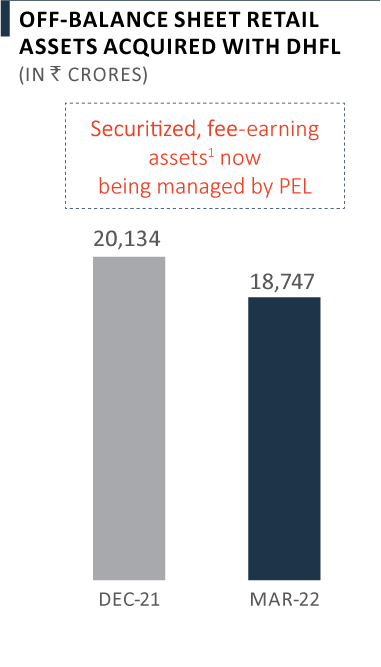

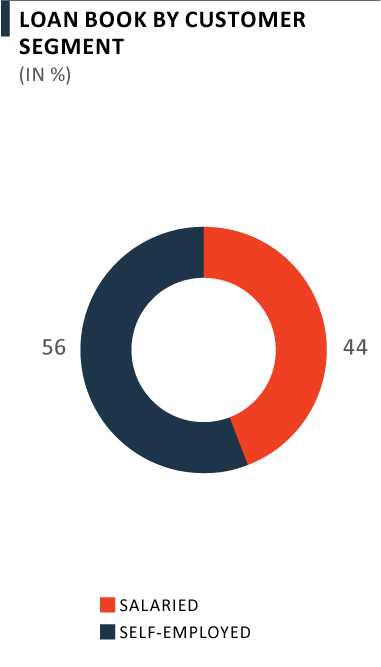

We are building a well-diversified loan book across product categories and customer segments, catering to the unserved financing needs of the ‘Bharat’ market. As a result of our focus on a granular retail loan book, the average disbursement ticket size was ₹ 13 Lakhs during Q4 FY 2022. Prior to the DHFL acquistion, the retail loan book primarily comprised of affluent housing loans with an average ticket size of ~₹ 75 Lakhs.

Note:

(1) Includes Direct Assignment deals and Pass-Through Certificates / Security Receipts

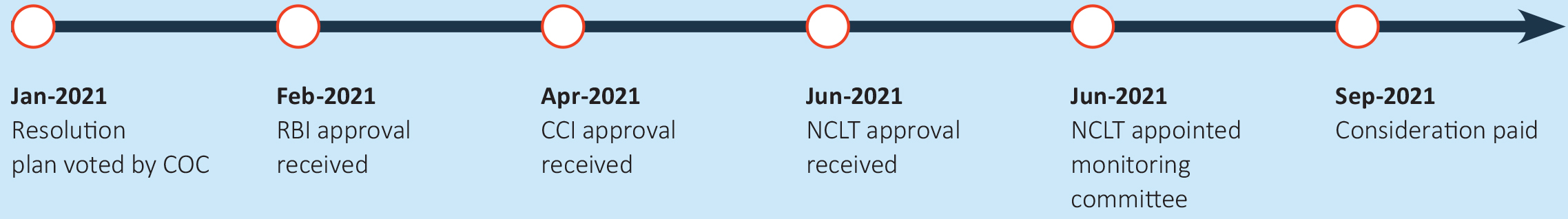

DHFL Acquisition

During FY 2022, the Company successfully completed the acquisition of DHFL, the first financial services company in India resolved under the Insolvency and Bankruptcy Code (IBC). In value terms, the transaction is among the largest resolutions to date, setting the precedent for future resolutions in the sector. In January 2021, ~94% of the creditors of DHFL voted in favour of Piramal’s resolution plan. Approvals were also obtained from the RBI, CCI and NCLT for the completion of this transaction in September 2021.

Piramal Capital & Housing Finance Limited (PCHFL) merged into DHFL with effect from September 30, 2021 pursuant to the reverse merger as per the resolution plan. Consequently, the name of the Company was changed from ‘Dewan Housing Finance Corporation Limited’ to ‘Piramal Capital & Housing Finance Limited’ with effect from November 3, 2021.

Consideration paid for the DHFL acquisition:

The total consideration paid by the Piramal Group of ~₹ 34,250 Crores at the completion of the acquisition, includes an upfront cash component of ~₹ 14,700 Crores and issuance of debt instruments of ~₹ 19,550 Crores (10-year NCDs at 6.75% p.a. on a half-yearly basis).

Key strategic rationale - what did the DHFL acquisition lead to?

- Diversification: Transformed the business from a wholesale-driven into a diversified lender. The share of retail loans increased to 36% (post-merger) versus 12% (as of March 2021).

- Growth: Significantly increased the size of the retail loan book, creating one of the largest HFCs in India. The retail loan book increased by >4x yoy to ₹ 21,552 Crores (as of March 2022).

- Scale: The acquisition created a pan-India distribution network, with >300 branches and access to a customer pool of ~1 million customers.

- Customer segment: Addressing the needs of the under-served ‘Bharat’ mark et in affordable housing, as DHFL had an extensive distribution network, largely spread across tier 2/3/4 cities and towns.

- Strengthened liabilities: The acquisition resulted in a reduction in the average borrowing cost and further improved the ALM profile. The deal was funded by ~₹ 19,550 Crores of 10-year NCDs at 6.75% per annum, with back-ended outflows.

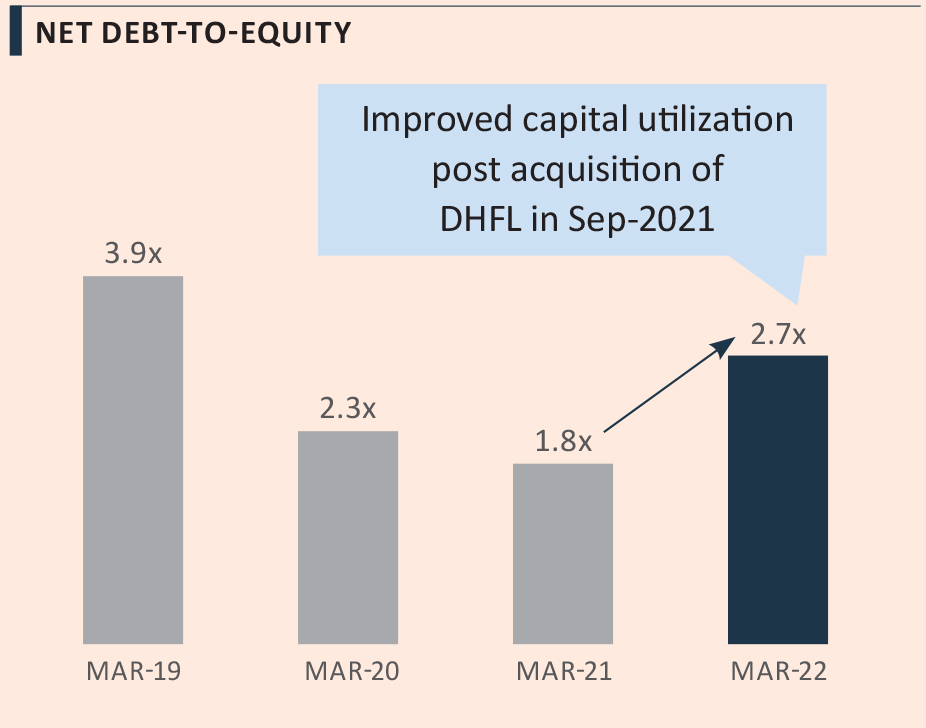

- Improved capital efficiency: The acquisition resulted in improved utilisation of equity in the financial services business, as its net debt-to-equity increased to 2.7x as of March 2022 versus 1.8x as of March 2021.

Notes: (1) Life-to-date customers; (2) Union Territories

A value-accretive acquisition:

- Attractive purchase price: The acquisition was carried out at <0.4x of the gross value of DHFL’s assets. Furthermore, the acquisition-led growth was achieved without infusing or raising any additional equity.

- Accretive on Day-1: The acquisition was accretive from the onset, as yields on the acquired retail book are >11%, whereas the cost of borrowing to fund the acquisition was ~7%. Additionally, an off-balance sheet, fee-earning securitised pool of assets worth ₹ 18,747 Crores (as of March 2022) has been acquired along with the loan book. Also, all operating costs have already been incurred to build this portfolio.

- Asset quality remains in-line with expectations: The consideration paid for DHFL is based on fair valuation, which adequately factors in unforeseen asset quality risks. In addition, there is a potential upside from recoveries.

- Well-poised from growth: The acquisition creates a pan-India platform of >300 branches across 24 states/UTs, with a customer base of ~1 million (life-to-date). We believe that the initial investments will yield significant benefit in the medium-to-long term.

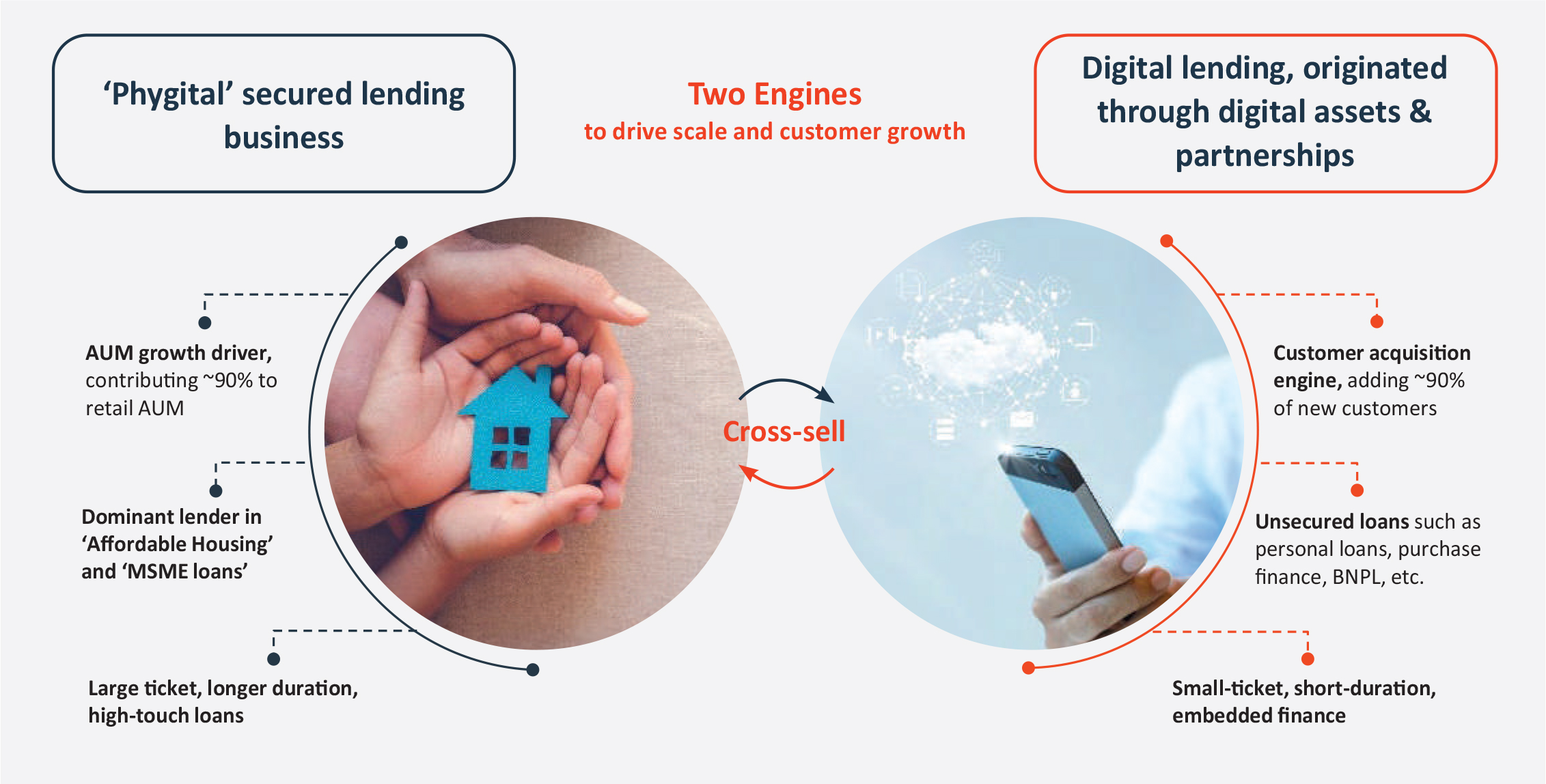

Our approach to retail lending

We adopted a twin-engine approach to build our multi-product retail business, in line with the stated strategy to diversify our loan book, and make it more granular to reduce the concentration risk.

Adopting a ‘twin engine’ strategy to build the retail lending business

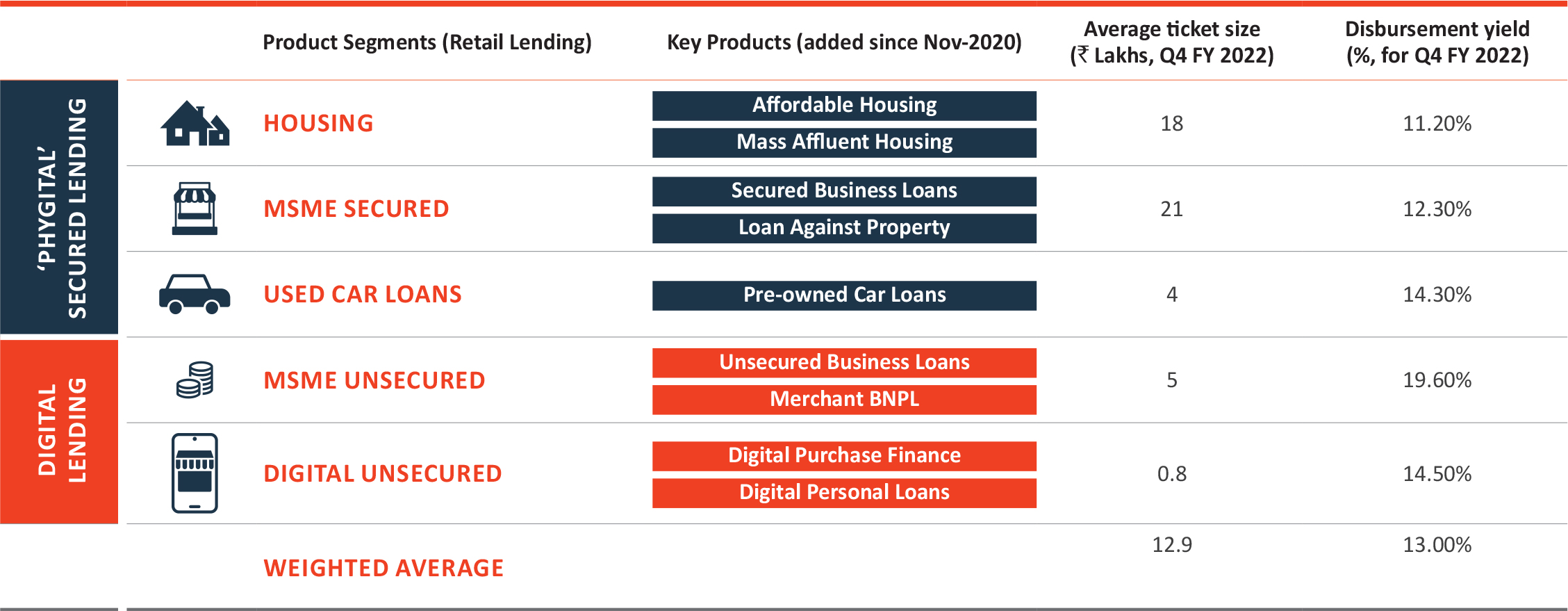

We have rolled-out several products since the launch of our multi-product retail lending platform in November 2020 across both, secured and unsecured businesses. We are also partnering with leading fintech and consumer tech firms to acquire customers at scale, at low cost, and enable seamless digital lending.

The average ticket size for loans disbursed in Q4 FY 2022 was ~₹ 13 Lakhs, varying across products, such as MSME secured lending, and digital unsecured loans.

Notably, digital lending businesses offer a significantly higher yield compared to the affordable housing and secured MSME loans. Products such as used car loans, MSME unsecured and digital unsecured loans offer attractive yield of 15%-20% boosting overall yields.

Engine #1 - ‘Phygital’ secured lending

‘Phygital’ lending encompasses traditional branch-led secured affordable housing and MSME lending business, catering to the budget customers of ‘Bharat,’ while being digital at the core. It is characterised by high-touch intensity model with a higher proportion of self-employed customers. Furthermore, it constitutes the major (~90%) part of the overall retail AUM. Secured lending will continue to build the AUM as these are long duration loans.

The business leverages the widespread network of branches in tier II and tier III cities across India to bridge the lending gap in the under-served ‘Bharat’ market, while serving self-employed, cash salaried, small business owners, and salaried customers.

‘Phygital’ Secured Lending: Physically-distributed, digitally-enabled lending

Extensive distribution network

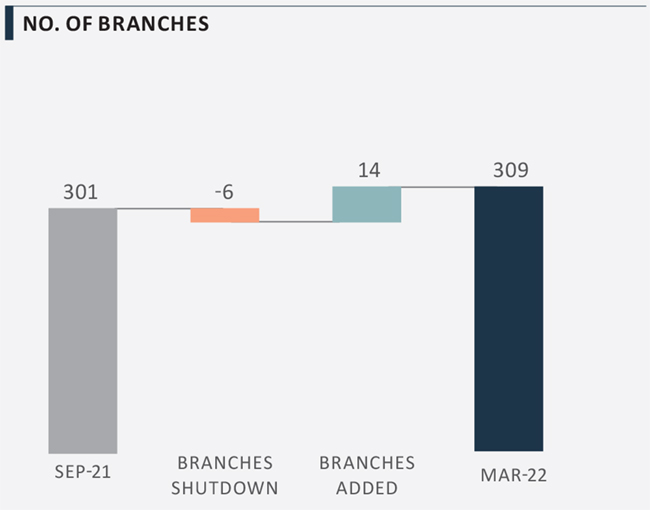

We have a pan-India distribution network, with extensive presence in the ‘Bharat’ market. Further, we’ve made significant progress on re-activation of DHFL branches. Since the completion of the acquisition in September 2021, we have further optimised and expanded the branch network. We have closed six ‘high cost’ branches and have added 14 new branches, thereby taking the total branch count to 309 as of March 2022.

Catering to the under-served financing needs of customers of the ‘Bharat’ market

While there is an ample availability of credit in the prime housing finance market in India, an entire segment of customers lacks access to credit. We are serving the customers in the affordable housing segment with an average ticket size of less than ₹ 20 Lakhs. The portfolio, however, continues to be driven by the affordable housing business, with majority of customers being self-employed and informal salaried.

Small business owner

‘Kirana store’ owner in Bahadurgarh, Haryana

Required working capital for wholesale trading in nearby localities

Cash salaried

Runs a coaching center in Ulhasnagar, Maharashtra

To purchase a 1BHK in Thane

Small business owner

Tailoring business in Meerut, Uttar Pradesh

Required loans for renovation of shop

Self-employed

Electrical contractor in Kannur, Kerala

To buy a house for self-occupation

Self-employed

Trader of plywood in Dewas, Madhya Pradesh

To buy a plot and construct a house

Small business owner

Pharmacy owner in Kanchipuram, Tamil Nadu

Small business loan

DHFL integration and branch re-activation

Post the completion of DHFL acquisition in September 2021, there has been significant progress on restarting the DHFL franchise and hiring, while integrating the two businesses. New loan origination has restarted at most of the DHFL branches. By March 2022, 99% of the branches were ‘login active,’ 98% were ‘sanction active,’ and 97% were ‘disbursement active’ branches.

The integration is largely complete on the people side, as we have absorbed all 3,000+ erstwhile DHFL employees, completed the trainings and rebuilt the collections and sales talent, which had witnessed a high attrition. We have also extended offers to more than 3,000 people since the acquisition. Grades and policies have already been harmonised across the firm, and management hierarchies have been rolled-out.

On the risk and collections side, the risk modelling is complete with the outcomes as anticipated by models with no negative surprises. Customer-facing digital assets are fully integrated, and large-scale IT asset upgrade program is underway for employees.

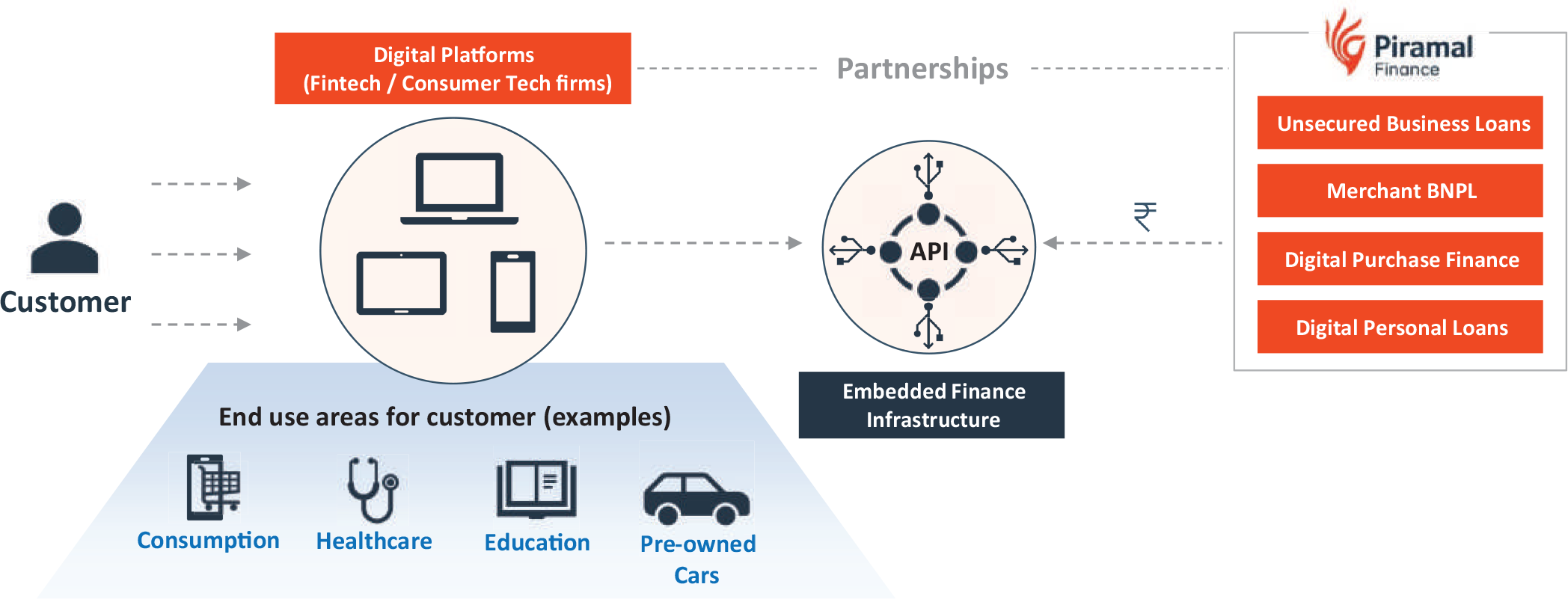

Engine #2: Digital lending-originated through digital assets and partnerships

Our second engine of growth in the retail lending business is digital embedded finance. This includes small ticket and short-duration loans (such as personal loans, purchase finance, merchant buy-now-pay-later, etc.), originating through digital channels and partnerships, which act as a customer acquisition engine, adding over 90% of new customers. We aim to be preferred lending partners for the consumer-tech ecosystem, offering personalised financing solutions to customers.

Digital embedded finance – our business model

Partners and product categories:

We continue to diversify across product categories, business models, and partners. So far, we have launched 12 diverse partnerships with fintech NBFCs, transaction platforms, ed-techs, MSME platforms, and gold collateral companies. The categories in focus include consumer fintech, pre-owned cars, education, healthcare services, merchant commerce, digital personal loans, and gold loans.

Our partnership arrangements vary across different partners. These arrangements / business models could involve revenue sharing, risk sharing, first loss default guarantee (with NBFC partners), co-lending, subvention-based, and customer referrals, to name a few.

Key capabilities and tech infrastructure:

We have developed an in-house loan origination system and a business-rule engine, which is highly modular. To ensure seamless customer experience, we have created a generic API (application programming interface) stack for easy integration. Our business model also supports joint product development with partners to deliver customised solutions for specific customer needs. We have agile squads for rapid go-to-market and are willing to experiment. To ensure healthy asset quality, we use proprietary fraud and underwriting models for real-time decisioning. Additionally, we have deep in-house collections capabilities covering 10,000+ pin-codes.

Digital Embedded Finance – Key Performance Highlights:

We have made significant progress in building the business during the year. We are scaling-up partnerships with fintech and consumer tech firms and have launched 15 programs (across 12 partnerships), so far. As of March 2022, the business had an AUM of ₹ 333 Crores. During Q4 FY 2022, the business contributed 22% to disbursements, and 93% to customers acquired.

Overview of our Digital Embedded Finance business

As of Mar-2022

15

Programs launched

10,175

Pin-codes Serviced

93%

contribution to customers acquired in Q4 FY 2022

22%

contribution to disbursements in Q4 FY 2022

36 seconds

least time taken for disbursed loan

98%

of loans provided with zero‑manual intervention

EarlySalary:

In FY 2022, we acquired a ~10% equity stake in EarlySalary, one of our key fintech business partners. EarlySalary is a leading fintech player, offering consumer loans catering to lifestyle needs.

As of March 2022, EarlySalary had an AUM of ₹ 1,019 Crores and a customer base of ~4,40,000, primarily serving young, aspirational techsavvy Indian customers. The median age of its customers is 28 years, and their median income is ~₹ 31,000 per month. Moreover, ~60% of the customers are based out of metros.

As part of our strategy, we will continue to partner with leading fintech players, having the necessary building blocks to reach significant scale.

Notes:

(1) Annualized Run Rate; as of Mar-2022

(2) Based on actual numbers of Apr-21 to Mar-22

Operating performance during FY 2022

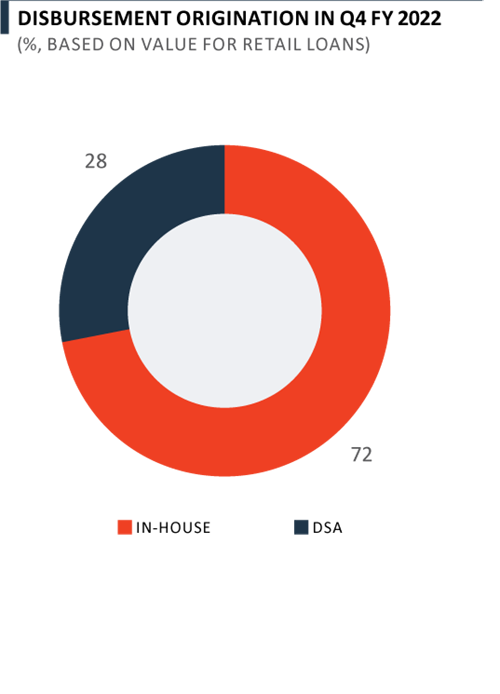

With a nationwide branch footprint, and 12 live strategic partnerships for digital loans, we have grown our retail disbursements manifold from ₹ 405 Crores in Q4 FY 2021 to ₹ 1,480 Crore in Q4 FY 2022, registering a growth of 267% on a yoy basis. We remain on-track to achieve disbursements of ₹ 2,500-3,500 Crores in Q3 FY 2023 (i.e., 5-7x of pre-DHFL acquisition levels).

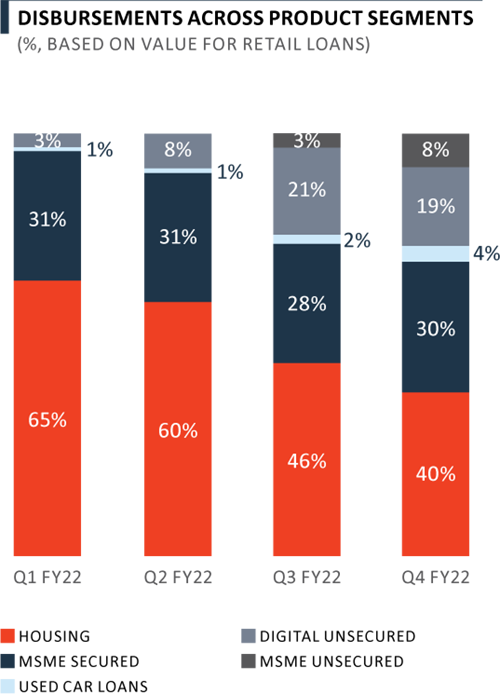

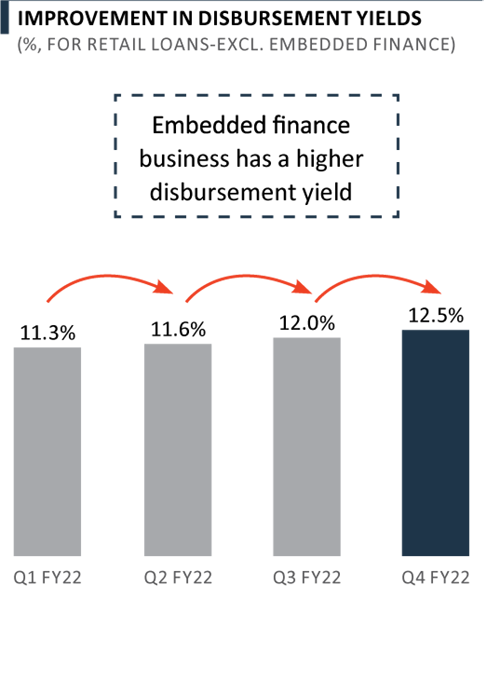

Furthermore, our disbursement yields continued to improve to 12.5% in Q4 FY 2022 versus ~11% in Q4 FY 2021, driven by shift in product mix of disbursements during the year. While digital unsecured and MSME unsecured loans accounted for ~25% of disbursements in H2 FY 2022, their share in the overall loan book remains low, given these are high-churn, short-duration loans.

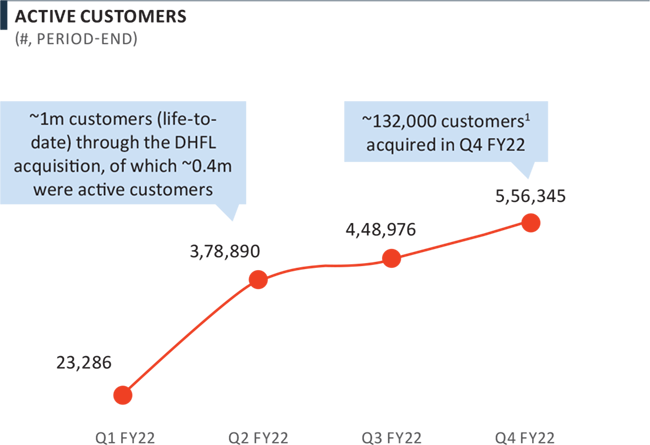

As our digital finance business gains traction, we are also acquiring customers at a rapid pace, but at lower customer acquisition costs, driven by the Digital Embedded Financing business. With the DHFL acquisition, we acquired ~1 million life-to-date customers, of which ~0.4 million were active customers. The digital initiatives are further aiding the growth in customer acquisition.

Notes:

(1) Gross additions

Investing for Future: Building capabilities to deliver longterm sustainable growth

In order to build a sustainable business supported by a superior technology architecture and the right talent, we are committed to invest across technology / analytics, talent, and branch network.

We have set-up a digital Center of Excellence (CoE) in Bangalore, and hired ~400 employees in the technology and analytics team.

In addition, we plan to add 100 branches in the next 12 months, and expand to 1,000 locations in the mid-to-long term.

We have a strong pipeline of partnerships at various stages of business build, as we scale-up the embedded finance. In the past few months, we have managed to bring our entire business on cloud, assembled a future-ready tech stack, with a combination of off-theshelf and internally engineered technology.

The business is using modular, next-gen capabilities to re-imagine the entire customer journey. Also, we have on-boarded a healthy mix of experienced, diverse, and tech-native management professionals to drive execution of the retail lending business, going forward.

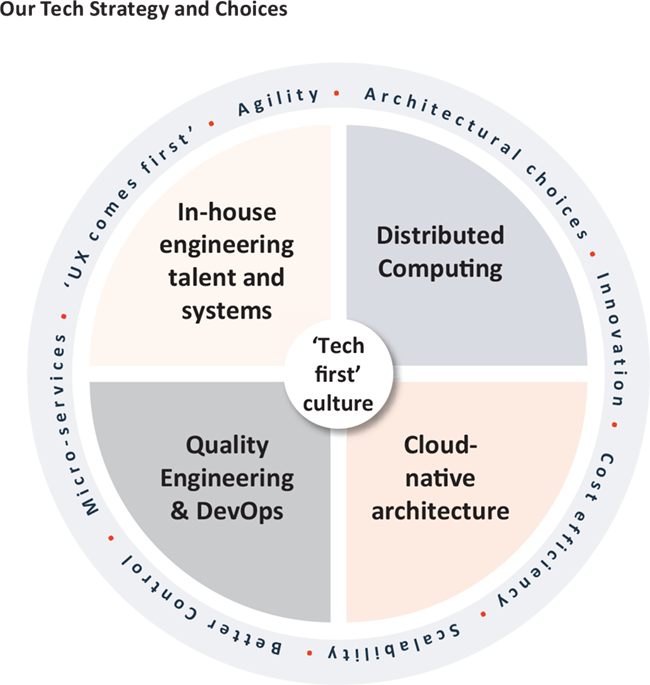

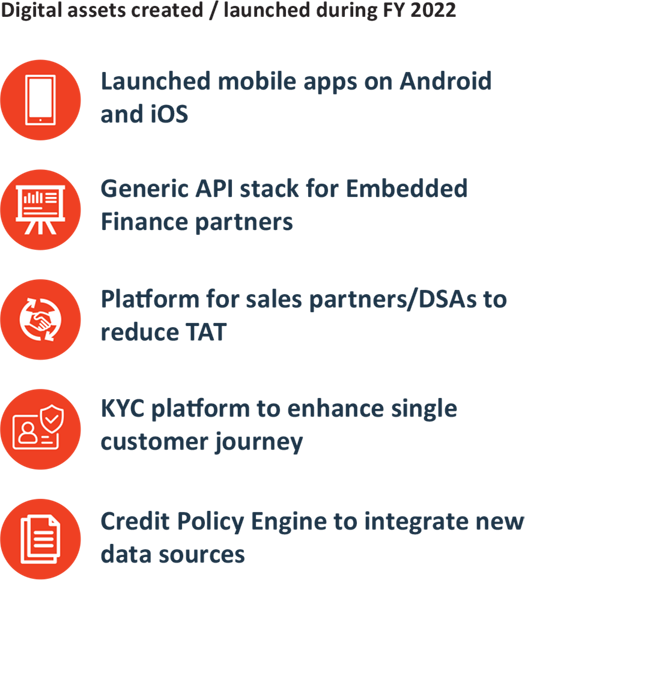

Our Tech Strategy and Key Initiatives:

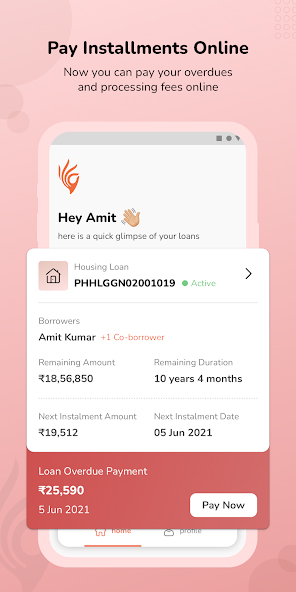

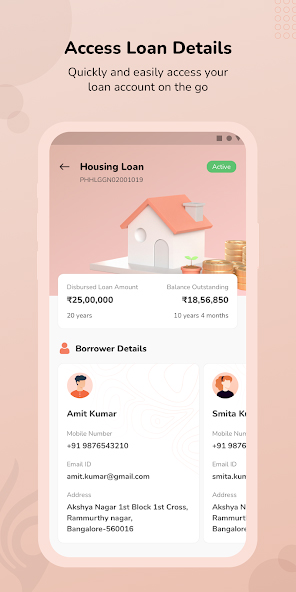

Mobile App:

We launched customer apps on Android and iOS. The app is a one-stop shop for customers for accessing their loan account, and avail cross-sell offers. More than 1,25,000 customers have downloaded the app.

Launched Mobile App (Android and iOS)

127,000+

App Downloads

4.6 (iOS)

App Rating

4.3 (Android)

App Rating

Wholesale Lending >

Market scenario

As the country recovers from the pandemic and economic activity gains traction, the demand for corporate credit will see a gradual improvement. In the past few quarters, corporate entities have been able to deleverage and reduce high-cost debt, while improving profitability and retained earnings for future capex. A budgetary capex boost of ₹ 7.5 Trillion by government for FY 2023 will further catalyse the broader economic recovery and corporate spending. As per estimates1, industrial capex will rise 1.4-1.5x during FY 2023-26 versus FY 2017-20 period, driven by Production Linked Incentive (PLI) Scheme.

In FY 2022, real estate industry witnessed a sharp rebound in activity, with sales and launches recovering to the pre-pandemic levels. Large developers with strong execution record and deleveraged balance sheets are well placed to tap demand, and continue to gain market share. The momentum has continued despite the roll-back of stampduty, with sales run-rate among the strongest in a decade, and unsold inventory on a declining trend. The second wave of the pandemic had a mild impact on the sector as developers were better prepared and had adopted technology. The sector saw a low-to-negligible impact of the third wave.

While rising commodity prices are likely to put pressure on input costs, real estate developers with execution track-record, financial closure, right ticket-sizes, and disciplined pricing, will be able to generate healthy sales and profitability. Affordable housing remains one of the attractive segments, as the country moves towards bridging the supply-demand gap.

Furthermore, with mid-market lending gradually gaining ground, Indian wholesale credit market is expected to clock an annual growth of 10-11% over CY23-301 . A significant portion of India’s mid-market, privately owned companies are based out of tier-2 cities. These businesses have typically relied on bank finance to fuel their growth aspirations. Over the years, banks have become very conservative to lend, given their last decades of experience with high NPAs and the arduous resolution process. NBFCs, although recovered from 2018 crisis, are reluctant to do significant incremental corporate lending, and gradually, rationalising or exiting the wholesale lending segment. This leaves a huge void to fill, especially as India embarks on a significant growth journey.

Note:

(1) CRISIL Research

Source: Knight Frank

Performance of PEL’s developer clients

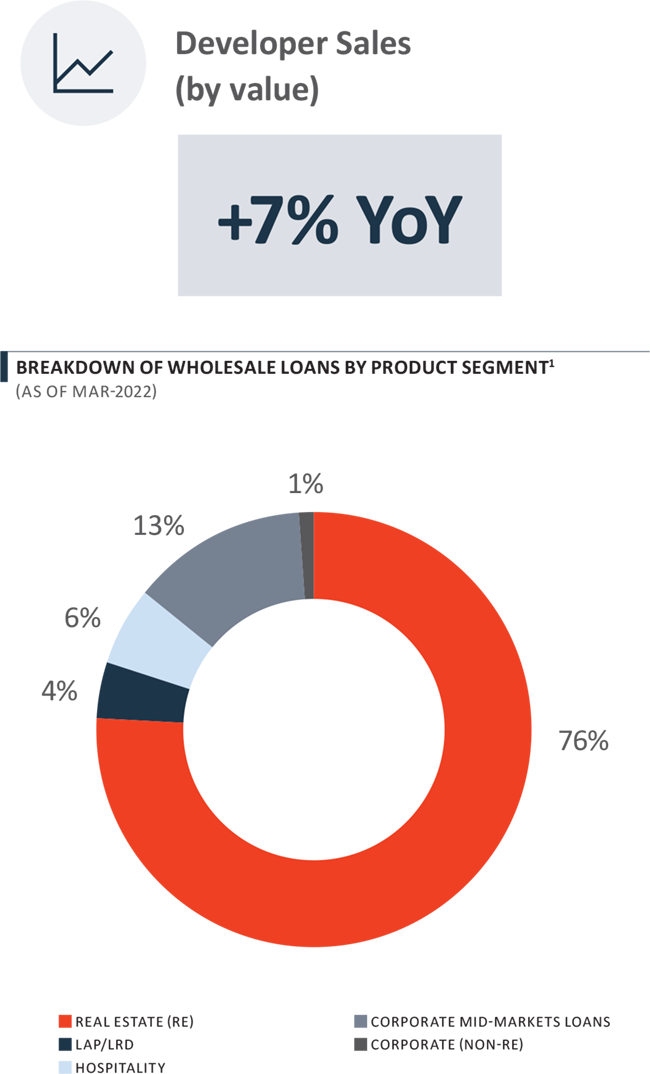

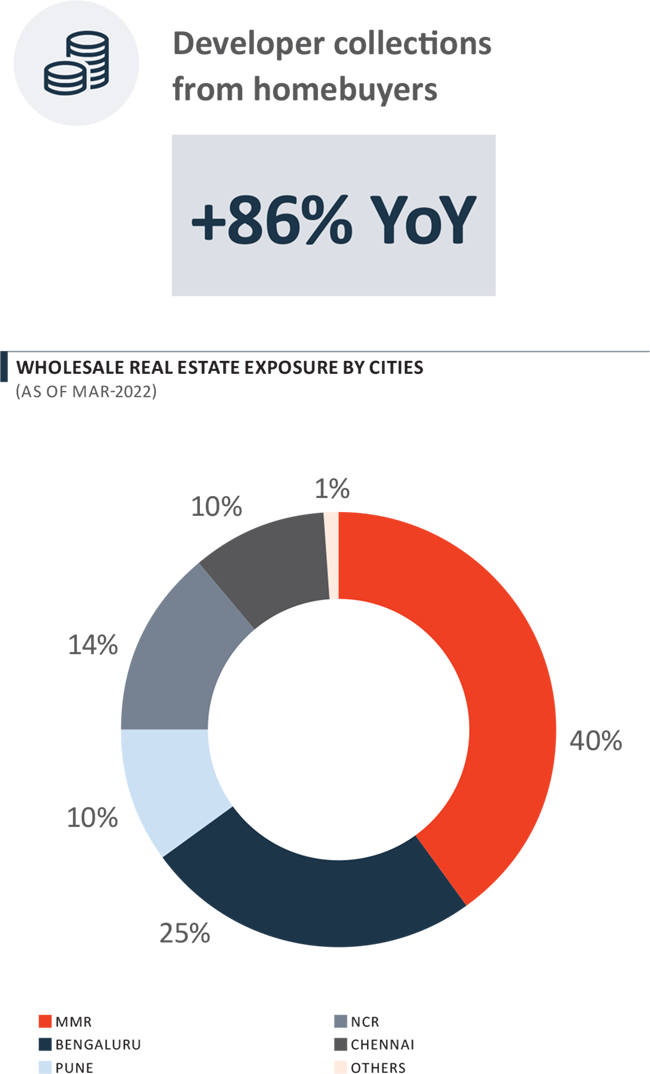

Performance of our developer clients was in line with the broader market. Our developer clients reported a 7% yoy growth in sales in FY 2022, in spite of no material government incentives announced during the year, in comparison to the prior year. New launches contributed ~18% to sales in FY 2022. Furthermore, affordable and mid-market segments reported relatively stronger growth of ~11% yoy.

Developer collections from homebuyers witnessed a strong growth of 86% yoy, driven by advancement in stage of projects. Moreover, collections from sales recorded in the prior year (driven by pent-up demand), also helped drive overall growth in collections in FY 2022.

Performance of our developer clients in FY 2022

Note:

(1) Excludes wholesale loans acquired from DHFL and PEL’s share in AIFs and investments

Operating Performance in FY 2022 – Wholesale Lending

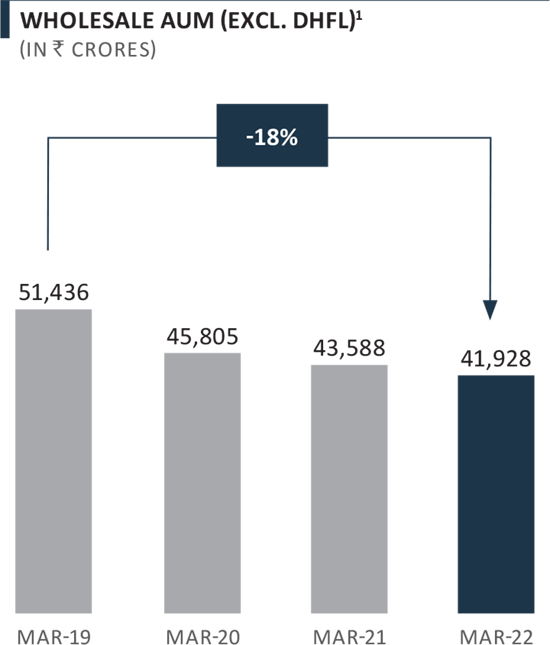

In line with the stated strategy, the business continued to make progress to make the loan book more diversified and granular. As a result, during FY 2022, the financial services business witnessed a decline in the overall wholesale loan book, along with a reduction in the top 10 exposures.

- Overall wholesale AUM has reduced by 18% since March 2019 to ₹ 41,928 Crores as of March 2022.

- Top-10 exposures have declined by 31% since March 2019 from ₹ 18,404 Crores to ₹ 12,777 Crores.

- As of March 2022, exposure to no single account exceeds 15% of the net worth of the financial services business, and all the accounts2 were <10% of net worth.

Notes:

(1) Includes PEL’s share in AIFs and investments for the periods March 2021 and March 2022 of ₹ 4,223 Crores and ₹ 5,171 Crores, respectively; excludes ₹ 1,705 Crores of wholesale loans acquired through the DHFL acquisition as of March 2022

(2) Net of provisioning

ʻWholesale lending 2.0’

During FY 2022, we also laid out the foundations for ‘Wholesale Lending 2.0.’ Significant consolidation has taken place in the NBFC sector, especially in the wholesale lending / developer financing business. We are among the few NBFCs that have continued to remain strong even after this prolonged crisis environment. Hence, there exists a significant gap in a large addressable market, having only a few credit providers.

Our new approach, as part of ‘Wholesale Lending 2.0’, will be more calibrated, with focus on smaller loans, granular book, and cash-flow backed lending. It will be based on superior risk management. We will create focused, analytics-driven underwriting vertical. Also, there would be pro‑active asset monitoring with early warning signals. Furthermore, high-yield loans will be done under fund structures, going forward.

Asset quality >

Overall asset quality:

The overall GNPA ratio declined to 3.4% as of March 2022 from 4.1% as of March 2021, and the net NPA ratio declined to 1.6% as of March 2022 from 2.1% as of March 2021. The amalgamation of the DHFL book has made our overall asset quality metrics noticeably stronger. Also, there was limited impact of RBI’s circular on NPA classification and harmonisation, announced during the year. As of March 2022, overall provisions increased to ₹ 3,735 Crores from ₹ 2,797 Crores a year ago. However, provisioning as a percentage of AUM remained unchanged yoy at 5.7%, given the increase in AUM after the DHFL acquisition.

Asset quality – wholesale portfolio:

In Q4 FY 2020, at the onset of the COVID-19 pandemic, the Company had created provisions of ₹ 1,903 Crores. During FY 2021 and FY 2022, despite conservative accounting of the DHFL loan book, overall improvement in the loan book mix and a favourable real estate market scenario, we continued to maintain most of those provisions.

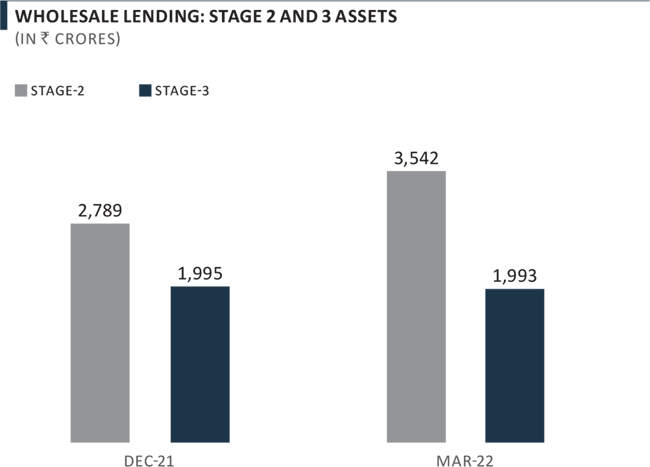

In Q4 FY 2022, we re-evaluated our wholesale portfolio to detect any lasting impacts of the pandemic or recent stresses in the macroeconomy on our clients. Based on this assessment, we moved some of our non-real estate exposures to Stage 2 and thus, we have made additional provisioning and interest reversal of ₹ 1,037 Crores for the same. This includes additional provisioning of ₹ 822 Crores and interest reversal of ₹ 215 Crores against loans of ₹ 2,292 Crores.

These were high-yield, structured mezzanine loans done under the 'Holdco' structure. We have discontinued doing such kind of deals. As a result, total provisions increased to ₹ 3,735 Crores (equivalent to 5.7% of our AUM), however, GNPA and NNPA ratios remain broadly unchanged qoq as of March 2022.

The acquired wholesale loan book from DHFL has been significantly marked down at the time of consolidation and had no impact on asset quality.

AS OF MAR-2022

4.6%

Wholesale GNPA ratio1

2.1%

Wholesale NNPA ratio1

7.9%

Provisions as a % of wholesale AUM

76%

Underlying projects in mid-tolate stages of construction

Note:

(1) GNPA and NNPA ratios as a % of AUM.

Asset quality – retail portfolio:

As of March 2022, retail GNPA ratio stood at 1.1% and NNPA ratio stood at 0.8%. Total provisions as a percentage of retail loans stood at 1.3%. The asset quality of the portfolio remains healthy as of March 2022, with 74% of housing loans towards completed homes, a conservative loan-to-value ratio (63% for housing; 50% for MSME loans and 76% for used car loans) and median CIBIL score of customers at 743.

Impact of DHFL acquisition on asset quality of retail loans:

At the time of acquisition, we had developed proprietary AI/ML models to predict the default risk in DHFL’s retail portfolio. The models used 52 inputs across customer risk, collateral risk, and demographics, and estimated the defaults over the next 12 months. The output of these models was factored into the deal valuation. The asset quality of the DHFL retail portfolio remains in line with expectations. The incremental NPA formation has largely been from the ‘high risk’ segment as predicted by ML-models. Moreover, the model efficacy was well-tested during the second COVID wave.

Purchased or Originated Credit Impaired (POCI):

In the acquired retail portfolio from DHFL, 100% of Stage-3 and Stage-2 book (combined), as on merger date (together amounting to face value of ₹ 9,488 Crores) was classified as Purchased or Originated Credit Impaired (POCI). This book has been fair valued at ₹ 3,465 Crores (fair value adjustment of 63%) as of March 2022, and this fair value is represented in PEL’s financial statements. Under IndAS 103, accounts classified as POCI will remain in POCI until closure. These accounts will not get reclassified as Stage-1 / 2 / 3 assets in their lifecycle. Any differences in cashflow in the POCI book (i.e., higher or lower than fair value adjustment) would be accounted through P&L. The overall POCI book will shrink as cashflows are recovered from the book.

Note:

(1) 100% of DHFL’s Stage-3 book and Stage-2 book (combined), as on merger date (together amounting to face value of ` 9,488 Crores), has been classified as Purchased or Originated Credit Impaired (POCI). This book has been fair valued at ` 3,465 Crores (fair value adjustment of 63%) as of Mar-2022, and this fair value is represented in PEL’s Financial Statements. Under IndAS 103, accounts classified as POCI will remain in POCI until closure. These accounts will not get reclassified as Stage-1 / 2 / 3 assets in their lifecycle. Any differences in cashflow in the POCI book (i.e. higher or lower than fair value adjustment) would be accounted through P&L. The overall POCI book will shrink as cashflows are recovered from the book.

Alternatives

Our Alternatives platform is a fund management business with long-standing partnerships with marquee investors, and committed capital of ~$ 1 Billion. The fund management business provides customised financing solutions to high-quality corporates through – 'Piramal Credit Fund', a performing, sector-agnostic credit fund with capital commitment from CDPQ; and 'IndiaRF', a distressed asset investing platform with Bain Capital Credit, which invests in equity and/or debt across non-real estate sectors.

As the Indian economy evolves, Piramal Alternatives looks to be a significant provider of customised financing solutions to high-quality corporates that are looking to maximise their growth. The return on sponsor commitments, as well as income (in the form of both fee and carry), are likely to further improve, as we scale up existing funds and expand the product suite.

Life insurance JV

As a part of DHFL acquisition, the Company also acquired a 50% stake in Pramerica Life Insurance (PLI), which is a joint venture (JV) with Prudential International Insurance Holdings.

PLI is an industry leader in the defense segment, which contributes 68% to PLI’s Annual Premium Equivalent (APE). It has a customer base of 2.5 Million and a vast distribution network, comprising of >15,000 agents and 134 branches across 28 states / 2 Union Territories in India.

The business reported Gross Written Premium of ` 1,099 Crores in FY 2022 and its Embedded Value stood at ₹ 1,802 Crores as of March 2022. Additionally, for FY 2022, the Claims Paid ratio stood at 98%, and the Persistency Ratio (13th month) stood at 78% – which have remained broadly consistent for the last five years.

Given PLI’s robust balance sheet, Solvency Ratio of 404% as of March 2022, we aim to drive growth of this business in the coming years.

Investments in Shriram Group

PEL had invested a total amount of ₹ 4,583 Crores in Shriram Group companies, which comprised ₹ 1,636 Crores for a ~10% stake in STFC, ₹ 2,146 Crores for a ~20% stake in SCL, and ₹ 801 Crores for a ~10% stake in SCUF.

In June 2019, PEL sold its entire direct investment of 9.96% in STFC for ~₹ 2,300 Crores. Post the STFC stake sale, the investments were worth ₹ 5,095 Crores1 as of March 31, 2022.

Additionally, the investment is part of the unallocated equity pool, serving as an accessible, return-generating pool of capital for PEL’s future growth initiatives.

Note:

(1) Investments in SCUF based on market value; SCL based on book value, including accumulated profits

Borrowing side >

Market scenario

To curb the impact of COVID-19 and manage liquidity and overall health of financial institutions, the RBI and the government took numerous measures to maintain adequate liquidity in the system. As the economy recovered, the borrowing costs declined to multi-year lows, and spreads narrowed across rating cohorts.

With inflationary pressures rising globally, the economy is now entering a phase of higher interest rate environment. Globally, central banks have accelerated their path to policy normalisation, and the RBI too, has commenced policy tightening, as domestic inflation continues to rise.

As rates increase, financial institutions are likely to face pressure on cost of borrowings. However, funding costs for some NBFCs may continue to decline in the near-term on repricing of maturing high-cost borrowings. Thus, going forward, lenders with a diversified funding mix and a robust ALM profile will have a competitive edge.

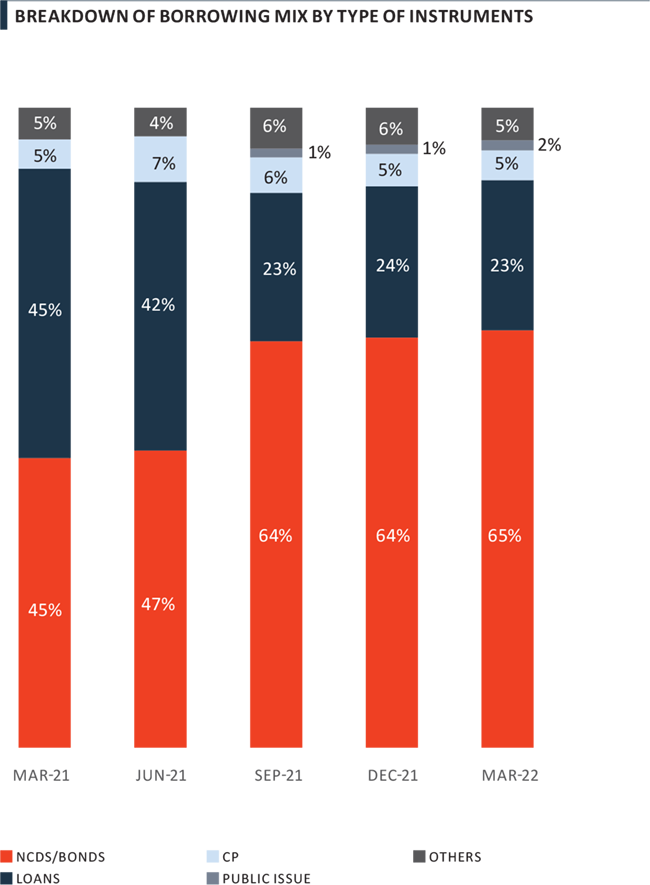

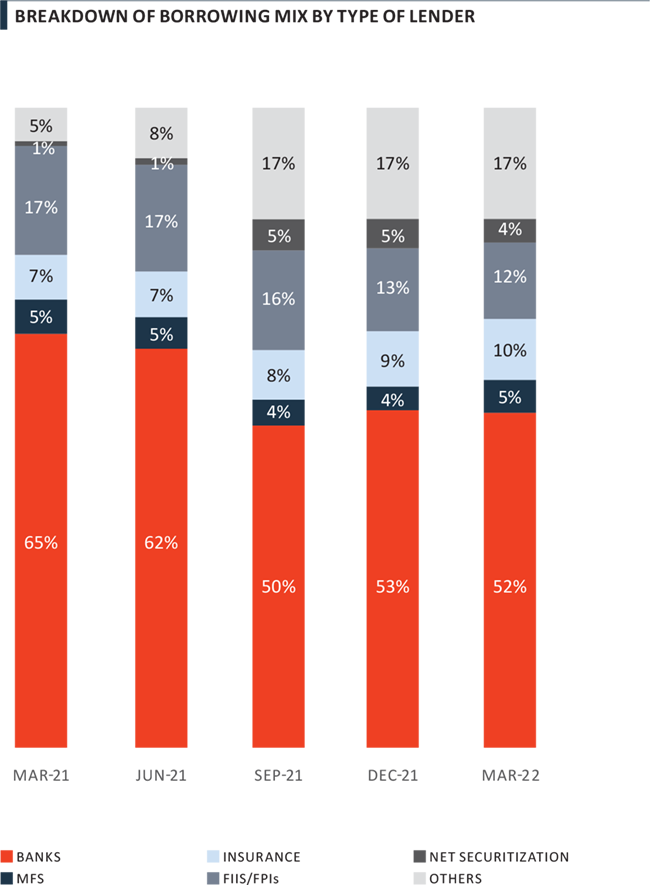

Funding sources

The Company raises funds through several sources including term loans, NCDs, securitisation, external commercial borrowings (ECB) and tier 2 instruments. The borrowings are primarily long-term in nature, with the predominance of term loans and NCDs in the funding mix.

Note: Borrowing mix for PEL (excluding Pharma business)

Cost of borrowings

With the successful acquisition of DHFL and strengthened balance sheet in the backdrop of lower interest rate environment, the incremental borrowing cost witnessed a gradual decline in FY 2022. We were able to reduce our average cost of borrowings significantly by 170 bps yoy in Q4 FY 2022, partly driven by the immediate impact of DHFL acquisition through 10-year NCDs worth ~₹ 19,550 Crores at 6.75%.

Moreover, we are now able to raise debt at a rate lower than our average cost of borrowings. For instance, we raised ₹ 804 Crores through a retail bond issuance in July 2021, with a weighted average tenure of 4.15 years and weighted average coupon of ~8.7%.

With 79% of borrowings as ‘fixed rate liabilities’ and 63% of assets at floating rate, as of March 2022, PEL is well positioned to navigate the rising interest rate environment. Further, cost of borrowings is expected to decline over time, as we continue to make the loan book more diversified and granular.

Capital adequacy ratio

As of March 31, 2022, the capital adequacy ratio for the financial services business stood at 21% as compared to 36% as of March 31, 2021. The yoy change in capital adequacy reflects the impact of DHFL acquisition, which was a major step towards efficiently optimising and deploying capital. With net debt-to-equity of 2.7x as of March 2022, PEL remains amongst the most well-capitalised, sizeable NBFCs in the country.

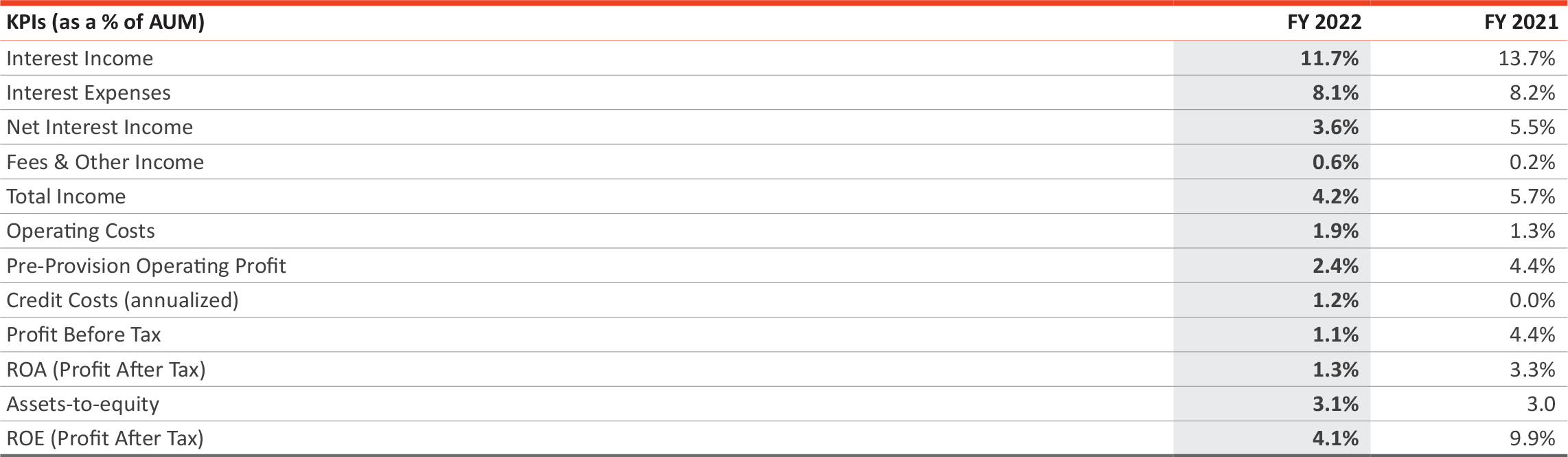

Financial performance for the year >

The overall loan book grew 33% from ₹ 48,891 Crores as of March 2021 to ₹ 65,185 Crores as of March 2022, largely driven by the addition of retail loan book through DHFL acquisition. Also, as part of our strategy to build a more granular book, the overall portfolio mix of Retail: Wholesale loans has changed favourably from 12:88 as of March 2021 to 36:64 as of March 2022.

Interest income: Interest income saw a modest yoy increase to ₹ 7,016 Crores in FY 2022, as loan book growth (driven by the DHFL acquisition) was largely offset by a decline in yields (amid reduction of the wholesale loan book and a shift in the loan book mix towards retail) and interest reversal of ₹ 215 Crores during Q4 FY 2022.

Interest expenses: Despite a continued decline in average cost of funds during the year, interest expenses increased due to an increase in borrowings, corresponding to the growth in the loan book through DHFL acquisition.

Net interest income (NII): NII declined due a shift in the loan book mix towards retail, interest reversal and the impact of negative carry due to excess cash held on the balance sheet.

Fee & Other Income: Significant yoy increase of 215% in fee & other income to ₹ 362 Crores in FY 2022, driven by fee-income in retail lending, as well as income generated through deploying surplus liquidity.

Operating Expenses: Operating expenses increased primarily on account of DHFL acquisition (for H2 FY 2022) and building up of tech-enabled Retail lending platform.

Credit costs: FY 2022 credit costs include one-time provisions of ₹ 822 Crores on a few wholesale loan accounts, partly offset of recoveries worth ₹ 261 Crores from the retail POCI book. We continue to remain vigilant across our portfolio and maintain conservative provisioning to take care of contingencies arising in the future.

Profitability: PAT was largely impacted by additional provisioning and interest reversal worth ₹ 1,037 Crores on select wholesale non-RE accounts that moved to Stage-2 during the year. In the mid-to-long term, further improvement in capital utilisation through growth in AUM is likely to improve profitability and returns profile.

P&L Summary – Financial Services (Lending Business)

Note: Figures in previous periods might have been regrouped or restated, wherever necessary to make them comparable to current period. For FY 2022, yield and NIM exclude fee-income from securitized assets and recoveries from DHFL’s legacy retail NPA pool.

Key strategic priorities and FY 2027 aspirations >

- Transforming into a well-diversified business, with the aim to achieve a loan book mix of 2/3rd retail and 1/3rd wholesale in 5 years

- Lower cost of borrowings, driven by diversification of loan book growth and funding sources

- Further optimise capital utilisation through loan book growth and inorganic initiatives

- Maintaining adequate provision to manage future contingencies

- Improve profitability through growth, lower borrowing costs, change in retail product mix and capital optimisation